Answered step by step

Verified Expert Solution

Question

1 Approved Answer

What is the par value per share of Targets stock? How many shares of Targets Corporation's common stock were outstanding as of January 30, 2015?

What is the par value per share of Target’s stock?

- How many shares of Target’s Corporation's common stock were outstanding as of January 30, 2015?

- Target’s annual report provides some details about the company’s executive officers. How many are identified? What is their minimum, maximum, and average age? How many are females?

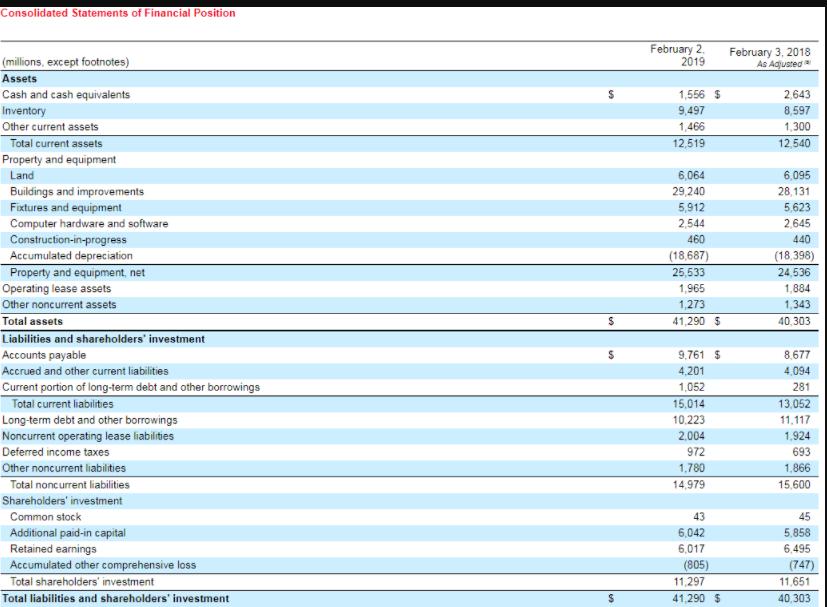

- Target’s balance sheet does not show a balance for treasury stock. Does this mean the company has not repurchased any of its own stock? Explain.

