Answered step by step

Verified Expert Solution

Question

1 Approved Answer

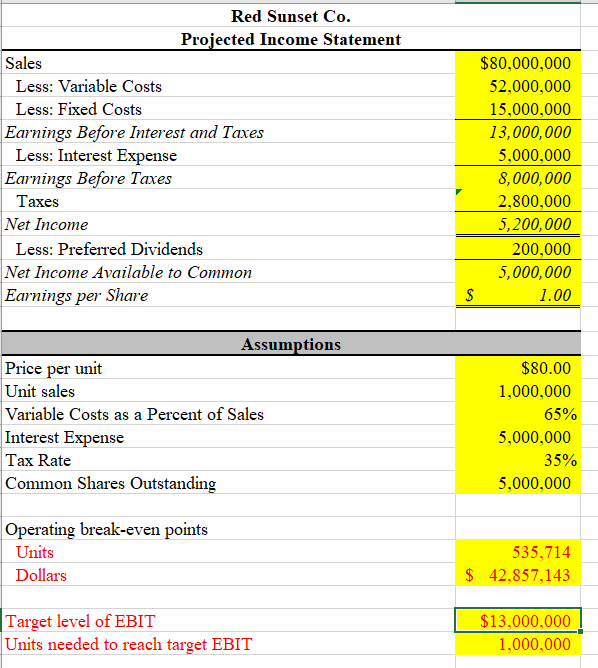

What is the interpretation of this information? How is this company doing? Red Sunset Co. Projected Income Statement Sales Less: Variable Costs Less: Fixed Costs

What is the interpretation of this information? How is this company doing?

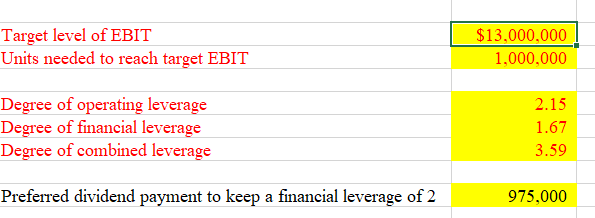

Red Sunset Co. Projected Income Statement Sales Less: Variable Costs Less: Fixed Costs Earnings Before Interest and Taxes Less: Interest Expense Earnings Before Taxes Taxes Net Income Less: Preferred Dividends Net Income Available to Common Earnings per Share $80,000,000 52,000,000 15,000,000 13,000,000 5,000,000 8,000,000 2,800,000 5,200,000 200,000 5,000,000 $ 1.00 $ Assumptions Price per unit Unit sales Variable Costs as a Percent of Sales Interest Expense Tax Rate Common Shares Outstanding $80.00 1,000,000 65% 5,000,000 35% 5,000,000 Operating break-even points Units Dollars 535,714 $ 42,857,143 Target level of EBIT Units needed to reach target EBIT $13,000,000 1,000,000 Target level of EBIT Units needed to reach target EBIT $13,000,000 1,000,000 Degree of operating leverage Degree of financial leverage Degree of combined leverage 2.15 1.67 3.59 Preferred dividend payment to keep a financial leverage of 2 975,000Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started