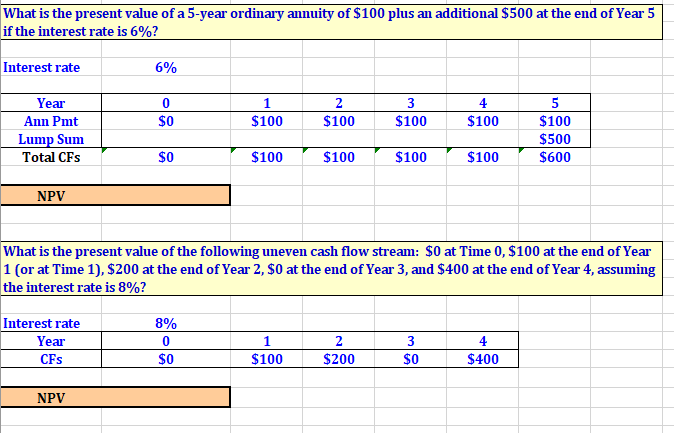

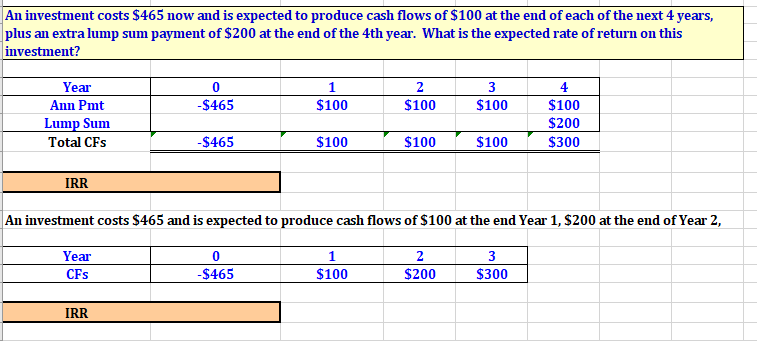

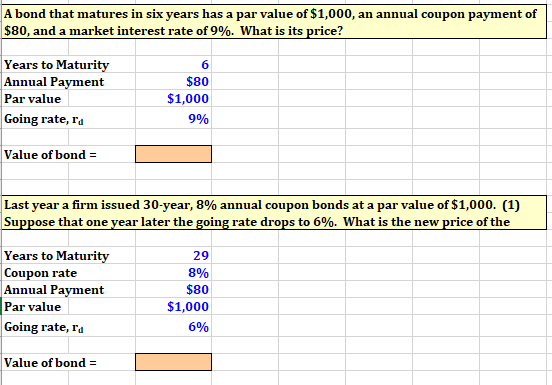

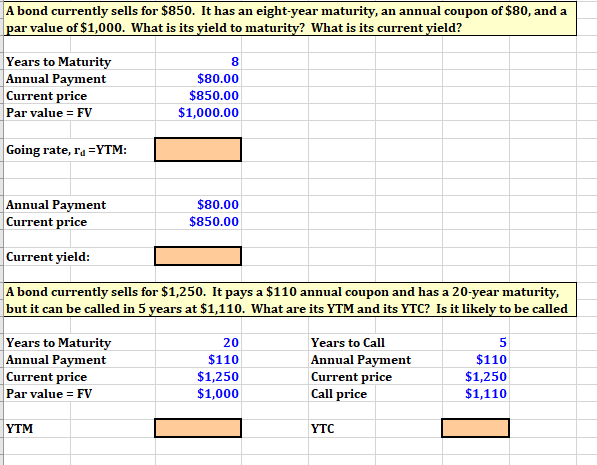

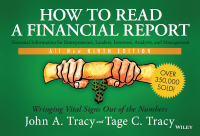

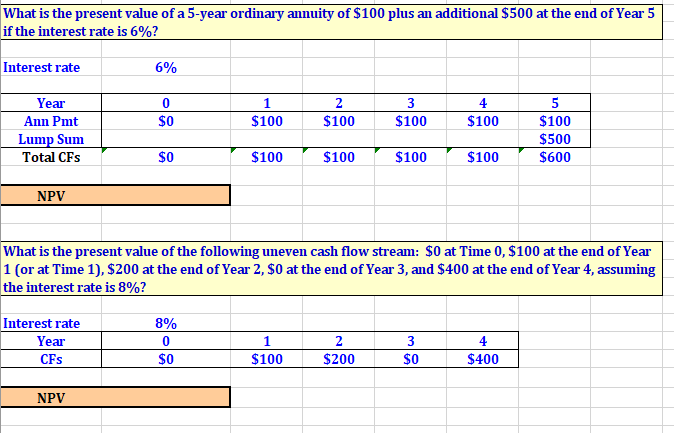

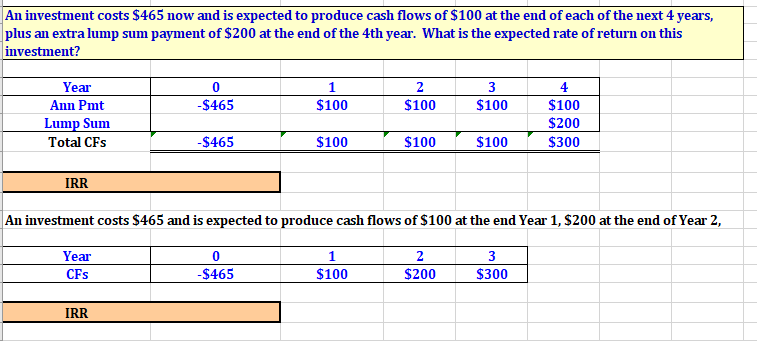

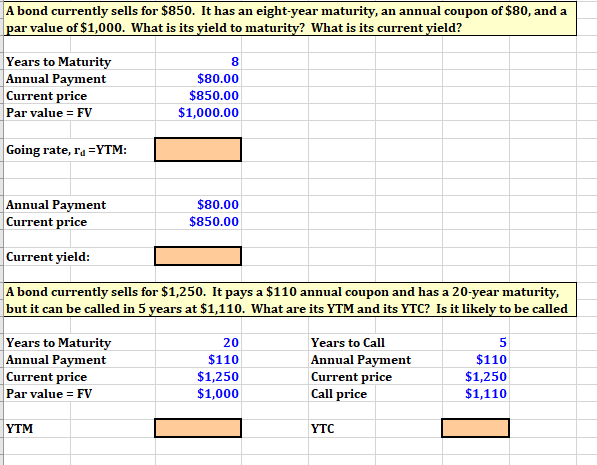

What is the present value of a 5-year ordinary annuity of $100 plus an additional $500 at the end of Year 5 if the interest rate is 6%? Interest rate 6% Year Ann Pmt Lump Sum Total CFs 5 $100 $500 $600 4 $100 S0 $100 $100 $100 S0 $100 $100 $100 $100 NPV What is the present value of the following uneven cash flow stream: SO at Time 0, $100 at the end of Year 1 (or at Time 1), $200 at the end of Year 2, $0 at the end of Year 3, and $400 at the end of Year 4, assuming the interest rate is 8%? Interest rate 8% Year CFs S0 $100 $200 S0 $400 NPV An investment costs $465 now and is expected to produce cash flows of $100 at the end of each of the next 4 years, plus an extra lump sum payment of $200 at the end of the 4th year. What is the expected rate of return on this investment? Year Ann Pmt Lump Sum Total CFs 4 $100 $200 $300 $465 $100 $100 $100 $465 $100 $100 $100 IRR An investment costs $465 and is expected to produce cash flows of $100 