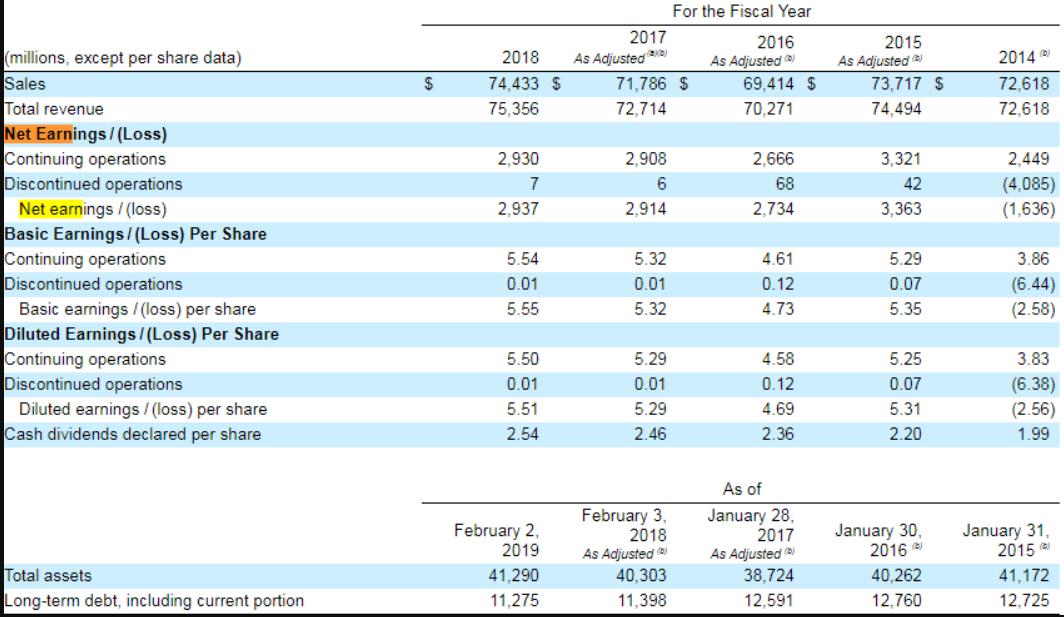

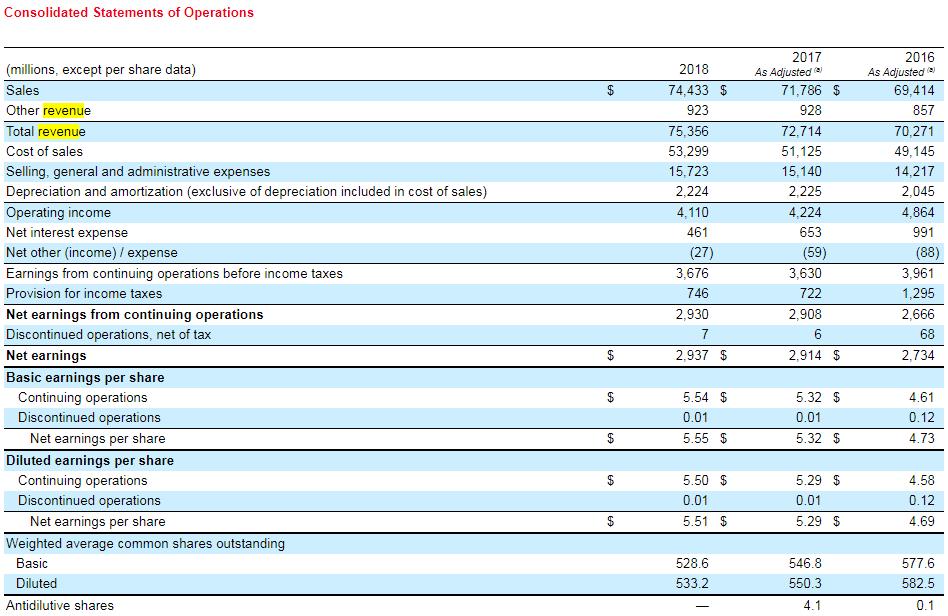

For the Fiscal Year 2017 (millions, except per share data) Sales 2016 As Adjusted ) 2015 As Adjusted ) 73,717 $ 2018 As Adjusted a 2014 2$ 74,433 $ 71,786 $ 69,414 $ 72,618 Total revenue 75,356 72,714 70,271 74,494 72,618 Net Earnings/(Loss) Continuing operations Discontinued operations 2,930 2,908 2,666 3,321 2,449 7 68 42 (4,085) (1,636) 2,734 Net earnings / (loss) Basic Earnings/ (Loss) Per Share Continuing operations Discontinued operations 2,937 2,914 3,363 5.54 5.32 4.61 5.29 3.86 (6.44) (2.58) 0.01 0.01 0.12 0.07 Basic earnings / (loss) per share Diluted Earnings/(Loss) Per Share Continuing operations Discontinued operations Diluted earnings / (loss) per share Cash dividends declared per share 5.55 5.32 4.73 5.35 5.50 5.29 4.58 5.25 3.83 0.01 0.01 0.12 0.07 (6.38) (2.56) 5.51 5.29 4.69 5.31 2.54 2.46 2.36 2.20 1.99 As of February 3, 2018 As Adjusted January 28, 2017 As Adjusted 38,724 February 2, 2019 January 30, 2016 January 31, 2015 Total assets 41,290 40,303 40,262 41,172 Long-term debt, including current portion 11,275 11,398 12,591 12,760 12,725

Step by Step Solution

★★★★★

3.42 Rating (174 Votes )

There are 3 Steps involved in it

Step: 1

Stepbystep explanation a What is the par value per share of Targets stock Net Assets Nos of equity s...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started