Answered step by step

Verified Expert Solution

Question

1 Approved Answer

What is the opportunity cost of capital? A share of stock with a beta of 0.73 now sells for $50. Investors expect the stock to

What is the opportunity cost of capital?

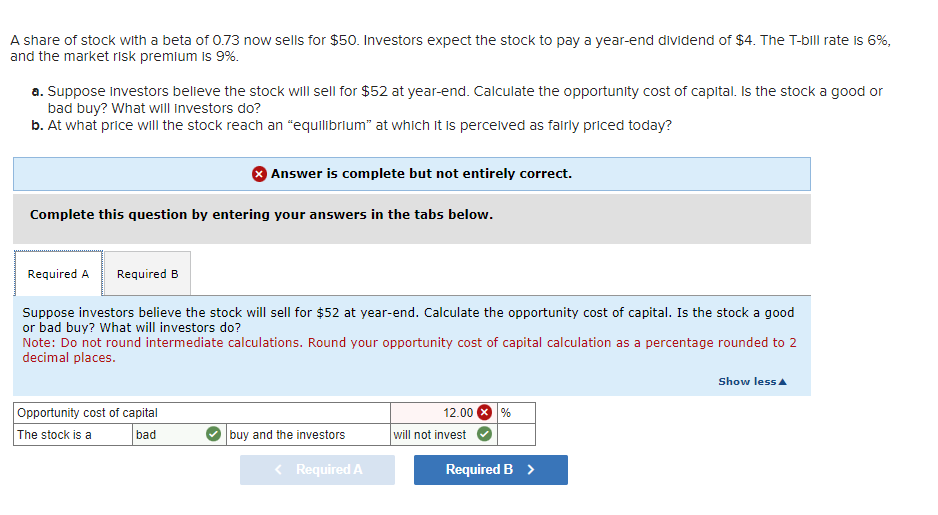

A share of stock with a beta of 0.73 now sells for $50. Investors expect the stock to pay a year-end dividend of $4. The T-bill rate is 6 ? and the market risk premium is 9%. a. Suppose investors believe the stock will sell for $52 at year-end. Calculate the opportunity cost of capital. Is the stock a good o bad buy? What will investors do? b. At what price will the stock reach an "equilibrium" at which it is percelved as farrly priced today? Answer is complete but not entirely correct. Complete this question by entering your answers in the tabs below. Suppose investors believe the stock will sell for $52 at year-end. Calculate the opportunity cost of capital. Is the stock a good or bad buy? What will investors do? Note: Do not round intermediate calculations. Round your opportunity cost of capital calculation as a percentage rounded to 2 decimal places

A share of stock with a beta of 0.73 now sells for $50. Investors expect the stock to pay a year-end dividend of $4. The T-bill rate is 6 ? and the market risk premium is 9%. a. Suppose investors believe the stock will sell for $52 at year-end. Calculate the opportunity cost of capital. Is the stock a good o bad buy? What will investors do? b. At what price will the stock reach an "equilibrium" at which it is percelved as farrly priced today? Answer is complete but not entirely correct. Complete this question by entering your answers in the tabs below. Suppose investors believe the stock will sell for $52 at year-end. Calculate the opportunity cost of capital. Is the stock a good or bad buy? What will investors do? Note: Do not round intermediate calculations. Round your opportunity cost of capital calculation as a percentage rounded to 2 decimal places Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started