Answered step by step

Verified Expert Solution

Question

1 Approved Answer

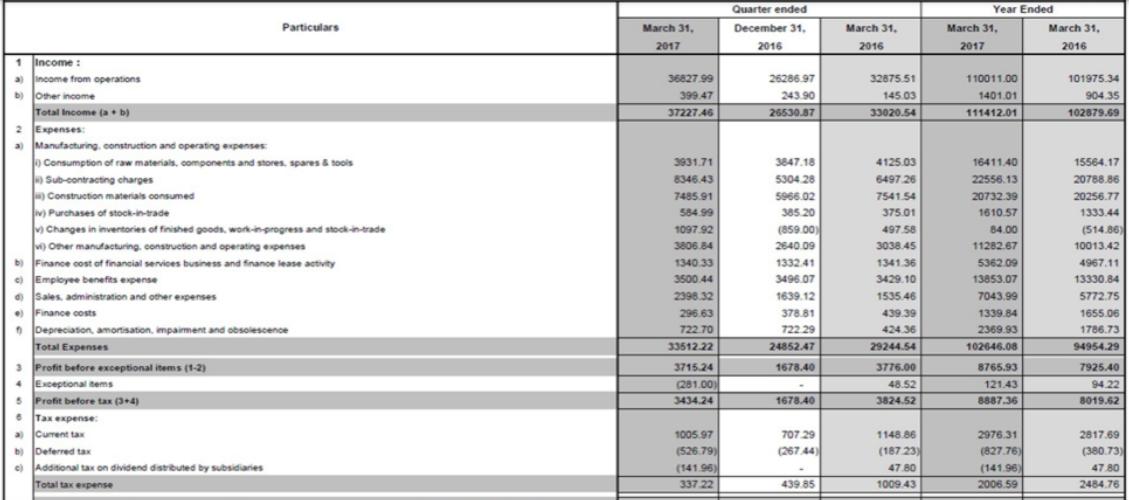

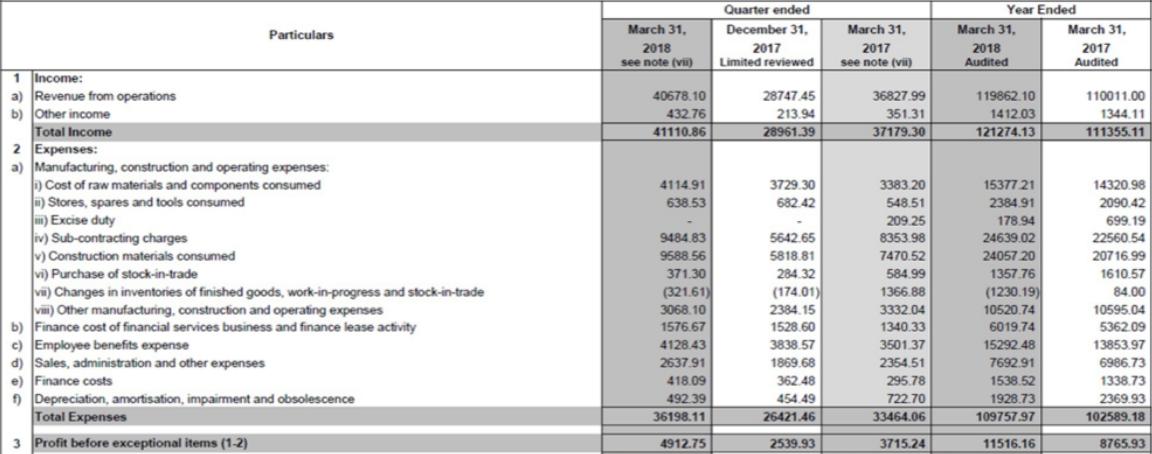

What is the major chunk of expenses? Express it in % terms (% to Total income). Has there been any change over the years? (look

What is the major chunk of expenses? Express it in % terms (% to Total income). Has there been any change over the years? (look at least 3 years to see a trend) How do you think there is scope for your organization to reduce the ‘costs’ vis a vis increase in sales? (Answer this from your understanding of your organization’s financials). How do you see yourself making a change in reducing the ‘costs’ of your organization?

1 Income: a) income from operations b) Other income Total Income (a + b) 2 Expenses: a) Manufacturing, construction and operating expenses Consumption of raw materials, components and stores, spares & tools Sub-contracting charges Construction materials consumed iv) Purchases of stock-in-trade Changes in inventories of finished goods, work-in-progress and stock-in-trade v) Other manufacturing, construction and operating expenses b) Finance cost of financial services business and finance lease activity e) Employee benefits expense d) Sales, administration and other expenses Finance costs Depreciation, amortisation, impairment and obsolescence Total Expenses Profit before exceptional items (1-2) Particulars 3 4 Exceptional items 5 6 Profit before tax (3+4) Tax expense: a) Current tax b) Deferred tax e) Additional tax on dividend distributed by subsidiaries Total tax expense March 31, 2017 36827.99 399.47 37227.46 3931.71 8346.43 7485.91 584.99 1097.92 3806.84 1340.33 3500.44 2398.32 296.63 722.70 33512.22 3715.24 (281.00) 3434.24 1005.97 (526.79) (141.96) 337.22 Quarter ended December 31, 2016 26286.97 243.90 26530.87 3847.18 5304.28 5966.02 385.20 (859.00) 2640.09 1332.41 3496.07 1639.12 378.81 722.29 24852.47 1678.40 1678.40 707.29 (267.44) 439.85 March 31, 2016 32875.51 145.03 33020.54 4125.03 6497.26 7541.54 375.01 497.58 3038.45 1341.36 3429.10 1535.46 439.39 424.36 29244.54 3776.00 48.52 3824.52 1148.86 (187.23) 47.80 1009.43 Year Ended March 31, 2017 110011.00 1401.01 111412.01 16411.40 22556.13 20732.39 1610.57 84.00 11282.67 5362.09 13853.07 7043.99 1339.84 2369.93 102646.08 8765.93 121.43 8887.36 2976.31 (827.76) (141.96) 2006.59 March 31, 2016 101975.34 904.35 102879.69 15564.17 20788.86 20256.77 1333.44 (514.86) 10013.42 4967.11 13330.84 5772.75 1655.06 1786.73 94954.29 7925.40 94.22 8019.62 2817.69 (380.73) 47.80 2484.76

Step by Step Solution

★★★★★

3.37 Rating (156 Votes )

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started