at the end Year 1, $200 at the end of Year 2, Year CFs $465 $100 $200 $300 IRR A bond that matures in six years has a par value of $1,000, an annual coupon payment of $80, and a market interest rate of 9%, what is its price? Years to Maturity Annual Payment Par value Going rate, ra 6 $80 $1,000 9% Value of bond = Last year a firm issued 30-year, 8% annual coupon bonds at a par value of $1,000. (1) Suppose that one year later the going rate drops to 6%. What is the new price of the Years to Maturity Coupon rate Annual Payment Par value Going rate, ra 29 8% $80 $1,000 6% Value of bond = A bond currently sells for $850. It has an eight-year maturity, an annual coupon of $80, and a ar value of $1,000. What is its vield to maturity? What is its current vield? Years to Maturity Annual Payment Current price Par value FV 8 $80.00 $850.00 $1,000.00 Going rate, rd YTM: Annual Payment Current price $80.00 $850.00 Current yield A bond currently sells for $1,250. It pays a $110 annual coupon and has a 20-year maturity, but it can be called in 5 vears at $1,110. What are its YTM and its YTC? Is it likely to be called 20 $110 $1,250 $1,000 Years to Call Years to Maturity Annual Payment Current price Par value = FV $110 $1,250 $1,110 Annual Payment Current price Call price YTM YTC