What is the one most pressing immediate budgetary problem facing this family or individual in the next 12 months?

Is this temporary or a chronic economic situation and why have you determined it to be so?

What can each of the families or individuals do to reduce the problem during the next 12 months?

The financial spreadsheets for each of the families are provided to what the family can do to work on the problem.

How will the proposals reduce their budgetary problems?

What are two risk management mechanisms each family could have taken beforehand to handle risk exposure and minimize after loss?

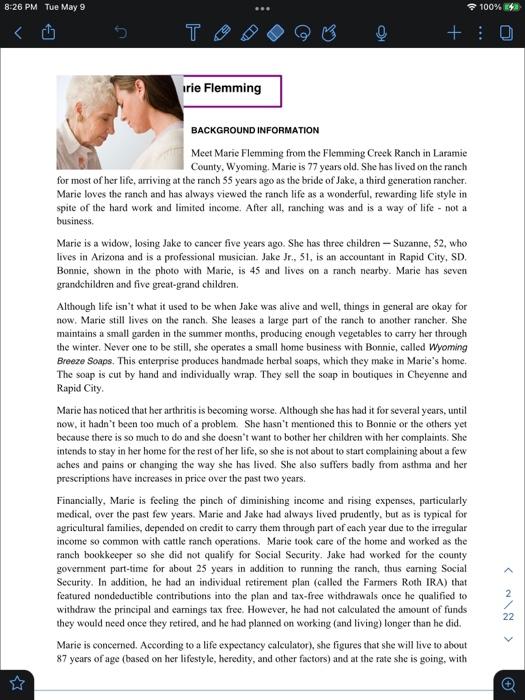

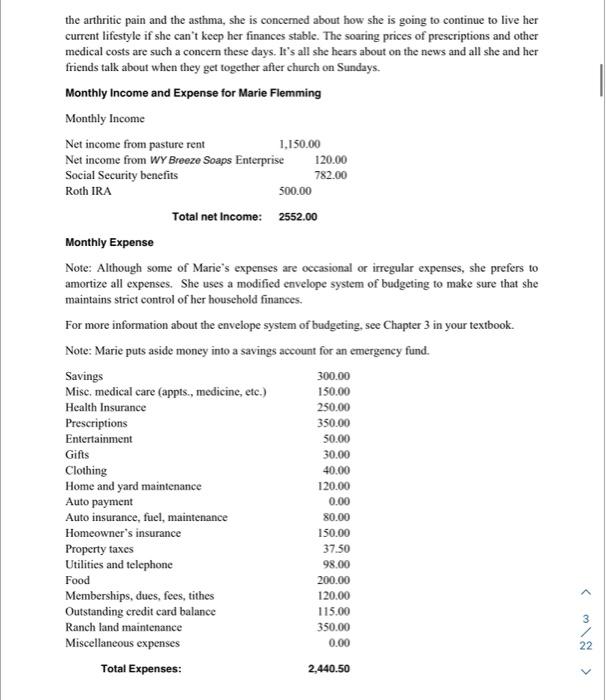

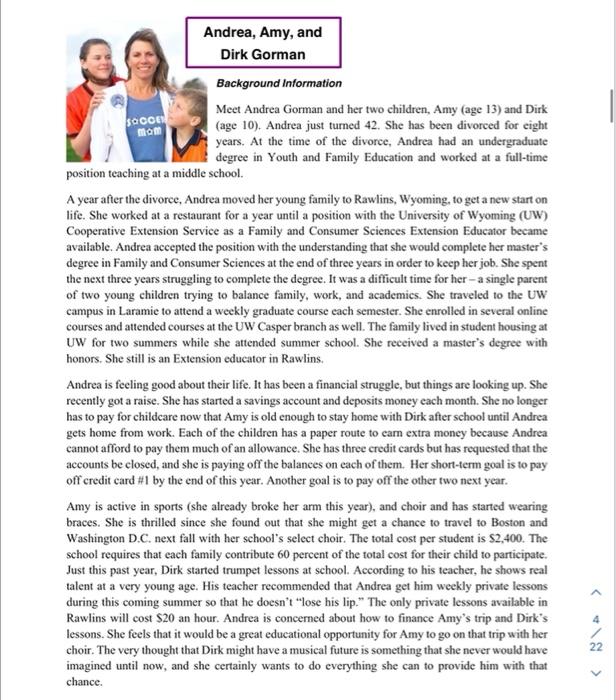

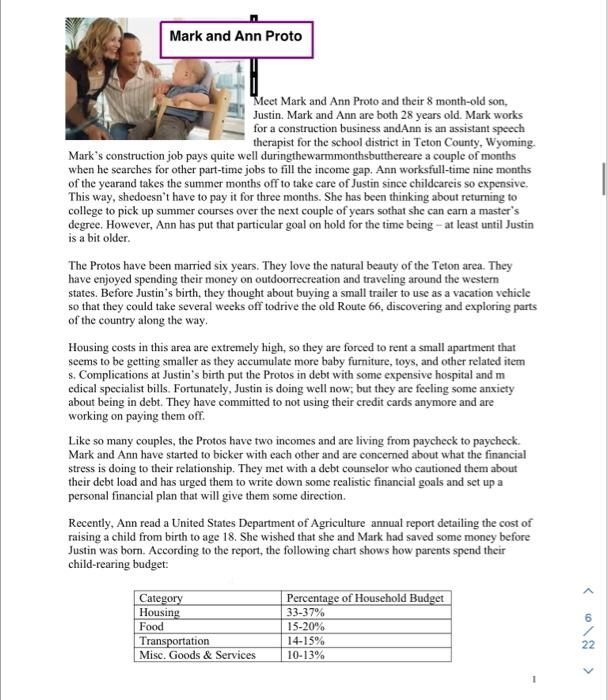

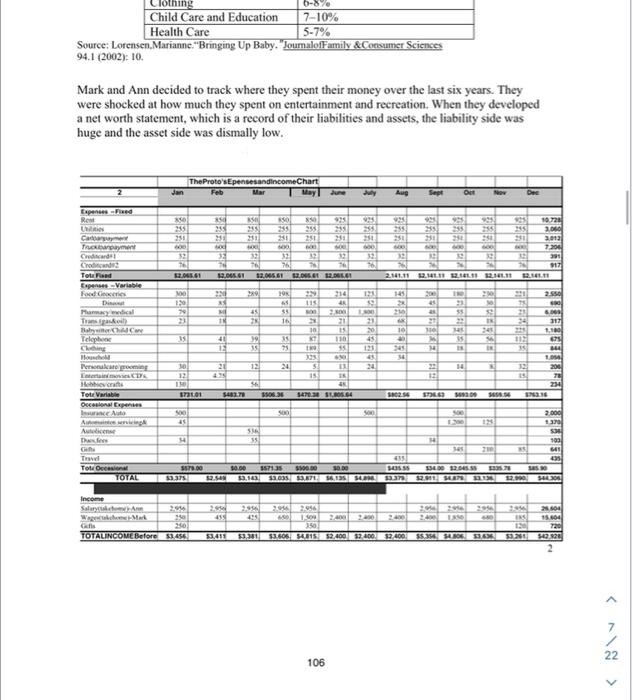

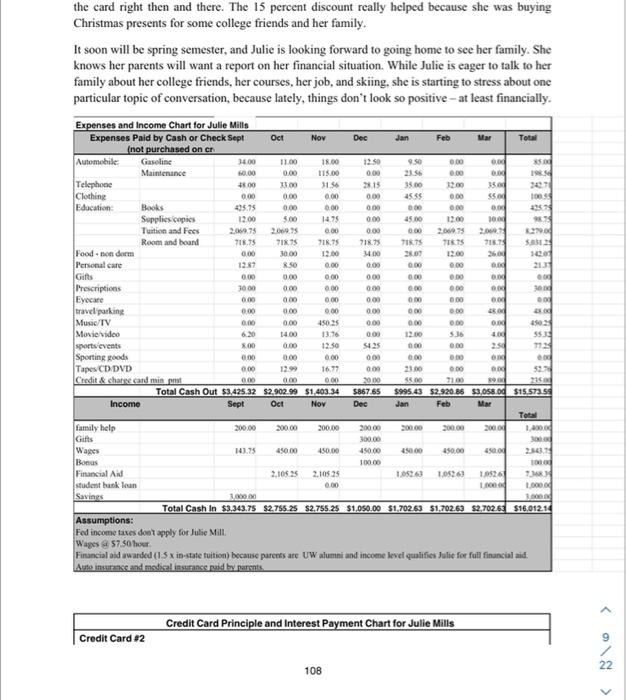

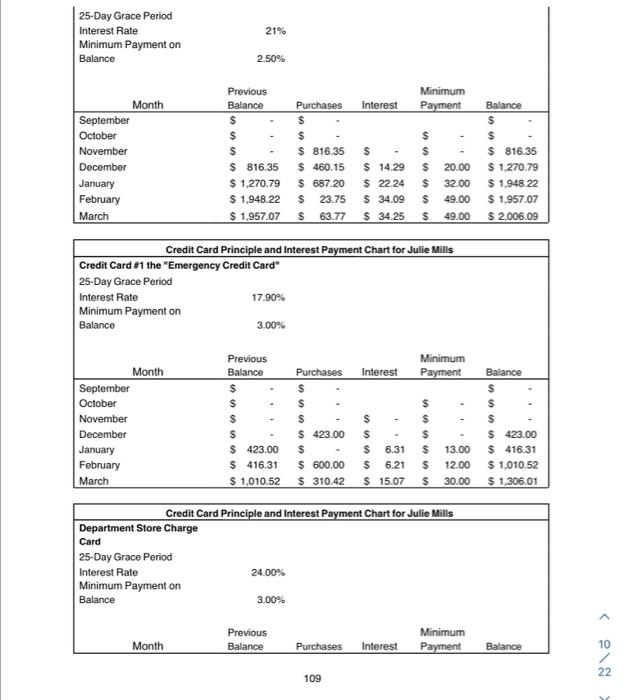

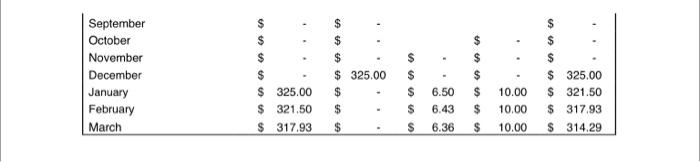

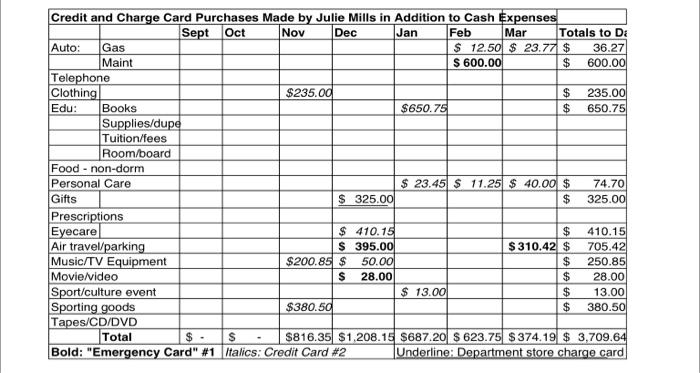

County. Wyoming. Marie is 77 years old. She has lived on the ranch for most of her life, arriving at the ranch 55 years ago as the bride of Jake, a third generation rancher. Marie loves the ranch and has always viewed the ranch life as a wonderful, rewarding life style in spite of the hard work and limited income. After all, ranching was and is a way of life - not a business. Marie is a widow, losing Jake to cancer five years ago. She has three children - Suzanne, 52 , who lives in Arizona and is a professional musician. Jake Jr.,51, is an accountant in Rapid City, SD. Bonnie, shown in the photo with Marie, is 45 and lives on a ranch nearby. Marie has seven grandchildren and five great-grand children. Although life isn't what it used to be when Jake was alive and well, things in general are okay for now. Marie still lives on the ranch. She leases a large part of the ranch to another rancher. She maintains a small garden in the summer months, producing enough vegetables to carry her through the winter. Never one to be still, she operates a small home business with Bonnie, called Wyoming Breeze Soaps. This enterprise produces bandmade herbal soaps, which they make in Marie's home. The soap is cut by hand and individually wrap. They sell the soap in boutiques in Cheyenne and Rapid City. Marie has noticed that her arthritis is becoming worse. Although she has had it for several years, until now, it hadn't been too much of a problem. She hasn't mentioned this to Bonnie or the others yet because there is so much to do and she doesn't want to bother her children with her complaints. She intends to stay in her home for the rest of her life, 90 she is not about to start complaining about a few aches and pains or changing the way she has lived, She also suffers badly from asthma and her prescriptions have increases in price over the past two years. Financially, Marie is feeling the pinch of diminishing income and rising expenses, particularly medical, over the past few years. Marie and Jake had always lived prudently, but as is typieal for agricultural families, depended on credit to carry them through part of each year due to the irregular income so common with cattle ranch operations. Marie took care of the home and worked as the ranch bookkeeper so she did not qualify for Social Security. Jake had worked for the county government part-time for about 25 years in addition to running the ranch, thus earning Social Security. In addition, he had an individual retirement plan (called the Farmers Roth IRA) that featured nondeductible contributions into the plan and tax-free