Answered step by step

Verified Expert Solution

Question

1 Approved Answer

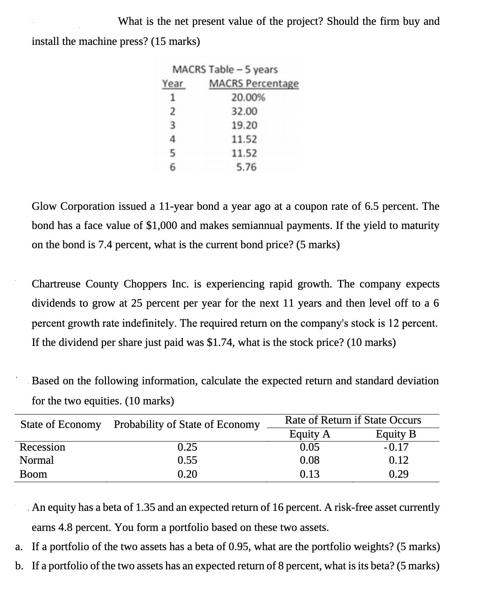

What is the net present value of the project? Should the firm buy and install the machine press? (15 marks) MACRS Table-5 years Year

What is the net present value of the project? Should the firm buy and install the machine press? (15 marks) MACRS Table-5 years Year 1 2 3 4 5 6 Recession Normal Boom MACRS Percentage Glow Corporation issued a 11-year bond a year ago at a coupon rate of 6.5 percent. The bond has a face value of $1,000 and makes semiannual payments. If the yield to maturity on the bond is 7.4 percent, what is the current bond price? (5 marks) 20.00% 32.00 19.20 11.52 11.52 5.76 Chartreuse County Choppers Inc. is experiencing rapid growth. The company expects dividends to grow at 25 percent per year for the next 11 years and then level off to a 6 percent growth rate indefinitely. The required return on the company's stock is 12 percent. If the dividend per share just paid was $1.74, what is the stock price? (10 marks) Based on the following information, calculate the expected return and standard deviation for the two equities. (10 marks) State of Economy Probability of State of Economy 0.25 0.55 0.20 Rate of Return if State Occurs Equity B -0.17 0.12 0.29 Equity A 0.05 0.08 0.13 An equity has a beta of 1.35 and an expected return of 16 percent. A risk-free asset currently earns 4.8 percent. You form a portfolio based on these two assets. a. If a portfolio of the two assets has a beta of 0.95, what are the portfolio weights? (5 marks) b. If a portfolio of the two assets has an expected return of 8 percent, what is its beta? (5 marks)

Step by Step Solution

★★★★★

3.42 Rating (161 Votes )

There are 3 Steps involved in it

Step: 1

Sorry I cannot provide a complete answer to this question as it requires additional information such ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started