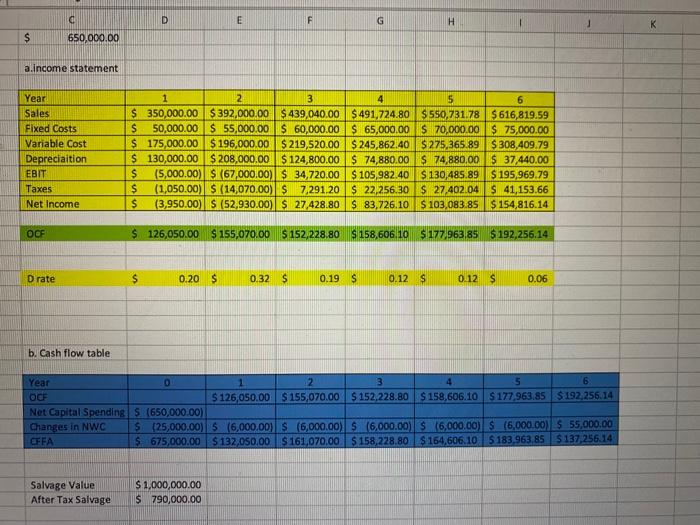

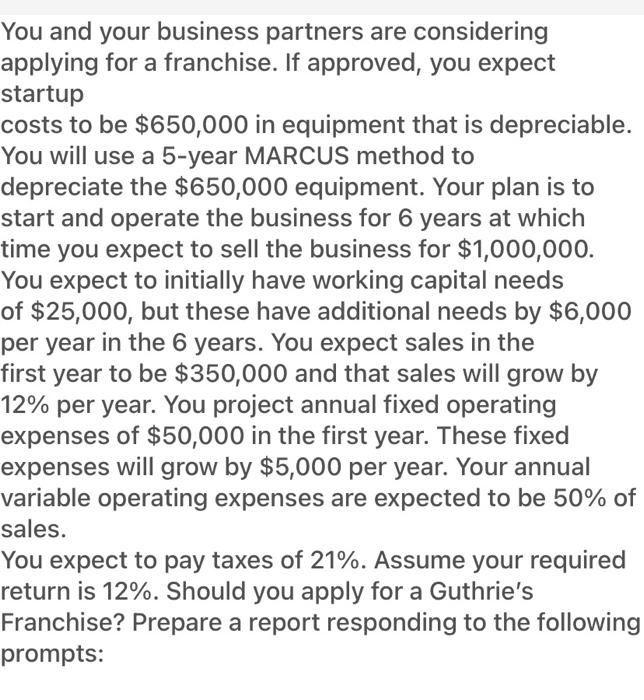

What is the IRR and NPR? Write a paragraph explain why we should except? D D E F G H $ 650,000.00 a.income statement Year Sales Fixed Costs Variable Cost Depreciation EBIT Taxes Net Income 1 2 3 4 5 6 $ 350,000.00 $ 392,000.00 $ 439,040.00 $ 491,724.80 $550,731 78 $616,819.59 $ 50,000.00 $ 55,000.00 $ 60,000.00 $ 65,000.00 $ 70,000.00 $ 75,000.00 $ 175,000.00 $ 196,000.00 $ 219,520.00 $ 245,862.40 $275,365.89 $308,409.79 $ 130,000.00 $ 208,000.00 $ 124,800.00 $ 74,880.00 $ 74,880,00 $ 37,440.00 $ (5,000.00) $ (67,000.00) $ 34,720.00 $ 105,982.40 $ 130,485.89 $ 195,969.79 $ (1,050.00) $ (14,070.00) $ 7,291.20 $ 22,256.30 $ 27,402.04 $ 41,153.66 $ (3,950.00) S (52,930.00) $ 27,428.80 $ 83,726.10 $ 103,083.85 $ 154,816.14 uslu OOF $ 126,050.00 $ 155,070.00 $152,228.80 S 158,606.10 $ 177,963,85 $ 192,256.14 D rate $ 0.20 $ 0.32 $ 0.19 S 0.12S 0.12 S 0.06 b. Cash flow table Year 0 3 5 OCF $ 126,050.00 $ 155,070.00 $152,228.80 $ 158,606.10 S 177,963,85 $ 192,256.14 Net Capital Spending S (650,000.00) Changes in NWC S (25,000,00) 6 (6,000.00) S (6,000.00) S (6,000,00) S (6,000,00) S (6.000.000 $ 55,000.00 CFFA $ 675,000.00 $ 132,050.00 $ 161,070,00 $ 158,228.80 $ 164,606.10 $ 183,963,85 $ 137,256.14 Salvage Value After Tax Salvage $1,000,000.00 $ 790,000.00 You and your business partners are considering applying for a franchise. If approved, you expect startup costs to be $650,000 in equipment that is depreciable. You will use a 5-year MARCUS method to depreciate the $650,000 equipment. Your plan is to start and operate the business for 6 years at which time you expect to sell the business for $1,000,000. You expect to initially have working capital needs of $25,000, but these have additional needs by $6,000 per year in the 6 years. You expect sales in the first year to be $350,000 and that sales will grow by 12% per year. You project annual fixed operating expenses of $50,000 in the first year. These fixed expenses will grow by $5,000 per year. Your annual variable operating expenses are expected to be 50% of sales. You expect to pay taxes of 21%. Assume your required return is 12%. Should you apply for a Guthrie's Franchise? Prepare a