Answered step by step

Verified Expert Solution

Question

1 Approved Answer

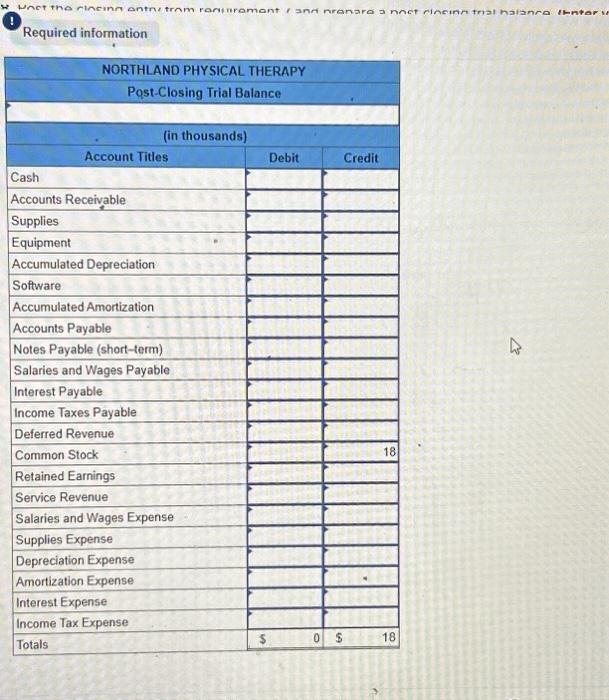

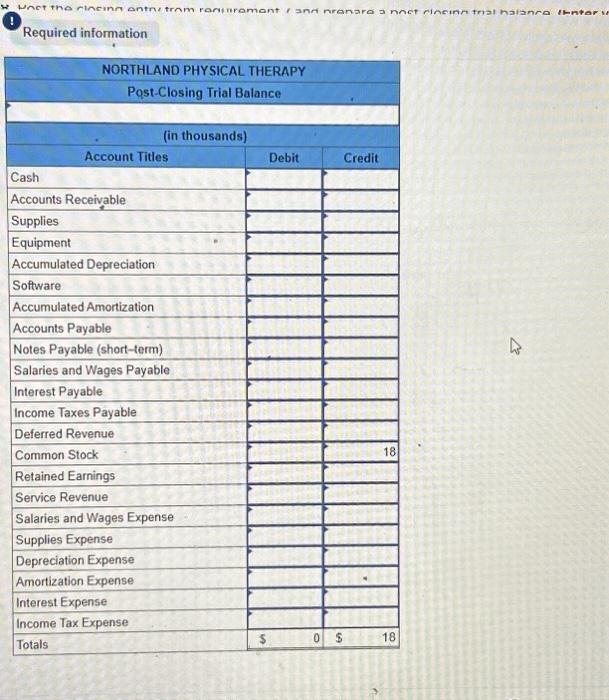

What is the post closing trial balance Required information [The following information applies to the questions displayed below] Drs. Glenn Feltham and David Ambrose began

