Question

What is the initial cash flow for this project? (Include capital expenditure, opportunity cost, and net working capital) Q2. What is the increase in depreciation

What is the initial cash flow for this project? (Include capital expenditure, opportunity cost, and net working capital)

What is the initial cash flow for this project? (Include capital expenditure, opportunity cost, and net working capital)

Q2. What is the increase in depreciation each year due to the proposal?

Q3. What is the after-tax salvage cash flow from the sales of the fixed assets at the end of the project?

Q4. What is the annual increase in operating cash under this cost-cutting proposal?

Q5. What is final years total cash flow? (final years increase in operating cash flow, recover net working capital, recover opportunity cost, and salvage cash flow)

Q6. What is the net present value of this project? Should ruler industry accept the project or not?

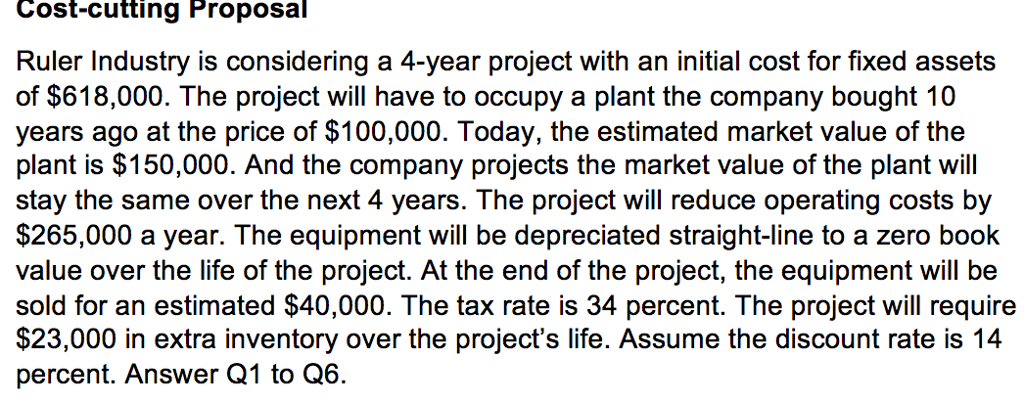

Cost-cutting Proposal Ruler Industry is considering a 4-year project with an initial cost for fixed assets of $618,000. The project will have to occupy a plant the company bought 10 years ago at the price of $100,000. Today, the estimated market value of the plant is $150,000. And the company projects the market value of the plant will stay the same over the next 4 years. The project will reduce operating costs by $265,000 a year. The equipment will be depreciated straight-line to a zero book value over the life of the project. At the end of the project, the equipment will be sold for an estimated $40,000. The tax rate is 34 percent. The project will require $23,000 in extra inventory over the project's life. Assume the discount rate is 14 percent. Answer Q1 to Q6Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started