Answered step by step

Verified Expert Solution

Question

1 Approved Answer

What is the net present value and internal Rate Of Return on this investment from local perspective? Texas Innovation (TI) (U.S.) is considering investing Rs

What is the net present value and internal Rate Of Return on this investment from local perspective?

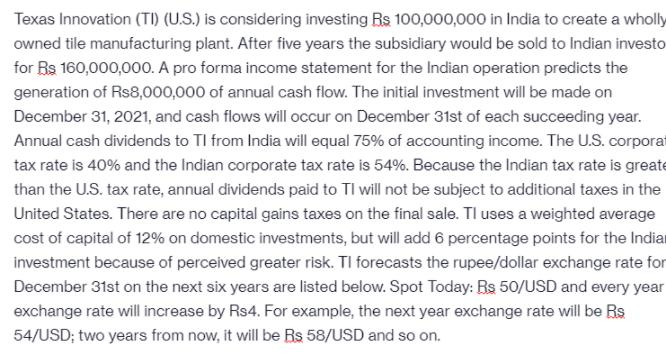

Texas Innovation (TI) (U.S.) is considering investing Rs 100,000,000 in India to create a wholly owned tile manufacturing plant. After five years the subsidiary would be sold to Indian investo for Rs 160,000,000. A pro forma income statement for the Indian operation predicts the generation of Rs8,000,000 of annual cash flow. The initial investment will be made on December 31, 2021, and cash flows will occur on December 31st of each succeeding year. Annual cash dividends to TI from India will equal 75% of accounting income. The U.S. corporat tax rate is 40% and the Indian corporate tax rate is 54%. Because the Indian tax rate is greate than the U.S. tax rate, annual dividends paid to TI will not be subject to additional taxes in the United States. There are no capital gains taxes on the final sale. Tl uses a weighted average cost of capital of 12% on domestic investments, but will add 6 percentage points for the India investment because of perceived greater risk. TI forecasts the rupee/dollar exchange rate for December 31st on the next six years are listed below. Spot Today: Rs 50/USD and every year exchange rate will increase by Rs4. For example, the next year exchange rate will be Rs 54/USD; two years from now, it will be Rs 58/USD and so on.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Assumptions and Values in Texas Innovation TI considering investing Rs 100000000 in India to create a wholly owned tile manufacturing plant with plans to sell the subsidiary to Indian investors for Rs ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started