report responding to the following prompts: What is the IRR and NPR? Write a paragraph explain why we should except? D D E F G H $ 650,000.00 a.income statement Year Sales Fixed Costs Variable Cost Depreciation EBIT Taxes Net Income 1 2 3 4 5 6 $ 350,000.00 $ 392,000.00 $ 439,040.00 $ 491,724.80 $550,731 78 $616,819.59 $ 50,000.00 $ 55,000.00 $ 60,000.00 $ 65,000.00 $ 70,000.00 $ 75,000.00 $ 175,000.00 $ 196,000.00 $ 219,520.00 $ 245,862.40 $275,365.89 $308,409.79 $ 130,000.00 $ 208,000.00 $ 124,800.00 $ 74,880.00 $ 74,880,00 $ 37,440.00 $ (5,000.00) $ (67,000.00) $ 34,720.00 $ 105,982.40 $ 130,485.89 $ 195,969.79 $ (1,050.00) $ (14,070.00) $ 7,291.20 $ 22,256.30 $ 27,402.04 $ 41,153.66 $ (3,950.00) S (52,930.00) $ 27,428.80 $ 83,726.10 $ 103,083.85 $ 154,816.14 uslu OOF $ 126,050.00 $ 155,070.00 $152,228.80 S 158,606.10 $ 177,963,85 $ 192,256.14 D rate $ 0.20 $ 0.32 $ 0.19 S 0.12S 0.12 S 0.06 b. Cash flow table Year 0 3 5 OCF $ 126,050.00 $ 155,070.00 $152,228.80 $ 158,606.10 S 177,963,85 $ 192,256.14 Net Capital Spending S (650,000.00) Changes in NWC S (25,000,00) 6 (6,000.00) S (6,000.00) S (6,000,00) S (6,000,00) S (6.000.000 $ 55,000.00 CFFA $ 675,000.00 $ 132,050.00 $ 161,070,00 $ 158,228.80 $ 164,606.10 $ 183,963,85 $ 137,256.14 Salvage Value After Tax Salvage $1,000,000.00 $ 790,000.00 You and your business partners are considering applying for a franchise. If approved, you expect startup costs to be $650,000 in equipment that is depreciable. You will use a 5-year MARCUS method to depreciate the $650,000 equipment. Your plan is to start and operate the business for 6 years at which time you expect to sell the business for $1,000,000. You expect to initially have working capital needs of $25,000, but these have additional needs by $6,000 per year in the 6 years. You expect sales in the first year to be $350,000 and that sales will grow by 12% per year. You project annual fixed operating expenses of $50,000 in the first year. These fixed expenses will grow by $5,000 per year. Your annual variable operating expenses are expected to be 50% of sales. You expect to pay taxes of 21%. Assume your required return is 12%. Should you apply for a Guthrie's Franchise? Prepare a report responding to the following prompts