Answered step by step

Verified Expert Solution

Question

1 Approved Answer

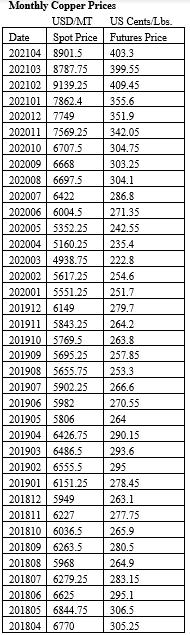

What is the optimal hedge ratio? What does it mean? What is the company's exposure that needs to be hedged in pounds of copper? Monthly

What is the optimal hedge ratio? What does it mean?

What is the company's exposure that needs to be hedged in pounds of copper?

Monthly Copper Prices USD/MT Date 202104 8901.5 202103 8787.75 202102 9139.25 202101 7862.4 202012 7749 2020117569.25 Spot Price 355.6 351.9 342.05 202010 6707.5 304.75 202009 6668 303.25 202008 6697.5 304.1 2020076422 286.8 202006 6004.5 271.35 202005 5352.25 242.55 202004 5160.25 235.4 202003 4938.75 202002 5617.25 202001 5551.25 201912 6149 201911 5843.25 201910 5769.5 201909 5695.25 201907 5902.25 201906 5982 US Cents/Lbs. Futures Price 403.3 399.55 409.45 201908 5655.75 253.3 266.6 270.55 264 201905 5806 201904 6426.75 201903 6486.5 201902 6555.5 201901 6151.25 201812 5949 201811 6227 201810 6036.5 201809 6263.5 201808 5968 201807 6279.25 201806 6625 201805 6844.75 201804 6770 222.8 254.6 251.7 279.7 264.2 263.8 257.85 290.15 293.6 295 278.45 263.1 277.75 265.9 280.5 264.9 283.15 295.1 306.5 305.25

Step by Step Solution

★★★★★

3.46 Rating (156 Votes )

There are 3 Steps involved in it

Step: 1

Answer The optimal hedge ratio refers to the proportion of a companys exposure that should be hedged ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started