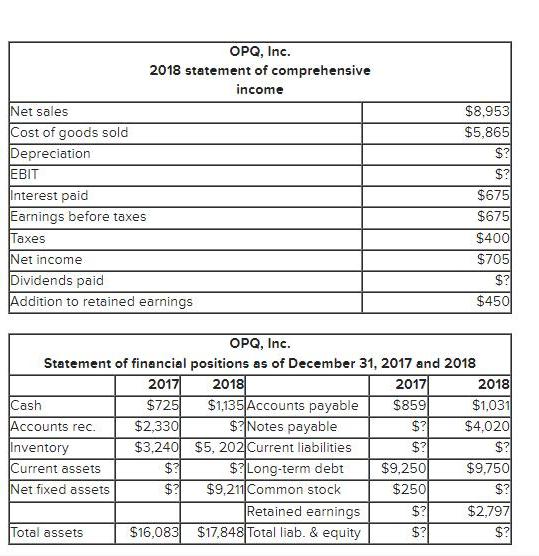

Question: What is the operating cash flow for 2018? Net sales Cost of goods sold Depreciation EBIT Interest paid Earnings before taxes Taxes Net income Dividends

What is the operating cash flow for 2018?

Net sales Cost of goods sold Depreciation EBIT Interest paid Earnings before taxes Taxes Net income Dividends paid Addition to retained earnings OPQ, Inc. 2018 statement of comprehensive income Cashi Accounts rec. Inventory Current assets Net fixed assets Total assets OPQ, Inc. Statement of financial positions as of December 31, 2017 and 2018 2017 2018 $725 $2,330 $1,135 Accounts payable $? Notes payable $3,240 $5, 202 Current liabilities $ Long-term debt $9,211 Common stock $? $? Retained earnings $16,083 $17,848 Total liab. & equity 2017 $859 $? $? $9,250 $250 $8,953 $5,865 $? $? $? $? $675 $675 $400 $705 $? $450 2018 $1,031 $4,020 $? $9,750 $? $2,797 $?

Step by Step Solution

3.42 Rating (155 Votes )

There are 3 Steps involved in it

The formula for operating cash flow is Operating Cash Flow Net Income Depreciation Change in Work... View full answer

Get step-by-step solutions from verified subject matter experts