What is the post closing trial balance

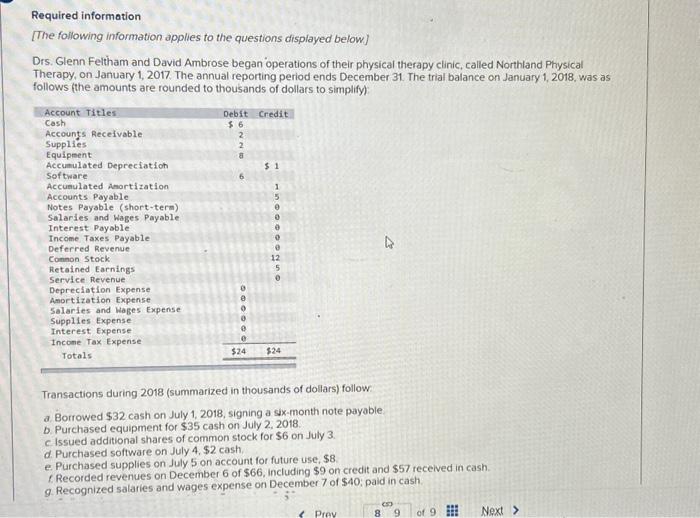

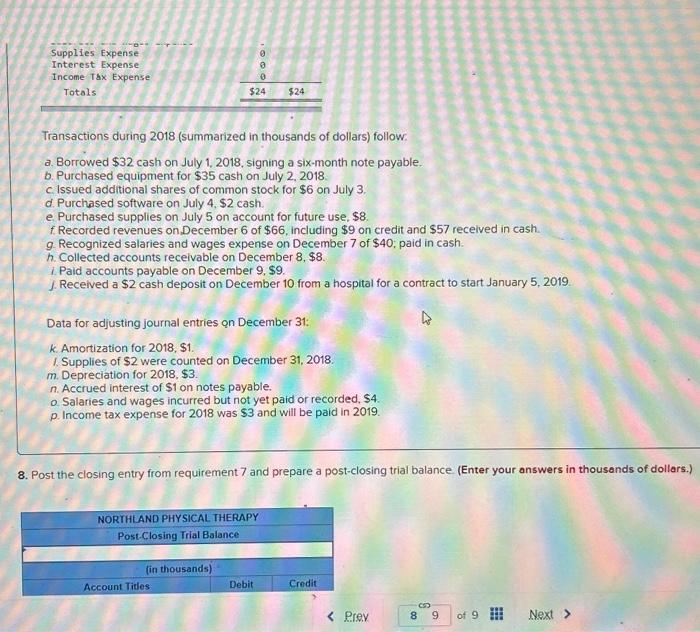

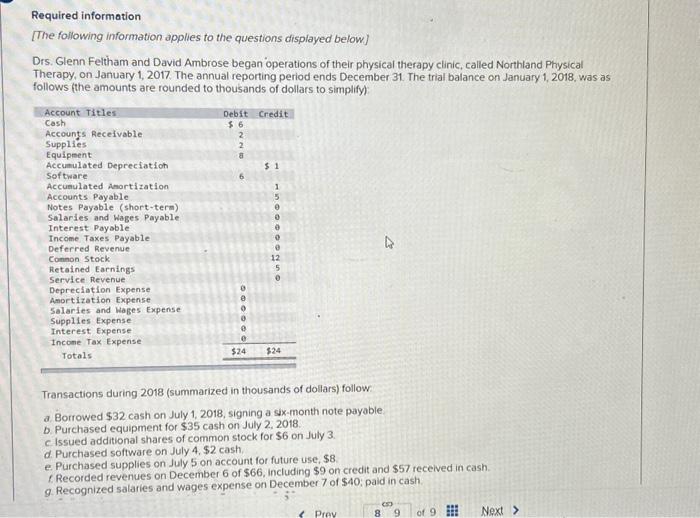

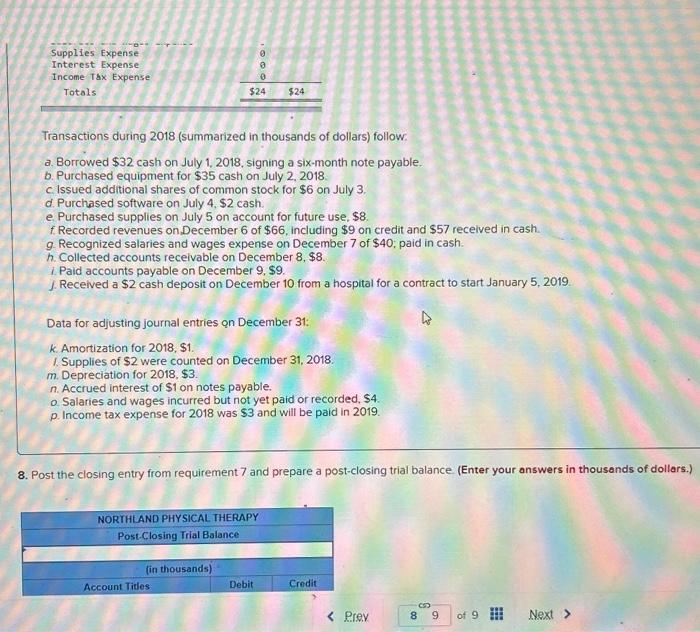

Required information [The following information applies to the questions displayed below] Drs. Glenn Feltham and David Ambrose began operations of their physical therapy clinic, called Northland Physical Therapy, on January 1,2017. The annual reporting period ends December 31 . The trial balance on January 1, 2018, was as follows (the amounts are rounded to thousands of dollars to simplify) Transactions during 2018 (summarized in thousands of dollars) follow a Borrowed $32 cash on July 1, 2018, signing a six-month note payable. b. Purchased equipment for $35 cash on July 2, 2018. c Issued additional shares of common stock for $6 on July 3. d. Purchased software on July 4,$2 cash. e. Purchased supplies on July 5 on account for future use, $8 f Recorded revenues on December 6 of $66, including $9 on credit and $57 recelved in cash. g. Recognized salaries and wages expense on December 7 of $40; paid in cash. I Transactions during 2018 (summarized in thousands of dollars) follow. a. Borrowed $32 cash on July 1,2018, signing a six-month note payable. b. Purchased equipment for $35 cash on July 2,2018. c. Issued additional shares of common stock for $6 on July 3. d. Purchased software on July 4,$2 cash. e. Purchased supplies on July 5 on account for future use, $8. f Recorded revenues on,December 6 of $66, including $9 on credit and $57 recelved in cash. g. Recognized salaries and wages expense on December 7 of $40; paid in cash. h. Collected accounts receivable on December 8,$8. i. Paid accounts payable on December 9,$9. f. Received a \$2 cash deposit on December 10 from a hospital for a contract to start January 5, 2019 Data for adjusting journal entries on December 31 : k. Amortization for 2018 , \$1. 1. Supplies of \$2 were counted on December 31, 2018. m. Depreciation for 2018,$3. n. Accrued interest of $1 on notes payable. o. Salaries and wages incurred but not yet paid or recorded, $4. p. Income tax expense for 2018 was \$3 and will be paid in 2019. 3. Post the closing entry from requirement 7 and prepare a post-closing trial balance (Enter your answers in thousands of dollars.)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started