Answered step by step

Verified Expert Solution

Question

1 Approved Answer

What is the NPV of Project Grow? (Be sure to present your answer in tabular form.) What is the payback period of Project Grow? What

What is the NPV of Project Grow? (Be sure to present your answer in tabular form.)

What is the payback period of Project Grow?

What is the discounted payback of Project Grow?

What is the IRR of Project Grow?

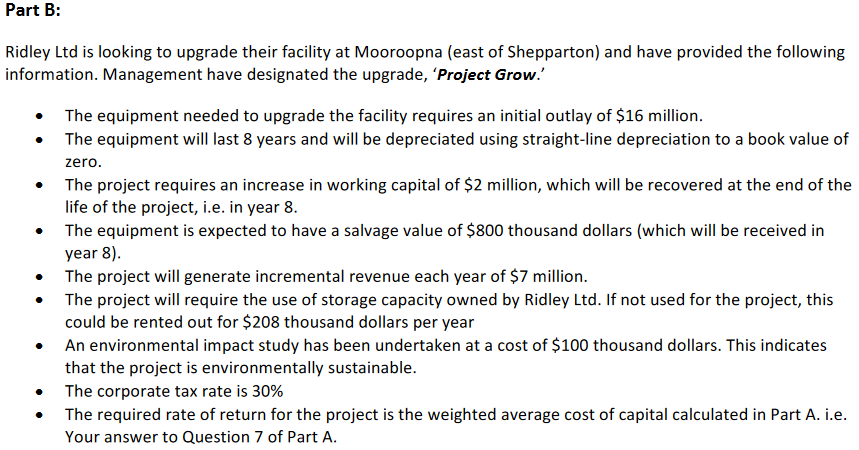

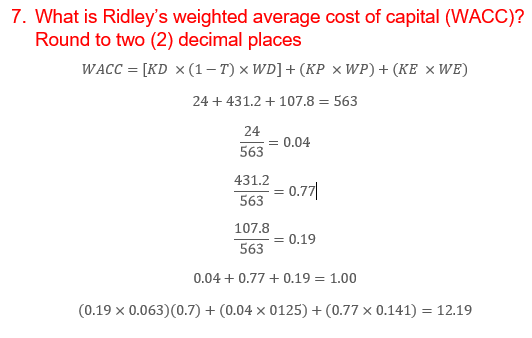

Part B: Ridley Ltd is looking to upgrade their facility at Mooroopna (east of Shepparton) and have provided the following information. Management have designated the upgrade, 'Project Grow.' The equipment needed to upgrade the facility requires an initial outlay of $16 million. The equipment will last 8 years and will be depreciated using straight-line depreciation to a book value of zero. The project requires an increase in working capital of $2 million, which will be recovered at the end of the life of the project, i.e. in year 8. The equipment is expected to have a salvage value of $800 thousand dollars (which will be received in year 8). The project will generate incremental revenue each year of $7 million. The project will require the use of storage capacity owned by Ridley Ltd. If not used for the project, this could be rented out for $208 thousand dollars per year An environmental impact study has been undertaken at a cost of $100 thousand dollars. This indicates that the project is environmentally sustainable. The corporate tax rate is 30% The required rate of return for the project is the weighted average cost of capital calculated in Part A. i.e. Your answer to Question 7 of Part A. 7. What is Ridley's weighted average cost of capital (WACC)? Round to two (2) decimal places WACC = [KD x(1-) XWD] + (KP XWP) + (KE XWE) 24 + 431.2 + 107.8 = 563 24 563 = 0.04 431.2 563 = 0.771 107.8 563 = 0.19 0.04 + 0.77 + 0.19 = 1.00 (0.19 x 0.063) (0.7) + (0.04 x 0125) + (0.77 x 0.141) = 12.19Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started