withdrawals once he qualified to withdraw the principal and earmings tax free. However, he had not calculated the amount of funds they would need once they retired, and he had planned on working (and living) longer than he did. Marie is concerned. According to a life expectancy calculator), she figures that she will live to about 87 years of age (based on her lifestyle, heredity, and other factors) and at the rate she is going, with the arthritic pain and the asthma, she is concerned about how she is going to continue to live her current lifestyle if she can't keep her finances stable. The soaring prices of prescriptions and other medical costs are such a concern these days. It's all she hears about on the news and all she and her friends talk about when they get together after church on Sundays. Monthly Expense Note: Although some of Marie's expenses are occasional or irregular expenses, she prefers to amortize all expenses. She uses a modified cnvelope system of budgeting to make sure that she maintains strict control of her household finances. For more information about the envelope system of budgeting, see Chapter 3 in your textbook. Note: Marie puts aside money into a savings account for an emergency fund. indrea, Amy, and Dirk Gorman Background Information Meet Andrea Gorman and her two children, Amy (age 13) and Dirk (age 10). Andrea just turned 42. She has been divorced for eight years. At the time of the divorce, Andrea had an undergraduate degree in Youth and Family Education and worked at a full-time position teaching at a middle school. A year after the divoree, Andrea moved her young family to Rawlins, Wyoming, to get a new start on life. She worked at a restaurant for a year until a position with the University of Wyoming (UW) Cooperative Extension Service as a Family and Consumer Sciences Extension Educator became available. Andrea accepted the position with the understanding that she would complete her master's degree in Family and Consumer Sciences at the end of three years in order to keep her job. She spent the next three years struggling to complete the degree. It was a difficult time for her-a single parent of two young children trying to balance family, work, and academics. She traveled to the UW campus in Laramic to attend a weekly graduate course each semester. She enrolled in several online courses and attended courses at the UW Casper branch as well. The family lived in student housing at UW for two summers while she attended summer school. She received a master's degree with honors. She still is an Extension educator in Rawlins. Andrea is feeling good about their life. It has been a financial struggle, but things are looking up. She recently got a raise. She has started a savings account and deposits money each month. She no longer has to pay for childcare now that Amy is old enough to stay home with Dirk after school until Andrea gets home from work. Each of the children has a paper route to earn extra money because Andrea cannot afford to pay them much of an allowance. She has three credit cards but has requested that the accounts be closed, and she is paying off the balances on each of them. Her short-term goal is to pay off credit card #1 by the end of this year. Another goal is to pay off the other two next year. Amy is active in sports (she already broke her arm this year), and choir and has started wearing braces. She is thrilled since she found out that she might get a chance to travel to Boston and Washington D.C. next fall with her school's select choir. The total cost per student is $2,400. The school requires that each family contribute 60 percent of the total cost for their child to participate. Just this past year, Dirk started trumpet lessons at school. According to his teacher, he shows real talent at a very young age. His teacher recommended that Andrea get him weekly private lessons during this coming summer so that he doesn't "lose his lip." The only private lessons available in Rawlins will cost $20 an hour. Andrea is concerned about how to finance Amy's trip and Dirk's lessons. She feels that it would be a great educational opportunity for Amy to go on that trip with her choir. The very thought that Dirk might have a musical future is something that she never would have imagined until now, and she certainly wants to do everything she can to provide him with that chance. Andrea dreams of the day when her unsecured debt is paid off and she has saved enough money to take the family on a trip. That day seems so far away. Recently, she started playing with the idea of putting the cost of a family vacation on a credit card, even though she really wants to get out of debt. Wouldn't it be wonderful to take the kids to Califomia to see the Pacific Ocean? On the other hand, wouldn't it be a terrific sense of accomplishment to be out of debt -- finally? Inn Proto and their 8 month-old son, Ann are both 28 years old. Mark works 1 business andAnn is an assistant speech ichool district in Teton County, Wyoming. Mark's construction job pays quite well duringthewarmmonthsbuthereare a couple of months when he searches for other part-time jobs to fill the income gap. Ann worksfull-time nine months of the yearand takes the summer months off to take care of Justin since childcareis so expensive. This way, shedoesn't have to pay it for three months. She has been thinking about returning to college to pick up summer courses over the next couple of years sothat she can earn a master's degree. However, Ann has put that particular goal on hold for the time being - at least until Justin is a bit older. The Protos have been married six years. They love the natural beauty of the Teton area. They have enjoyed spending their money on outdoorrecreation and traveling around the western states. Before Justin's birth, they thought about buying a small trailer to use as a vacation vehicle so that they could take several weeks off todrive the old Route 66 , discovering and exploring parts of the country along the way. Housing costs in this area are extremely high, so they are forced to rent a small apartment that seems to be getting smaller as they accumulate more baby furniture, toys, and other related item s. Complications at Justin's birth put the Protos in debt with some expensive hospital and m edical specialist bills. Fortunately, Justin is doing well now; but they are feeling some anxiety about being in debt. They have committed to not using their credit cards anymore and are working on paying them off. Like so many couples, the Protos have two incomes and are living from paycheck to paycheck. Mark and Ann have started to bicker with each other and are concerned about what the financial stress is doing to their relationship. They met with a debt counselor who cautioned them about their debt load and has urged them to write down some realistic financial goals and set up a personal financial plan that will give them some direction. Recently, Ann read a United States Department of Agriculture annual report detailing the cost of raising a child from birth to age 18 . She wished that she and Mark had saved some money before Justin was