What is the impact of sales growth on Digitronics borrowing needs?

- Digitronics has high long-term sales growth, which is a borrowing cause, but it has no seasonal sales growth

- Digitronics has no long-term sales growth and no seasonal sales growth, so there is no borrowing caused by sales growth.

- Digitronics has both long-term growth and seasonal sales growth, which reduce its need to borrow

- Digitronics has long-term sales growth and seasonal sales growth, both of which are borrowing causes.

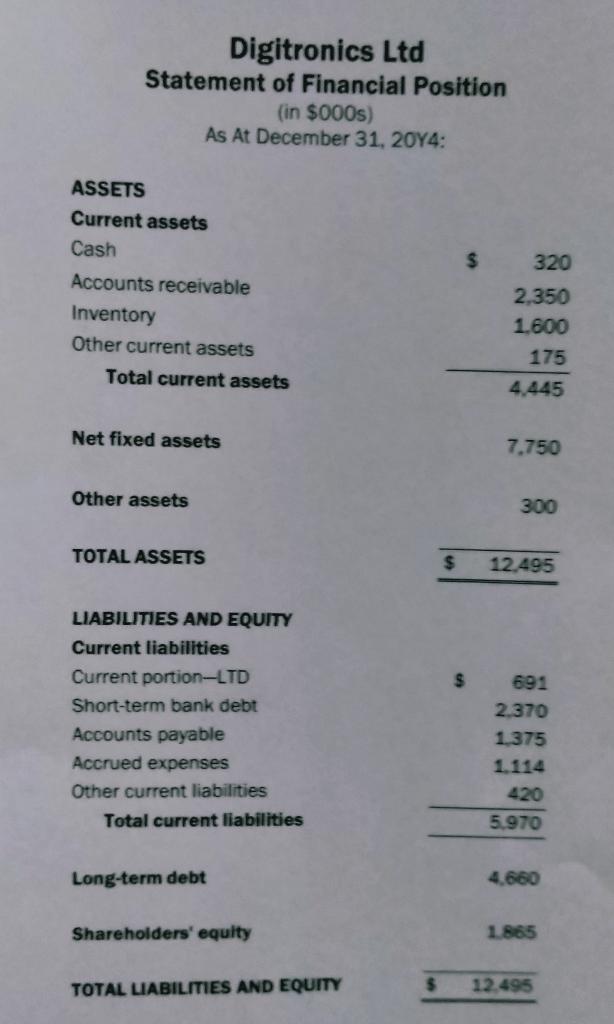

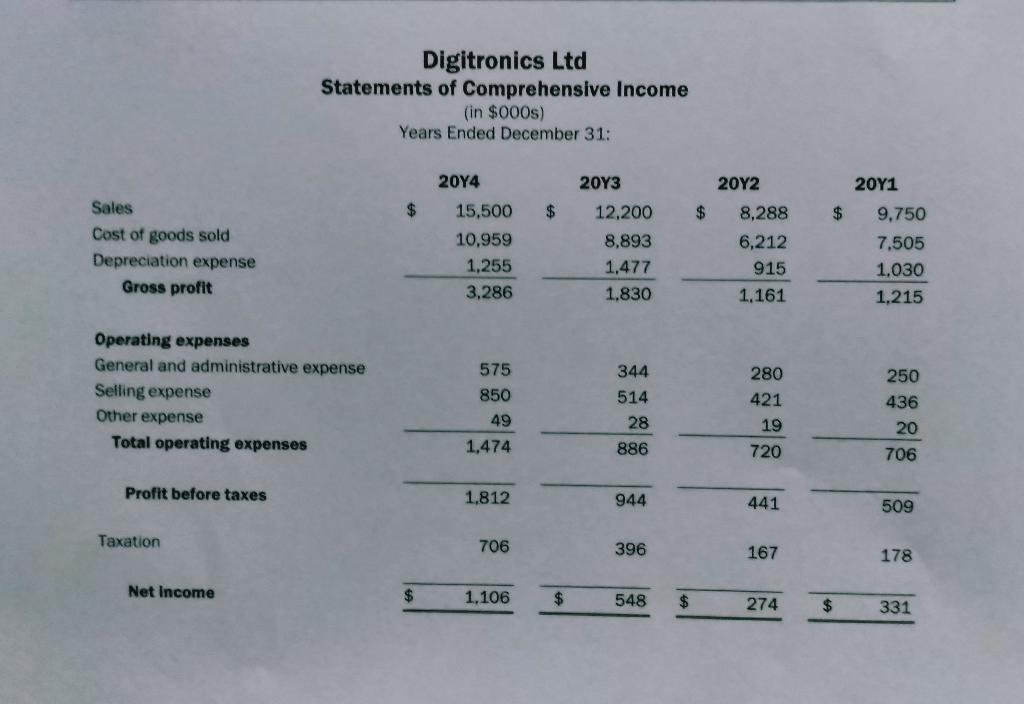

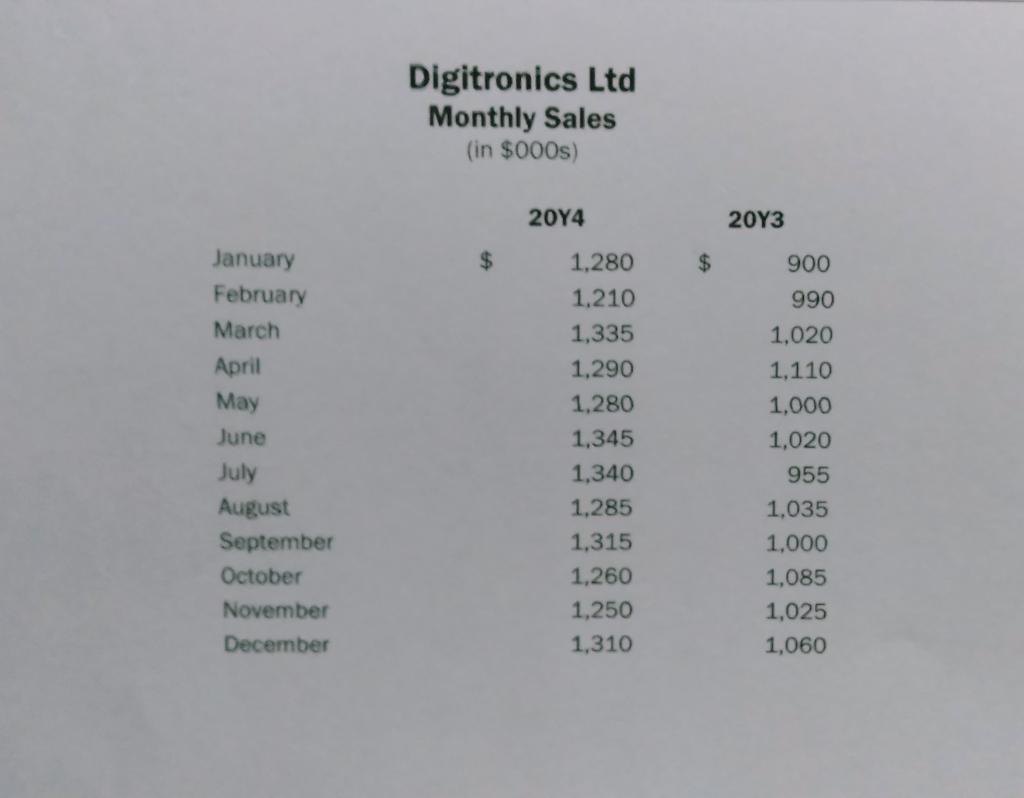

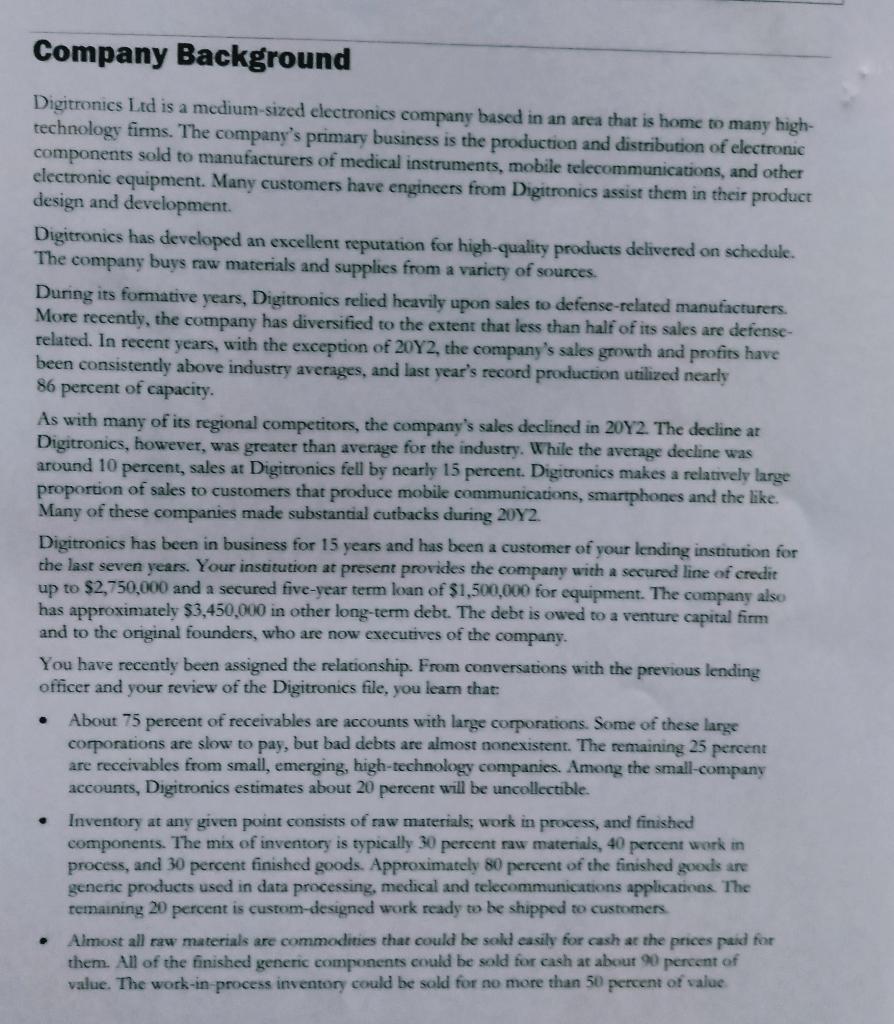

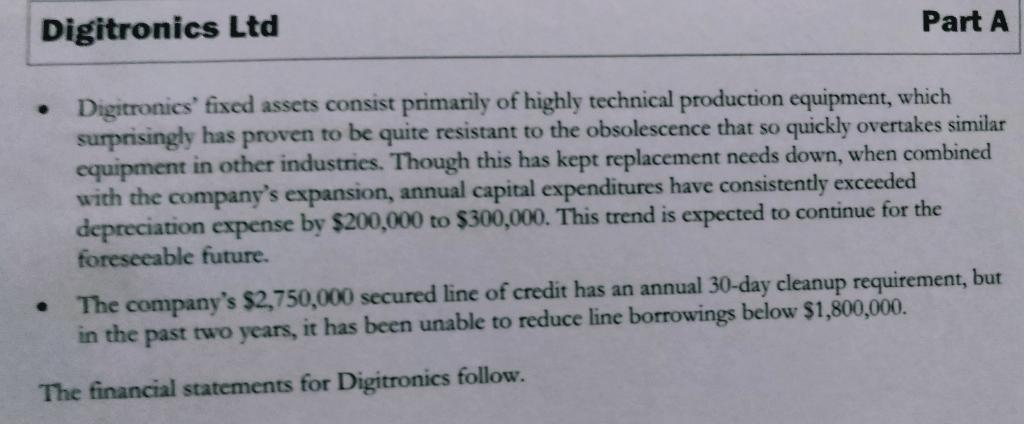

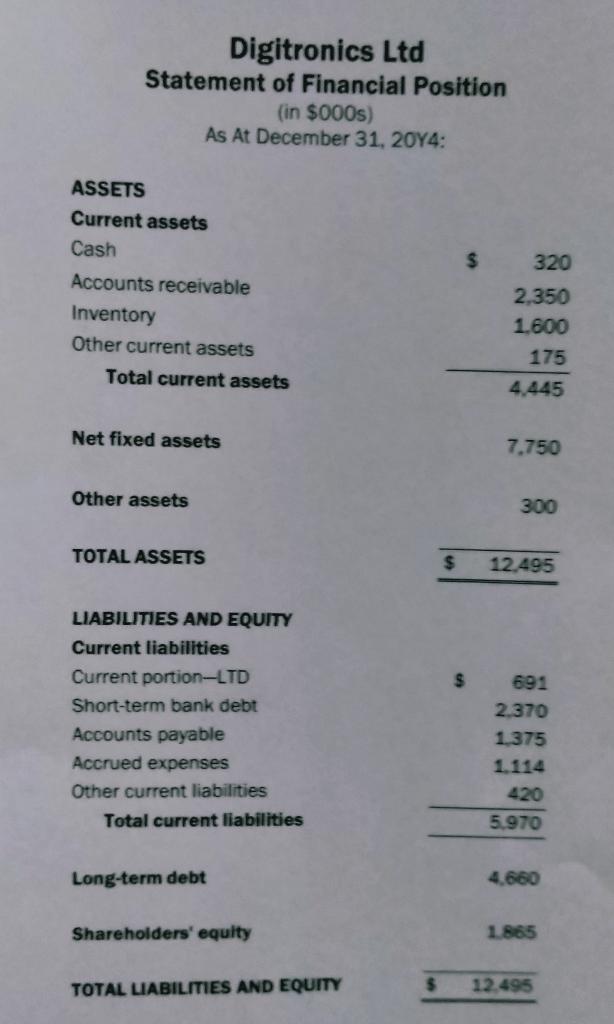

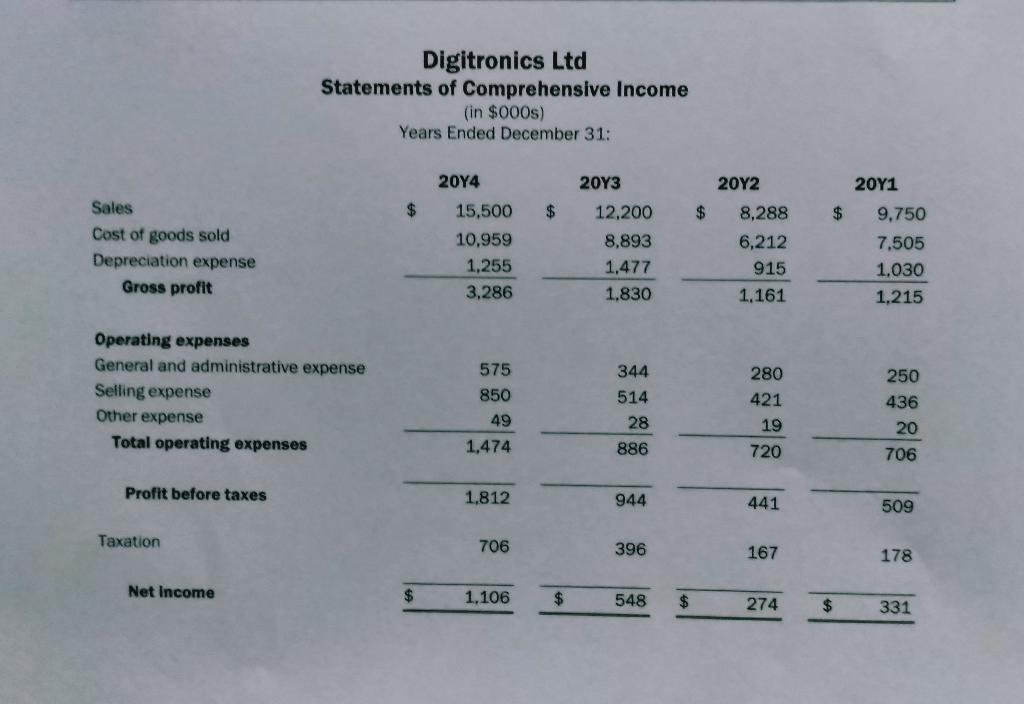

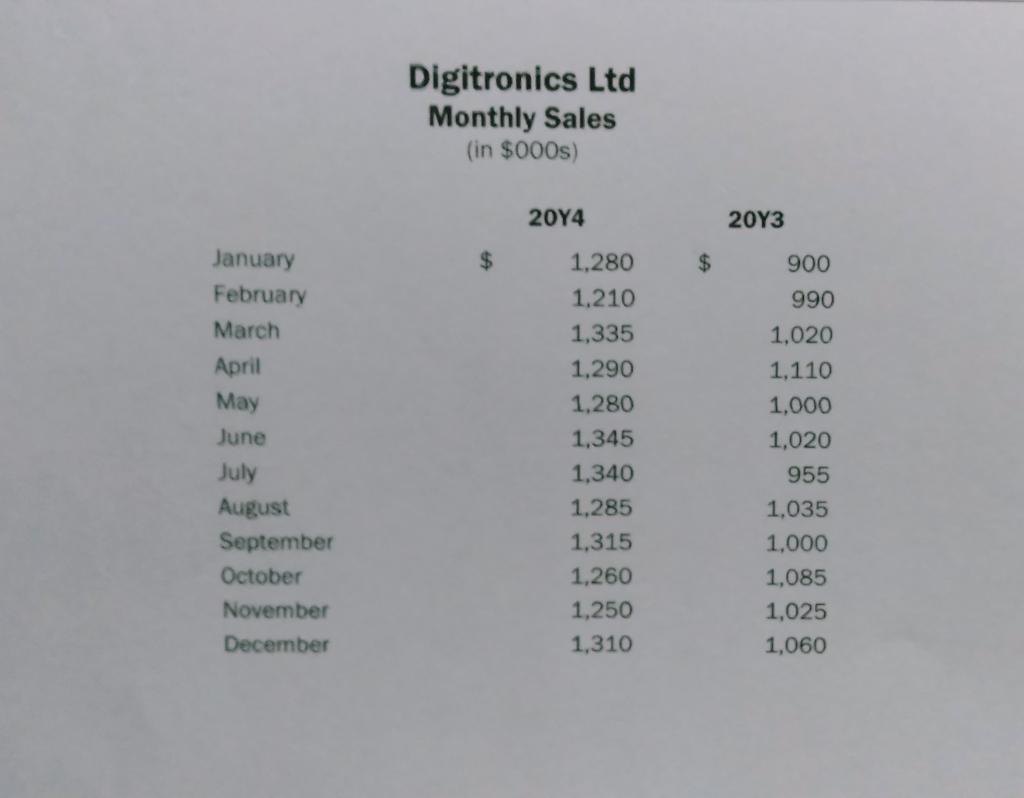

Digitronics Ltd Digitronics Ltd The following case information includes: Part A Company information Part B Statement of financial position Statements of comprehensive income Monthly sales figures Company