What is the payment to unsecured creditors without priority liabilities in March? What is the estate equity at the end of March? the total amount of assets to be realized in the Statement of Realization and Liquidation at the beginning of April?

What is the payment to unsecured creditors without priority liabilities in March? What is the estate equity at the end of March? the total amount of assets to be realized in the Statement of Realization and Liquidation at the beginning of April?

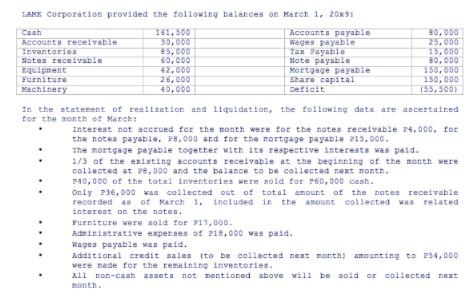

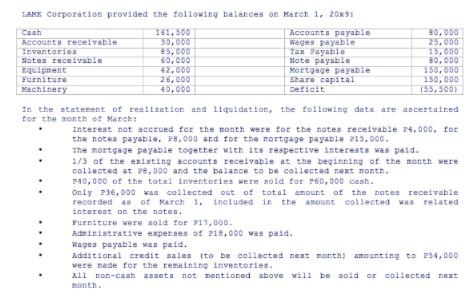

SAME Corporation provided the following balances on March 1, 20x33 151,300 accounts payable Accounts receivable 30,000 Weges payable Inventories 85,000 Tax Payable Notes receivable 40,000 Note payable Equipment 42,000 Mortgage payable Furniture 26,000 Share capital Vachinery 40,000 Deficit 30,000 25,000 15,000 30,000 150,000 150,000 135,5001 In the statement of realisation and liquidation, the following dets are ascertained for the month of March: Interest not accrued for the month were for the notes receivable 24,000. for the notes payable, 18.000 and for the mortgage payable 215.000. The mortgage payable together with its respective Interests was paid. 2/3 of the existing accounts receivable at the beginning of the month were collected at 20.000 and the balance to be collected next month. 240,000 of the total invertories were sold for 760,000 cash. Only 236,000 was collected out of total amount of the notes receivable recorded as of March 1. Included in the amount collected was related interest on the notes. Furniture were sold for 1,000. Administrative expenses of 218,000 was paid. Wages payable was paid. Additional credit sales to be collected next month) amounting to 134,000 were made for the remaining Inventortes. ALL D-cash assets not mentioned above will be sold or collected next month. SAME Corporation provided the following balances on March 1, 20x33 151,300 accounts payable Accounts receivable 30,000 Weges payable Inventories 85,000 Tax Payable Notes receivable 40,000 Note payable Equipment 42,000 Mortgage payable Furniture 26,000 Share capital Vachinery 40,000 Deficit 30,000 25,000 15,000 30,000 150,000 150,000 135,5001 In the statement of realisation and liquidation, the following dets are ascertained for the month of March: Interest not accrued for the month were for the notes receivable 24,000. for the notes payable, 18.000 and for the mortgage payable 215.000. The mortgage payable together with its respective Interests was paid. 2/3 of the existing accounts receivable at the beginning of the month were collected at 20.000 and the balance to be collected next month. 240,000 of the total invertories were sold for 760,000 cash. Only 236,000 was collected out of total amount of the notes receivable recorded as of March 1. Included in the amount collected was related interest on the notes. Furniture were sold for 1,000. Administrative expenses of 218,000 was paid. Wages payable was paid. Additional credit sales to be collected next month) amounting to 134,000 were made for the remaining Inventortes. ALL D-cash assets not mentioned above will be sold or collected next month

What is the payment to unsecured creditors without priority liabilities in March? What is the estate equity at the end of March? the total amount of assets to be realized in the Statement of Realization and Liquidation at the beginning of April?

What is the payment to unsecured creditors without priority liabilities in March? What is the estate equity at the end of March? the total amount of assets to be realized in the Statement of Realization and Liquidation at the beginning of April?