born. According to the report, the following chart shows how parents spend their child-rearing budget: Mark and Ann decided to track where they spent their money over the last six years. They were shocked at how much they spent on entertainment and reereation. When they developed a net worth statement, which is a record of their liabilities and assets, the liability side was huge and the asset side was dismally low. Background Information Meet 20-year-old Julie Mills. She is a junior at the University of Wyoming (UW) and is working towards a Bachelor of Arts degree in English Literature. She carries 14 credit hours and works part-time at a downtown restaurant four evenings a week for a total of 15 hours a week. Raised in Phoenix, Arizona, Julie has an older brother. She attended a junior college in Phoenix for her first two years at college. She persuaded her parents to let her attend the University of Wyoming for her last two years of college if she made good grades; saved $3,000; and could obtain financial aid. Her hard work and persistence paid off. She is excited about her independence and is determined to prove to her parents that she can help pay out-of-state expenses, make good grades at UW, and manage her finances = and her life. Her parents were concerned about how she would handle her finances away from home. Two years ago, her older brother, Joe, who is 26 , moved back home to reduce living expenses. He started accumulating credit card debt when he was at the University of Arizona, and by the time he had earned his MBA, he had more than $9,200 in credit card debt. He figures it will take him another year of hard work to pay off the debt. Before Julie left for Wyoming, her parents had a serious talk with her about debt and the consequences of not using credit cards wisely. When she left for Wyoming, she obtained her first eredit card that she assured her parents she would use only for emergencies. Julie's parents helped her purchase a used car when she was a freshman in college. Julie paid the down payment while Mom and Dad agreed to cover the semiannual insurance premiums. Julie pays for the gas, annual license, tax, and auto maintenance. When Julie arrived on the UW campus, she was approached by credit card issuers about obtaining another credit card. She held out for the first two months, but by November, it was too tempting an opportunity to refuse. Most of her friends had more than one credit card. Julie now has two credit cards. Her way of thinking is that the first card is reserved just for those dire emergencies her parents worried about. Card \#2 will be used for things that her parents wouldn't consider emergencies, but that she considers "almost emergencies." After all, each person has his or her own definition of an emergency, right? One of the first emergencies she encountered was the need to purchase skis and related clothing. Everyone on her dorm floor was skiing on weekends, and she didn't want to be left out. She also acquired a department store charge card, although she does not really count that as the same thing as a credit card because she can only use the card to charge for purchases at that department store, which is located in Denver. She was glad to get that opportunity because the store offered a 15 percent discount off the total purchase amount if she signed up for 107 the card right then and there. The 15 percent discount really helped because she was buying Christmas presents for some college friends and her family. It soon will be spring semester, and Julie is looking forward to going