Background Digitronics Ltd is a medium-sized electronics company based in an area that is home to many high- technology firms. The company's primary business is the production and distribution of electronic components sold to manufacturers of medical instruments, mobile telecommunications, and other electronic equipment. Many customers have engineers from Digitronics assist them in their product design and development. Digitronics has developed an excellent reputation for high-quality produets delivered on schedule. The company buys raw materials and supplies from a variety of sources During its formative years, Digitronics relied heavily upon sales to defense-related manufacturers. More recently, the company has diversified to the extent that less than half of its sales are defense- related. In recent years, with the exception of 20Y2, the company's sales growth and profits have been consistently above industry averages, and last year's record production utilized nearly 86 percent of capacity. As with many of its regional competitors, the company's sales declined in 20Y2. The decline at Digitronics, however, was greater than average for the industry. While the average decline was around 10 percent, sales at Digitronics fell by nearly 15 percent. Digitronics makes a relatively large proportion of sales to customers that produce mobile communications, smartphones and the like. Many of these companies made substantial cutbacks during 20Y2 Digitronics has been in business for 15 years and has been a customer of your lending institution for the last seven years. Your institution at present provides the company with a secured line of credit up to $2,750,000 and a secured five-year term loan of $1,500,000 for equipment. The company also has approximately $3,450,000 in other long-term debt. The debt is owed to a venture capital firm and to the original founders, who are now executives of the company. You have recently been assigned the relationship. From conversations with the previous lending officer and your review of the Digitronics file, you learn that: About 75 percent