Answered step by step

Verified Expert Solution

Question

1 Approved Answer

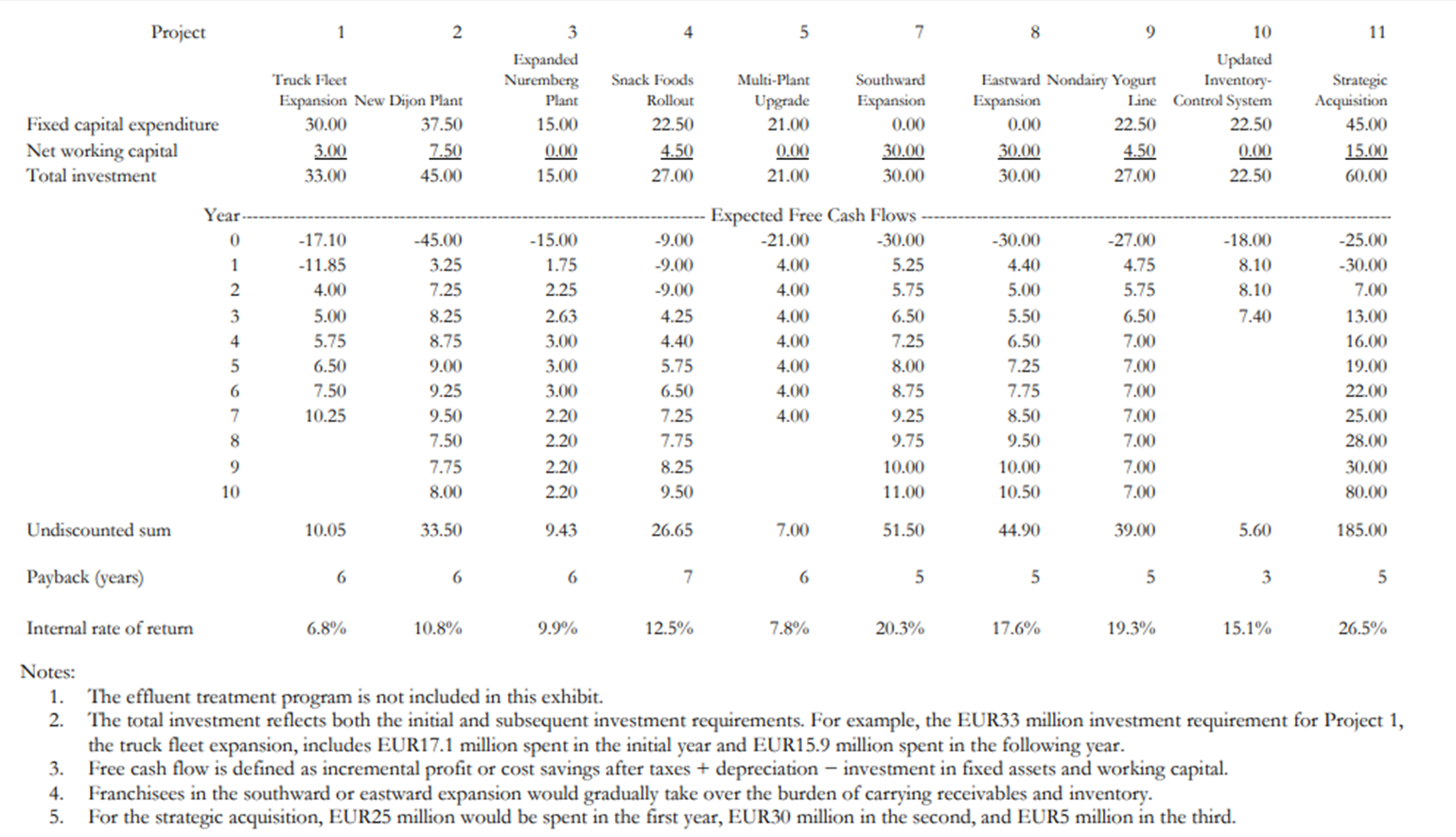

What is the NPV of the following 11 projects at their hurdle rate? Project 1. Truck fleet expansion Heinz Klink proposed purchasing 100 new refrigerated

What is the NPV of the following 11 projects at their hurdle rate?

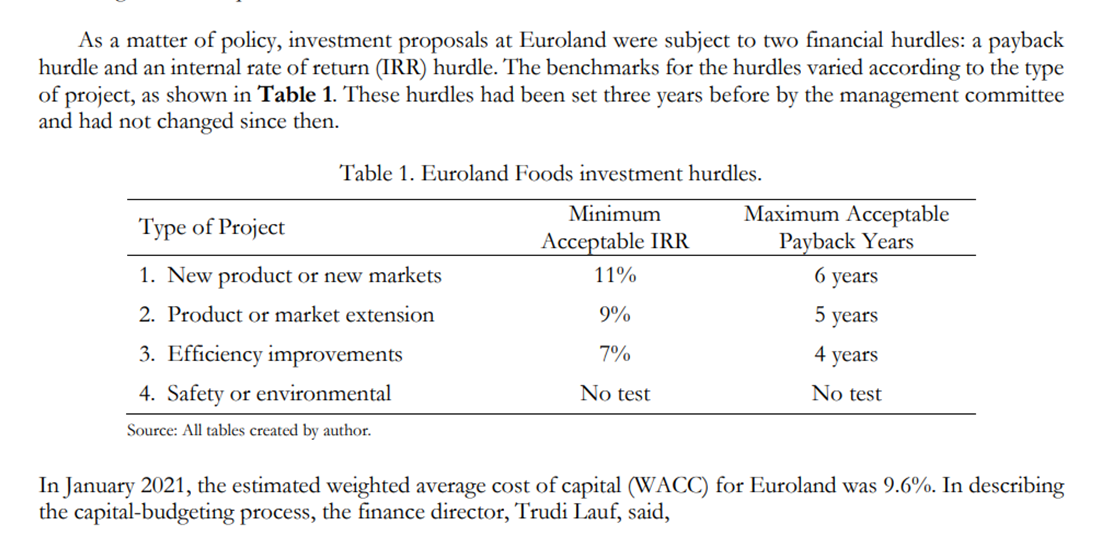

Project 1. Truck fleet expansion Heinz Klink proposed purchasing 100 new refrigerated tractor-trailer trucks, 50 each in 2021 and 2022. By doing so, the company could sell 60 old, fully depreciated trucks over the two years for a total of EUR4.05 million. The purchase would expand the fleet by 40 trucks within two years. Each of the new trailers would be larger than the old trailers and afforded a 15% increase in cubic meters of goods hauled on each trip. The new tractors would also be more fuel- and maintenance-efficient. The increase in the number of trucks would permit more flexible scheduling and more efficient routing and servicing of the fleet; it would also cut delivery times and, therefore, possibly inventories. It would also enable more frequent deliveries to the company's major markets, which would reduce the loss of sales caused by stock-outs. Finally, expanding the fleet would support geographical expansion over the long term. As shown in Exhibit 3, the total net investment in trucks (EUR30 million), along with the increase in working capital to support added maintenance, fuel, payroll, and inventories (EUR3 million), was expected to yield cost savings and added sales gains over the next seven years. The resulting IRR was estimated to be 6.8%, marginally below the minimum 7% required return on efficiency projects. The project was classified as efficiency, but some thought it should be classified as an expansion.

Step by Step Solution

★★★★★

3.48 Rating (164 Votes )

There are 3 Steps involved in it

Step: 1

Here are the steps to calculate the NPV of each project at the hurdle rate Project 1 Truck fleet exp...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started