home to see her family. She knows her parents will want a report on her financial situation. While Julie is eager to talk to her family about her college friends, her courses, her job, and skiing, she is starting to stress about one particular topic of conversation, because lately, things don't look so positive - at least financially. Wages si 57,50 hoer Firancial aid awatded ( 1.5x in-state fuition) because parens are UW alumni and income level qualifies Julie for full financial aid. 109 County. Wyoming. Marie is 77 years old. She has lived on the ranch for most of her life, arriving at the ranch 55 years ago as the bride of Jake, a third generation rancher. Marie loves the ranch and has always viewed the ranch life as a wonderful, rewarding life style in spite of the hard work and limited income. After all, ranching was and is a way of life - not a business. Marie is a widow, losing Jake to cancer five years ago. She has three children - Suzanne, 52 , who lives in Arizona and is a professional musician. Jake Jr.,51, is an accountant in Rapid City, SD. Bonnie, shown in the photo with Marie, is 45 and lives on a ranch nearby. Marie has seven grandchildren and five great-grand children. Although life isn't what it used to be when Jake was alive and well, things in general are okay for now. Marie still lives on the ranch. She leases a large part of the ranch to another rancher. She maintains a small garden in the summer months, producing enough vegetables to carry her through the winter. Never one to be still, she operates a small home business with Bonnie, called Wyoming Breeze Soaps. This enterprise produces bandmade herbal soaps, which they make in Marie's home. The soap is cut by hand and individually wrap. They sell the soap in boutiques in Cheyenne and Rapid City. Marie has noticed that her arthritis is becoming worse. Although she has had it for several years, until now, it hadn't been too much of a problem. She hasn't mentioned this to Bonnie or the others yet because there is so much to do and she doesn't want to bother her children with her complaints. She intends to stay in her home for the rest of her life, 90 she is not about to start complaining about a few aches and pains or changing the way she has lived, She also suffers badly from asthma and her prescriptions have increases in price over the past two years. Financially, Marie is feeling the pinch of diminishing income and rising expenses, particularly medical, over the past few years. Marie and Jake had always lived prudently, but as is typieal for agricultural families, depended on credit to carry them through part of each year due to the irregular income so common with cattle ranch operations. Marie took care of the home and worked as the ranch bookkeeper so she did not qualify for Social Security. Jake had worked for the county government part-time for about 25 years in addition to running the ranch, thus earning Social Security. In addition, he had an individual retirement plan (called the Farmers Roth IRA) that featured nondeductible contributions into the plan and tax-free withdrawals once he qualified to withdraw the principal and earmings tax free. However, he had not calculated the amount of funds they would need once they retired, and he had planned on working (and living) longer than he did. Marie is concerned. According to a life expectancy calculator), she figures that she will live to about 87 years of age (based on her lifestyle, heredity, and other factors) and at the rate she is going, with the arthritic pain and the asthma, she is concerned