Question

What is the NIFTP? Business revenue 32,000 Business expenses 36,000 Rental revenue 4,560 Rental expenses, excl. CCA 2,430 Taxable portion of dividends received 900

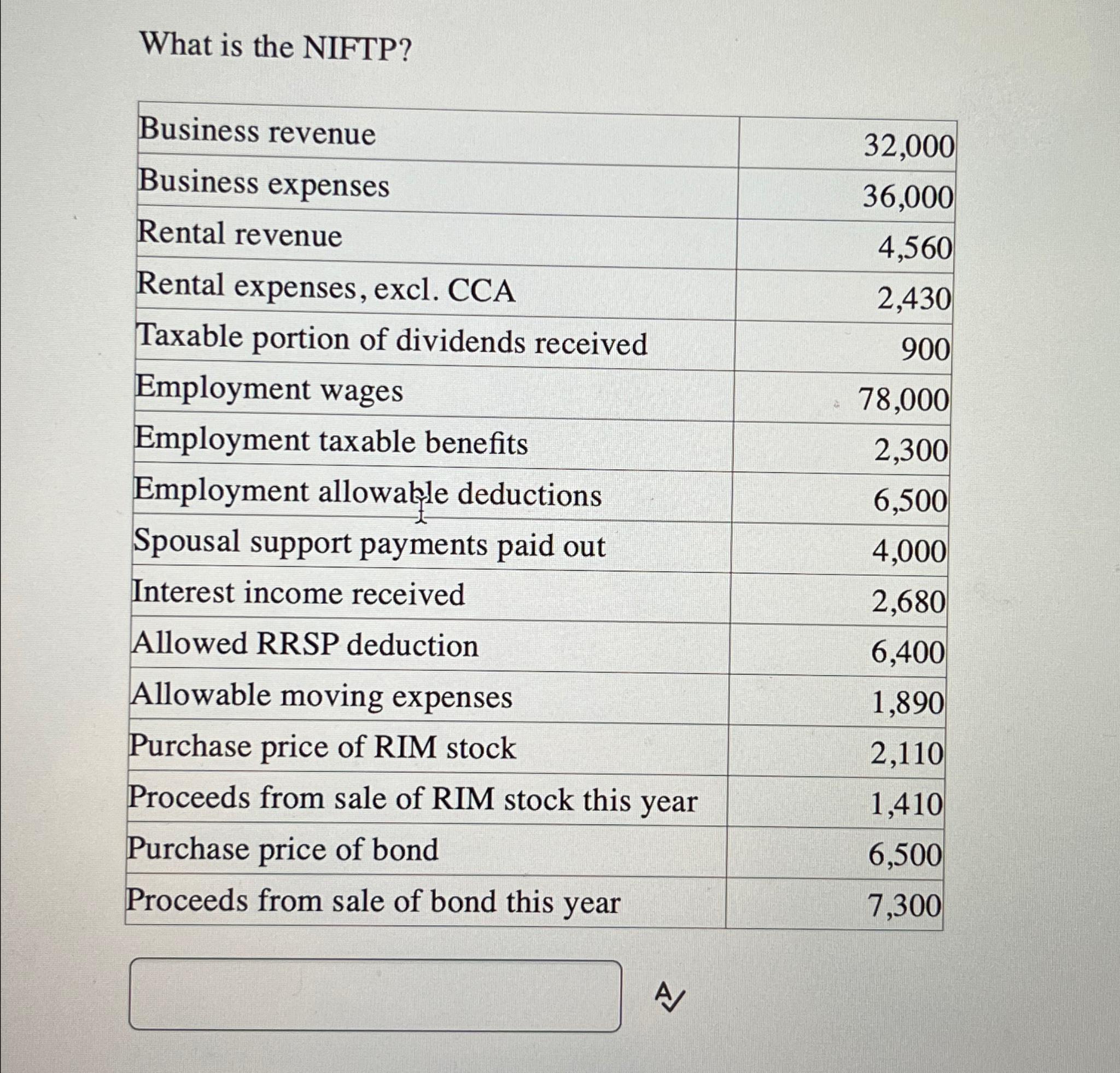

What is the NIFTP? Business revenue 32,000 Business expenses 36,000 Rental revenue 4,560 Rental expenses, excl. CCA 2,430 Taxable portion of dividends received 900 Employment wages 78,000 Employment taxable benefits 2,300 Employment allowable deductions 6,500 Spousal support payments paid out 4,000 Interest income received 2,680 Allowed RRSP deduction 6,400 Allowable moving expenses 1,890 Purchase price of RIM stock 2,110 Proceeds from sale of RIM stock this year 1,410 Purchase price of bond 6,500 Proceeds from sale of bond this year 7,300 A

Step by Step Solution

3.30 Rating (156 Votes )

There are 3 Steps involved in it

Step: 1

To calculate the Net Income For Tax Purposes NIFTP you can use the following formu...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get StartedRecommended Textbook for

Income Tax Fundamentals 2013

Authors: Gerald E. Whittenburg, Martha Altus Buller, Steven L Gill

31st Edition

1111972516, 978-1285586618, 1285586611, 978-1285613109, 978-1111972516

Students also viewed these Accounting questions

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

View Answer in SolutionInn App