Answered step by step

Verified Expert Solution

Question

1 Approved Answer

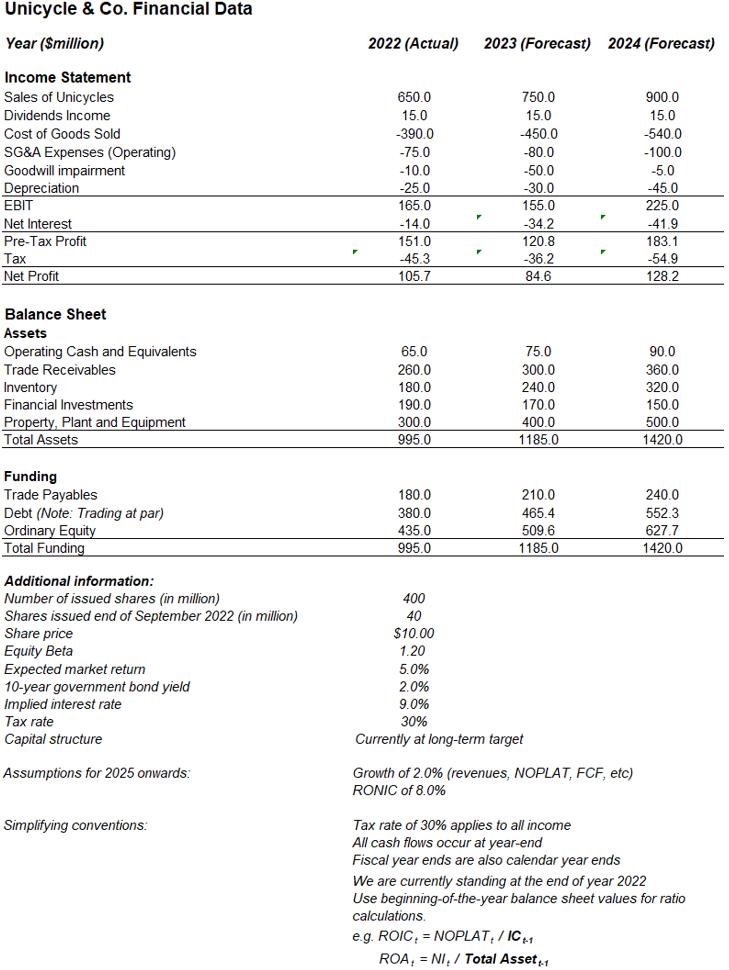

What is the operating invested capital (IC) for financial year 2024? Unicycle & Co. Financial Data Year (Smillion) Income Statement Sales of Unicycles Dividends Income

What is the operating invested capital (IC) for financial year 2024?

Unicycle & Co. Financial Data Year (Smillion) Income Statement Sales of Unicycles Dividends Income Cost of Goods Sold SG&A Expenses (Operating) Goodwill impairment Depreciation EBIT Net Interest Pre-Tax Profit Tax Net Profit Balance Sheet Assets Operating Cash and Equivalents Trade Receivables Inventory Financial Investments Property, Plant and Equipment Total Assets Funding Trade Payables Debt (Note: Trading at par) Ordinary Equity Total Funding Additional information: Number of issued shares (in million) Shares issued end of September 2022 (in million) Share price Equity Beta Expected market return 10-year government bond yield Implied interest rate Tax rate Capital structure Assumptions for 2025 onwards: Simplifying conventions: 2022 (Actual) 650.0 15.0 -390.0 -75.0 -10.0 -25.0 165.0 -14.0 151.0 -45.3 105.7 65.0 260.0 180.0 190.0 300.0 995.0 180.0 380.0 435.0 995.0 400 40 $10.00 1.20 5.0% 2.0% F F 2023 (Forecast) 2024 (Forecast) 750.0 15.0 -450.0 -80.0 -50.0 -30.0 155.0 -34.2 120.8 -36.2 84.6 75.0 300.0 240.0 170.0 400.0 1185.0 210.0 465.4 509.6 1185.0 9.0% 30% Currently at long-term target Tax rate of 30% applies to all income All cash flows occur at year-end F Growth of 2.0% (revenues, NOPLAT, FCF, etc) RONIC of 8.0% P e.g. ROIC, = NOPLAT, / IC+1 ROA, NI,/ Total Asset +1 900.0 15.0 -540.0 -100.0 -5.0 -45.0 225.0 -41.9 183.1 -54.9 128.2 90.0 360.0 320.0 150.0 500.0 1420.0 240.0 552.3 627.7 1420.0 Fiscal year ends are also calendar year ends We are currently standing at the end of year 2022 Use beginning-of-the-year balance sheet values for ratio calculations.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Operating Invested Capital IC is generally defined as the total capital invested in the ope...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started