about how she is going to continue to live her current lifestyle if she can't keep her finances stable. The soaring prices of prescriptions and other medical costs are such a concern these days. It's all she hears about on the news and all she and her friends talk about when they get together after church on Sundays. Monthly Expense Note: Although some of Marie's expenses are occasional or irregular expenses, she prefers to amortize all expenses. She uses a modified cnvelope system of budgeting to make sure that she maintains strict control of her household finances. For more information about the envelope system of budgeting, see Chapter 3 in your textbook. Note: Marie puts aside money into a savings account for an emergency fund. indrea, Amy, and Dirk Gorman Background Information Meet Andrea Gorman and her two children, Amy (age 13) and Dirk (age 10). Andrea just turned 42. She has been divorced for eight years. At the time of the divorce, Andrea had an undergraduate degree in Youth and Family Education and worked at a full-time position teaching at a middle school. A year after the divoree, Andrea moved her young family to Rawlins, Wyoming, to get a new start on life. She worked at a restaurant for a year until a position with the University of Wyoming (UW) Cooperative Extension Service as a Family and Consumer Sciences Extension Educator became available. Andrea accepted the position with the understanding that she would complete her master's degree in Family and Consumer Sciences at the end of three years in order to keep her job. She spent the next three years struggling to complete the degree. It was a difficult time for her-a single parent of two young children trying to balance family, work, and academics. She traveled to the UW campus in Laramic to attend a weekly graduate course each semester. She enrolled in several online courses and attended courses at the UW Casper branch as well. The family lived in student housing at UW for two summers while she attended summer school. She received a master's degree with honors. She still is an Extension educator in Rawlins. Andrea is feeling good about their life. It has been a financial struggle, but things are looking up. She recently got a raise. She has started a savings account and deposits money each month. She no longer has to pay for childcare now that Amy is old enough to stay home with Dirk after school until Andrea gets home from work. Each of the children has a paper route to earn extra money because Andrea cannot afford to pay them much of an allowance. She has three credit cards but has requested that the accounts be closed, and she is paying off the balances on each of them. Her short-term goal is to pay off credit card #1 by the end of this year. Another goal is to pay off the other two next year. Amy is active in sports (she already broke her arm this year), and choir and has started wearing braces. She is thrilled since she found out that she might get a chance to travel to Boston and Washington D.C. next fall with her school's select choir. The total cost per student is $2,400. The school requires that each family contribute 60 percent of the total cost for their child to participate. Just this past year, Dirk started trumpet lessons at school. According to his teacher, he shows real talent at a very young age. His teacher recommended that Andrea get him weekly private lessons during this coming summer so that he doesn't "lose his lip." The only private lessons available in Rawlins will cost $20 an hour. Andrea is concerned about how to finance Amy's trip and