Answered step by step

Verified Expert Solution

Question

1 Approved Answer

what is the operating cash flow and your two of the project? What is the initial cash outflow of this project? What is the total

what is the operating cash flow and your two of the project?

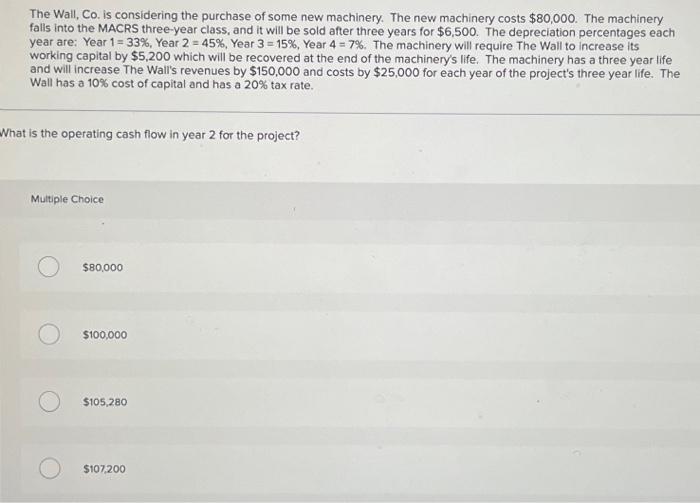

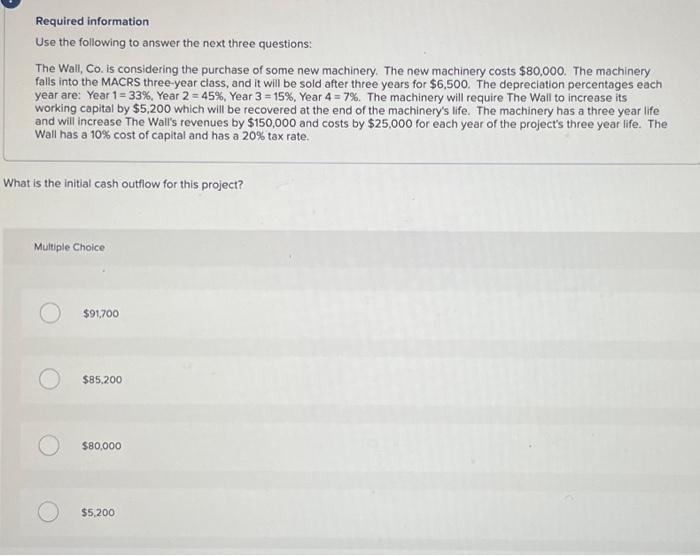

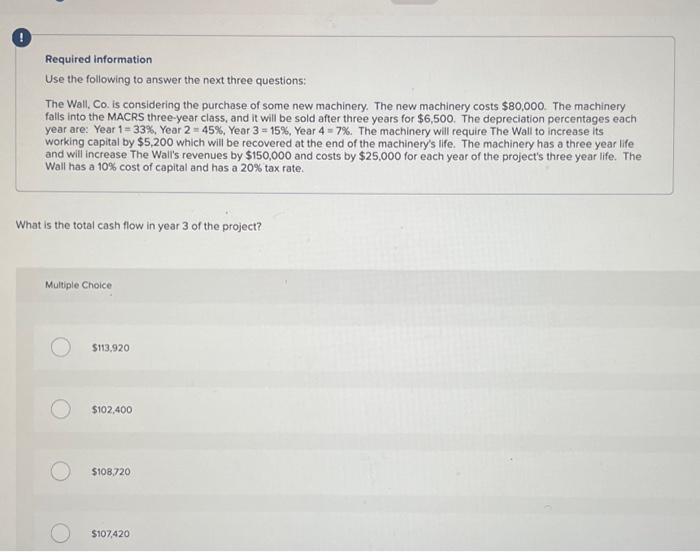

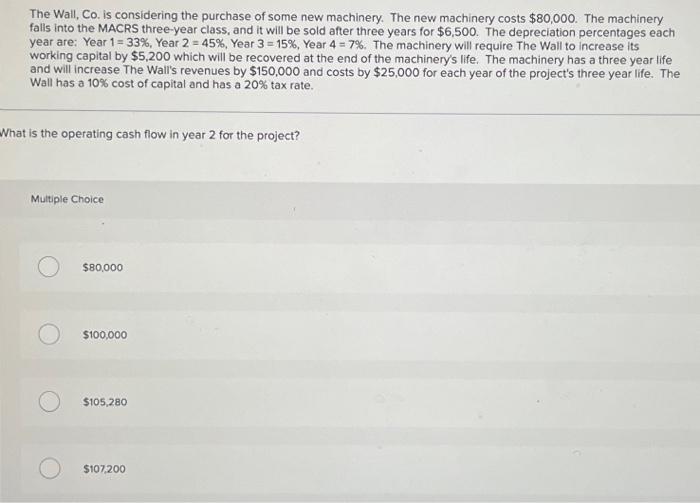

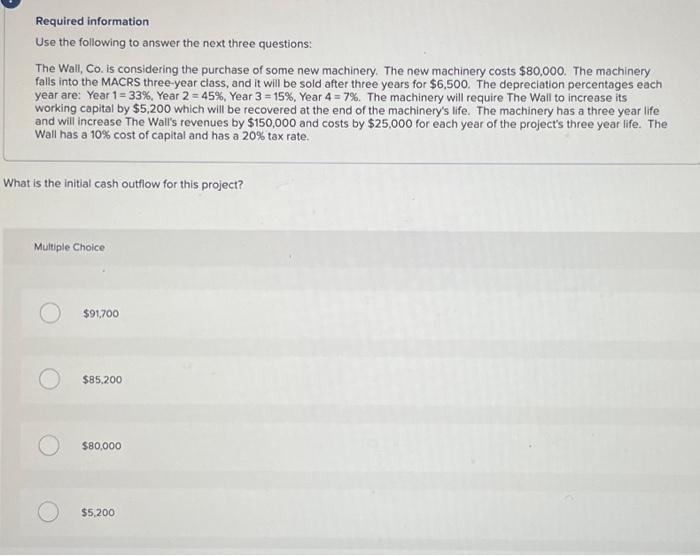

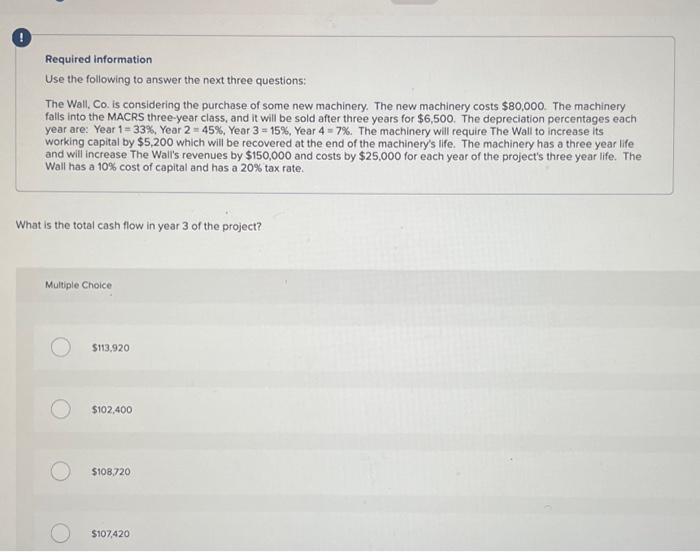

The Wall, Co. is considering the purchase of some new machinery. The new machinery costs $80,000. The machinery falls into the MACRS three-year class, and it will be sold after three years for $6,500. The depreciation percentages each year are: Year 1=33%, Year 2=45%, Year 3=15%, Year 4=7%. The machinery will require The Wall to increase its working capital by $5,200 which will be recovered at the end of the machinery's life. The machinery has a three year life and will increase The Wall's revenues by $150,000 and costs by $25,000 for each year of the project's three year life. The Wall has a 10% cost of capital and has a 20% tax rate. What is the operating cash flow in year 2 for the project? Multiple Choice $80,000 $100,000 $105,280 $107,200 Required information Use the following to answer the next three questions: The Wall, Co. is considering the purchase of some new machinery. The new machinery costs $80,000. The machinery falls into the MACRS three-year class, and it will be sold after three years for $6,500. The depreciation percentages each year are: Year 1=33%, Year 2=45%, Year 3=15%, Year 4=7%. The machinery will require The Wall to increase its working capital by $5,200 which will be recovered at the end of the machinery's life. The machinery has a three year life and will increase The Wall's revenues by $150,000 and costs by $25,000 for each year of the project's three year life. The Wall has a 10% cost of capital and has a 20% tax rate. What is the total cash flow in year 3 of the project? Multiple Choice $113,920 $102,400 $108720 $107,420 Required information Use the following to answer the next three questions: The Wall, Co. is considering the purchase of some new machinery. The new machinery costs $80,000. The machinery falls into the MACRS three-year class, and it will be sold after three years for $6,500. The depreciation percentages each year are: Year 1=33%, Year 2=45%, Year 3=15%, Year 4=7%. The machinery will require The Wall to increase its working capital by $5,200 which will be recovered at the end of the machinery's life. The machinery has a three year life and will increase The Wall's revenues by $150,000 and costs by $25,000 for each year of the project's three year life. The Wall has a 10% cost of capital and has a 20% tax rate. What is the initial cash outflow for this project? Multiple Choice $91,700 $85,200 $80,000 $5,200 What is the initial cash outflow of this project?

What is the total cash flow in year three of the project?

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started