what is the NPV using the cost of capital? and using hurdle rate? and what is the IRR?

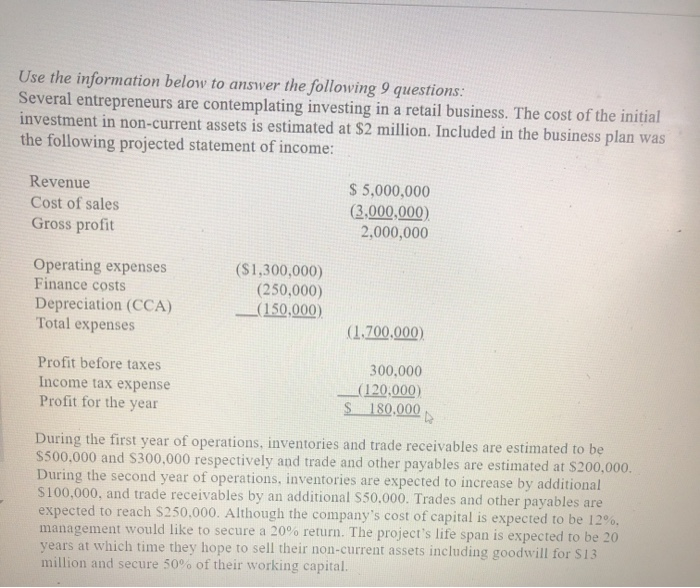

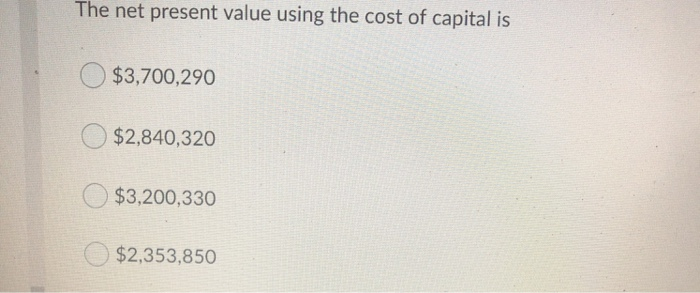

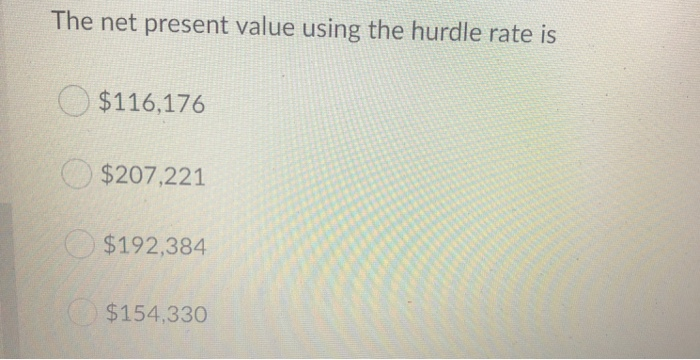

Use the information below to answer the following 9 questions: Several entrepreneurs are contemplating investing in a retail business. The cost of the initial investment in non-current assets is estimated at $2 million. Included in the business plan was the following projected statement of income: Revenue Cost of sales Gross profit $ 5,000,000 (3,000,000 2,000,000 Operating expenses Finance costs Depreciation (CCA) Total expenses ($1,300,000) (250,000) (150,000) (1.700.000) Profit before taxes Income tax expense Profit for the year 300,000 (120,000) 180,000 $ During the first year of operations, inventories and trade receivables are estimated to be $500,000 and $300,000 respectively and trade and other payables are estimated at $200,000. During the second year of operations, inventories are expected to increase by additional $100,000, and trade receivables by an additional $50,000. Trades and other payables are expected to reach $250,000. Although the company's cost of capital is expected to be 12%, management would like to secure a 20% return. The project's life span is expected to be 20 years at which time they hope to sell their non-current assets including goodwill for $13 million and secure 50% of their working capital. The net present value using the cost of capital is $3,700,290 $2,840,320 $3,200,330 $2,353,850 The net present value using the hurdle rate is $116,176 $207,221 $192,384 $154,330 Use the information below to answer the following 9 questions: Several entrepreneurs are contemplating investing in a retail business. The cost of the initial investment in non-current assets is estimated at $2 million. Included in the business plan was the following projected statement of income: Revenue Cost of sales Gross profit $ 5,000,000 (3,000,000 2,000,000 Operating expenses Finance costs Depreciation (CCA) Total expenses ($1,300,000) (250,000) (150,000) (1.700.000) Profit before taxes Income tax expense Profit for the year 300,000 (120,000) 180,000 $ During the first year of operations, inventories and trade receivables are estimated to be $500,000 and $300,000 respectively and trade and other payables are estimated at $200,000. During the second year of operations, inventories are expected to increase by additional $100,000, and trade receivables by an additional $50,000. Trades and other payables are expected to reach $250,000. Although the company's cost of capital is expected to be 12%, management would like to secure a 20% return. The project's life span is expected to be 20 years at which time they hope to sell their non-current assets including goodwill for $13 million and secure 50% of their working capital. The net present value using the cost of capital is $3,700,290 $2,840,320 $3,200,330 $2,353,850 The net present value using the hurdle rate is $116,176 $207,221 $192,384 $154,330