Dirk's lessons. She feels that it would be a great educational opportunity for Amy to go on that trip with her choir. The very thought that Dirk might have a musical future is something that she never would have imagined until now, and she certainly wants to do everything she can to provide him with that chance. Andrea dreams of the day when her unsecured debt is paid off and she has saved enough money to take the family on a trip. That day seems so far away. Recently, she started playing with the idea of putting the cost of a family vacation on a credit card, even though she really wants to get out of debt. Wouldn't it be wonderful to take the kids to Califomia to see the Pacific Ocean? On the other hand, wouldn't it be a terrific sense of accomplishment to be out of debt -- finally? Inn Proto and their 8 month-old son, Ann are both 28 years old. Mark works 1 business andAnn is an assistant speech ichool district in Teton County, Wyoming. Mark's construction job pays quite well duringthewarmmonthsbuthereare a couple of months when he searches for other part-time jobs to fill the income gap. Ann worksfull-time nine months of the yearand takes the summer months off to take care of Justin since childcareis so expensive. This way, shedoesn't have to pay it for three months. She has been thinking about returning to college to pick up summer courses over the next couple of years sothat she can earn a master's degree. However, Ann has put that particular goal on hold for the time being - at least until Justin is a bit older. The Protos have been married six years. They love the natural beauty of the Teton area. They have enjoyed spending their money on outdoorrecreation and traveling around the western states. Before Justin's birth, they thought about buying a small trailer to use as a vacation vehicle so that they could take several weeks off todrive the old Route 66 , discovering and exploring parts of the country along the way. Housing costs in this area are extremely high, so they are forced to rent a small apartment that seems to be getting smaller as they accumulate more baby furniture, toys, and other related item s. Complications at Justin's birth put the Protos in debt with some expensive hospital and m edical specialist bills. Fortunately, Justin is doing well now; but they are feeling some anxiety about being in debt. They have committed to not using their credit cards anymore and are working on paying them off. Like so many couples, the Protos have two incomes and are living from paycheck to paycheck. Mark and Ann have started to bicker with each other and are concerned about what the financial stress is doing to their relationship. They met with a debt counselor who cautioned them about their debt load and has urged them to write down some realistic financial goals and set up a personal financial plan that will give them some direction. Recently, Ann read a United States Department of Agriculture annual report detailing the cost of raising a child from birth to age 18 . She wished that she and Mark had saved some money before Justin was born. According to the report, the following chart shows how parents spend their child-rearing budget: Mark and Ann decided to track where they spent their money over the last six years. They were shocked at how much they spent on entertainment and reereation. When they developed a net worth statement, which is a record of their liabilities and assets, the liability side was huge and the asset side was dismally low. Background Information Meet 20-year-old Julie Mills. She is a junior at