Answered step by step

Verified Expert Solution

Question

1 Approved Answer

what is the payback period of SA's investment with work shown. Directions: Round amounts in answers to the nearest $0.01 (cent). If not specifically mentioned,

what is the payback period of SA's investment with work shown.

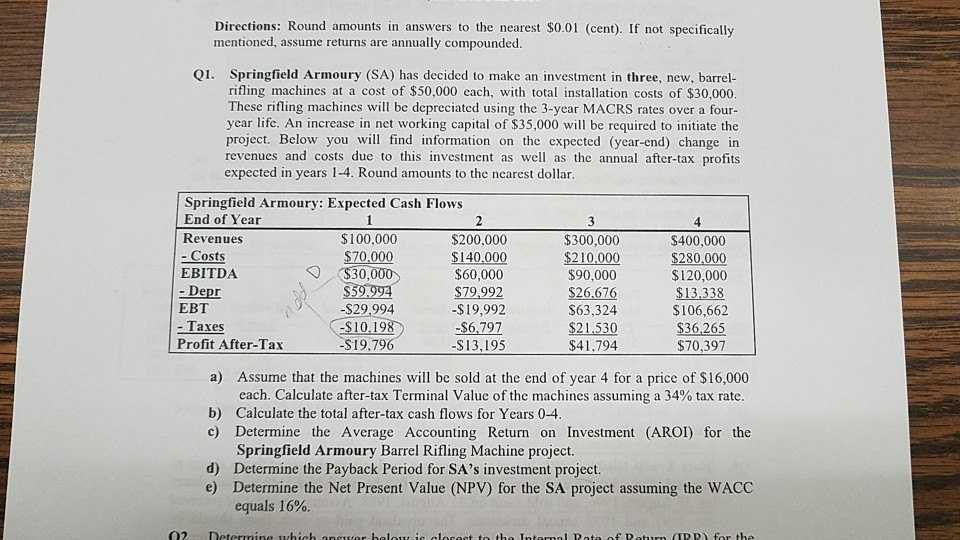

Directions: Round amounts in answers to the nearest $0.01 (cent). If not specifically mentioned, assume returns are annually compounded. Q1. Springfield Armoury (SA) has decided to make an investment in three, new, barrel- rifling machines at a cost of $50,000 each, with total installation costs of $30,000 These rifling machines will be depreciated using the 3-year MACRS rates over a four- year lifc. An increase in net working capital of $35,000 will be required to initiate the project. Below you will find information on the expected (year-end) change in revenues and costs due to this investment as well as the annual after-tax profits expected in years 1-4. Round amounts to the nearest dollar. Springfield Armoury: Expected Cash Flows End of Year Revenues - Costs EBITDA 4 $400,000 280.000 $120,000 S100,000 $70.000 $200,000 $300,000 $210,000 $140.000 $30,000$60,000 $79,992 -$19,992 $10.198$6,797 338 EBT - Taxes Profit After-Tax $29,994 S63,324 $106,662 $36,265 $70,397 $41.794 a) Assume that the machines will be sold at the end of year 4 for a price of $16,000 each. Calculate after-tax Terminal Value of the machines assuming a 34% tax rate b) Calculate the total after-tax cash flows for Years 0-4 c) Determine the Average Accounting Return on Investment (AROI) for the Springfield Armoury Barrel Rifling Machine project d) Determine the Payback Period for SA's investment project. e) Determine the Net Present Value (NPV) for the SA project assuming the WACC equals 16%. 02 netermineStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started