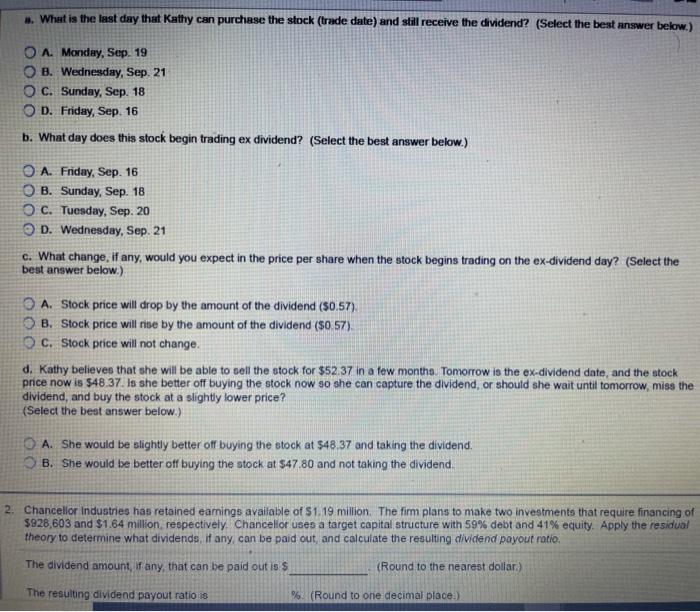

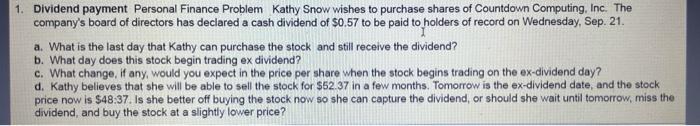

.. What is the last day that Kathy can purchase the stock (trade date) and still receive the dividend? (Select the best answer below.) O A. Monday, Sep. 19 OB. Wednesday, Sep. 21 OC. Sunday, Sep. 18 OD. Friday, Sep. 16 b. What day does this stock begin trading ex dividend? (Select the best answer below.) O A. Friday, Sep. 16 B. Sunday, Sep. 18 OC. Tuesday, Sep. 20 D. Wednesday, Sep. 21 c. What change, if any, would you expect in the price per share when the stock begins trading on the ex-dividend day? (Select the best answer below.) A. Stock price will drop by the amount of the dividend (50.57). B. Stock price will rise by the amount of the dividend ($0 57) C. Stock price will not change. d. Kathy believes that she will be able to sell the stock for $52.37 in a few months. Tomorrow is the ex-dividend date, and the stock price now is $48.37. Is she better off buying the stock now so she can capture the dividend, or should she wait until tomorrow, miss the dividend, and buy the stock at a slightly lower price? (Select the best answer below.) A. She would be slightly better off buying the stock at $48.37 and taking the dividend. B. She would be better off buying the stock at $47.80 and not taking the dividend 2. Chancellor Industries has retained earnings available of S1.19 million. The firm plans to make two investments that require financing of $828,603 and $164 million, respectively. Chancellor uses a target capital structure with 59% debt and 41% equity. Apply the residual theory to determine what dividends, if any, can be paid out, and calculate the resulting dividend payout ratio. The dividend amount, if any, that can be paid out is s (Round to the nearest dollar) The resulting dividend payout ratio is % (Round to one decimal place.) 1. Dividend payment Personal Finance Problem Kathy Snow wishes to purchase shares of Countdown Computing, Inc. The company's board of directors has declared a cash dividend of $0.57 to be paid to holders of record on Wednesday, Sep. 21. a. What is the last day that Kathy can purchase the stock and still receive the dividend? b. What day does this stock begin trading ex dividend? c. What change, if any, would you expect in the price per share when the stock begins trading on the ex-dividend day? d. Kathy believes that she will be able to sell the stock for $52.37 in a few months. Tomorrow is the ex-dividend date, and the stock price now is $48:37. Is she better off buying the stock now so she can capture the dividend, or should she wait until tomorrow, miss the dividend, and buy the stock at a slightly lower price