the University of Wyoming (UW) and is working towards a Bachelor of Arts degree in English Literature. She carries 14 credit hours and works part-time at a downtown restaurant four evenings a week for a total of 15 hours a week. Raised in Phoenix, Arizona, Julie has an older brother. She attended a junior college in Phoenix for her first two years at college. She persuaded her parents to let her attend the University of Wyoming for her last two years of college if she made good grades; saved $3,000; and could obtain financial aid. Her hard work and persistence paid off. She is excited about her independence and is determined to prove to her parents that she can help pay out-of-state expenses, make good grades at UW, and manage her finances = and her life. Her parents were concerned about how she would handle her finances away from home. Two years ago, her older brother, Joe, who is 26 , moved back home to reduce living expenses. He started accumulating credit card debt when he was at the University of Arizona, and by the time he had earned his MBA, he had more than $9,200 in credit card debt. He figures it will take him another year of hard work to pay off the debt. Before Julie left for Wyoming, her parents had a serious talk with her about debt and the consequences of not using credit cards wisely. When she left for Wyoming, she obtained her first eredit card that she assured her parents she would use only for emergencies. Julie's parents helped her purchase a used car when she was a freshman in college. Julie paid the down payment while Mom and Dad agreed to cover the semiannual insurance premiums. Julie pays for the gas, annual license, tax, and auto maintenance. When Julie arrived on the UW campus, she was approached by credit card issuers about obtaining another credit card. She held out for the first two months, but by November, it was too tempting an opportunity to refuse. Most of her friends had more than one credit card. Julie now has two credit cards. Her way of thinking is that the first card is reserved just for those dire emergencies her parents worried about. Card \#2 will be used for things that her parents wouldn't consider emergencies, but that she considers "almost emergencies." After all, each person has his or her own definition of an emergency, right? One of the first emergencies she encountered was the need to purchase skis and related clothing. Everyone on her dorm floor was skiing on weekends, and she didn't want to be left out. She also acquired a department store charge card, although she does not really count that as the same thing as a credit card because she can only use the card to charge for purchases at that department store, which is located in Denver. She was glad to get that opportunity because the store offered a 15 percent discount off the total purchase amount if she signed up for 107 the card right then and there. The 15 percent discount really helped because she was buying Christmas presents for some college friends and her family. It soon will be spring semester, and Julie is looking forward to going home to see her family. She knows her parents will want a report on her financial situation. While Julie is eager to talk to her family about her college friends, her courses, her job, and skiing, she is starting to stress about one particular topic of conversation, because lately, things don't look so positive - at least financially. Wages si 57,50 hoer Firancial aid awatded ( 1.5x in-state fuition) because parens are UW alumni and income level qualifies Julie for full financial aid. 109