of receivables are accounts with large corporations. Some of these large corporations are slow to pay, but bad debts are almost nonexistent. The remaining 25 percent are receivables from small, emerging, high-technology companies. Among the small-company accounts, Digitronics estimates about 20 percent will be uncollectible. Inventory at any given point consists of raw materials, work in process, and finished components. The mix of inventory is typically 30 percent raw materials, 40 percent work in process, and 30 percent finished goods. Approximately 80 percent of the finished goods are generic products used in data processing, medical and telecommunications applications. The remaining 20 percent is custom-designed work ready to be shipped to customers Almost all raw materials are commodities that could be sold easily for cash at the prices paid for them. All of the finished generic components could be sold for cash at about 90 percent of value. The work in process inventory could be sold for no more than 50 percent of value Part A Digitronics Ltd Digitronics' fixed assets consist primarily of highly technical production equipment, which surprisingly has proven to be quite resistant to the obsolescence that so quickly overtakes similar equipment in other industries. Though this has kept replacement needs down, when combined with the company's expansion, annual capital expenditures have consistently exceeded depreciation expense by $200,000 to $300,000. This trend is expected to continue for the foreseeable future. The company's $2,750,000 secured line of credit has an annual 30-day cleanup requirement, but in the past two years, it has been unable to reduce line borrowings below $1,800,000. The financial statements for Digitronics follow. Digitronics Ltd Statement of Financial Position (in $000s) As At December 31, 20Y4: $ ASSETS Current assets Cash Accounts receivable Inventory Other current assets Total current assets 320 2,350 1.600 175 4.445 Net fixed assets 7.750 Other assets 300 TOTAL ASSETS $ 12.495 $ LIABILITIES AND EQUITY Current liabilities Current portion-LTD Short-term bank debt Accounts payable Accrued expenses Other current liabilities Total current liabilities 691 2.370 1.375 1.114 420 5.970 Long-term debt 4.660 Shareholders' equity 1.865 TOTAL LIABILITIES AND EQUITY 12.495 Digitronics Ltd Statements of Comprehensive Income (in $000s) Years Ended December 31: 2014 20Y3 $ $ $ $ Sales Cost of goods sold Depreciation expense Gross profit 15,500 10,959 1,255 3,286 12,200 8.893 1,477 1.830 20Y2 8,288 6,212 915 20Y1 9.750 7.505 1,030 1.215 1.161 280 Operating expenses General and administrative expense Selling expense Other expense Total operating expenses 575 850 49 1,474 421 344 514 28 886 250 436 20 706 19 720 Profit before taxes 1,812 944 441 509 Taxation 706 396 167 178 Net Income $ 1,106 $ 548 $ 274 $ 331 Digitronics Ltd Monthly Sales (in $000s) 2014 20Y3 $ $ January February March April May June July August September October November December 1.280 1.210 1,335 1,290 1.280 1,345 1,340 1,285 1,315 1,260 1,250 1,310 900 990 1,020 1,110 1,000 1,020 955 1,035 1,000 1,085 1,025 1,060