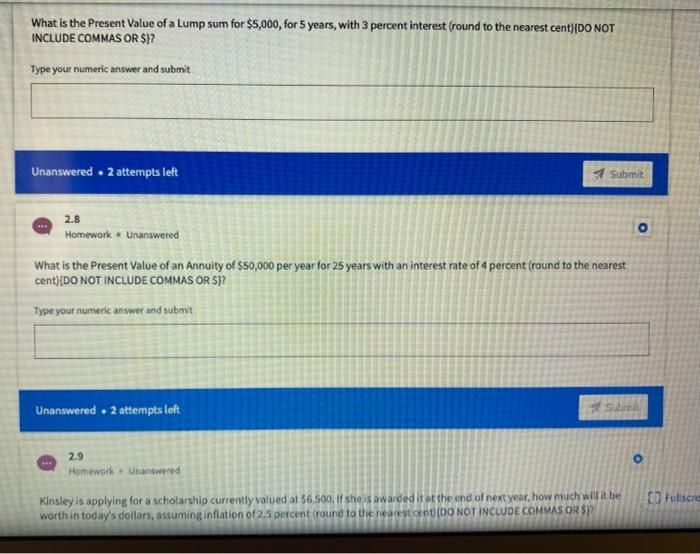

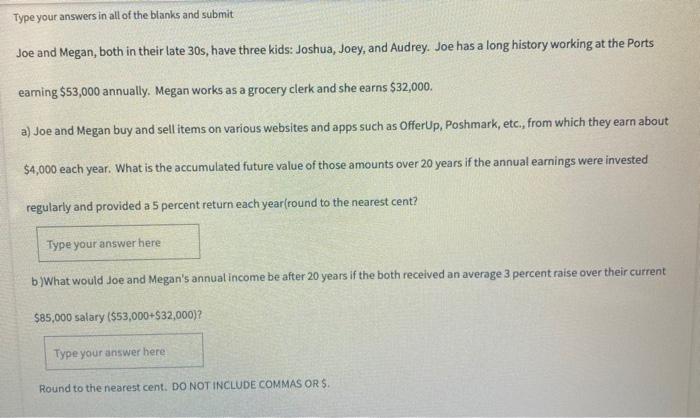

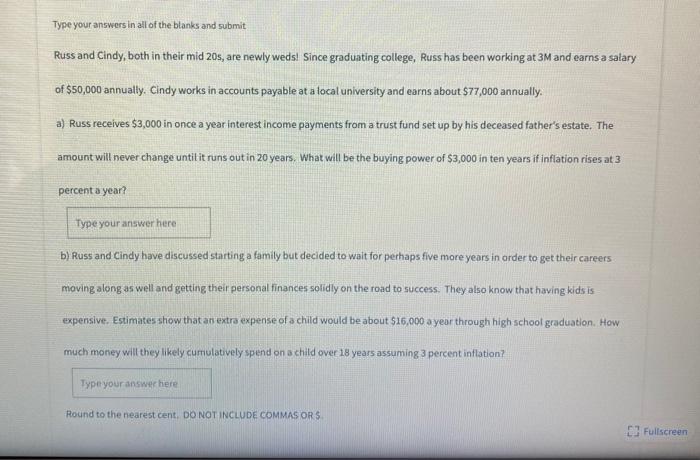

What is the Present Value of a Lump sum for $5,000, for 5 years, with 3 percent interest (round to the nearest cent){DO NOT INCLUDE COMMAS OR $)? Type your numeric answer and submit Unanswered . 2 attempts left Submit 2.8 Homework. Unanswered What is the Present Value of an Annuity of $50,000 per year for 25 years with an interest rate of 4 percent (round to the nearest cent)(DO NOT INCLUDE COMMAS OR 5)? Type your numeric answer and submit Unanswered. 2 attempts left 2.9 Homework. Unanswered Fullscre Kinsley is applying for a scholarship currently valued at $6,500, she is awarded it at the end of next year, how much will it be worth in today's dollars, assuming inflation of 2.5 percent round to the nearest cent) (DO NOT INCLUDE COMMAS OR$ Type your answers in all of the blanks and submit Joe and Megan, both in their late 30s, have three kids: Joshua, Joey, and Audrey. Joe has a long history working at the Ports eaming $53,000 annually. Megan works as a grocery clerk and she earns $32,000. a) Joe and Megan buy and sell items on various websites and apps such as OfferUp, Poshmark, etc., from which they earn about $4,000 each year. What is the accumulated future value of those amounts over 20 years if the annual earnings were invested regularly and provided a 5 percent return each year(round to the nearest cent? Type your answer here b)What would Joe and Megan's annual income be after 20 years if the both received an average 3 percent raise over their current $85,000 salary($53,000+$32,000)? Type your answer here Round to the nearest cent. DO NOT INCLUDE COMMAS OR$ Type your answers in all of the blanks and submit Russ and Cindy, both in their mid 20s, are newly weds! Since graduating college, Russ has been working at 3M and earns a salary of $50,000 annually, Cindy works in accounts payable at a local university and earns about $77,000 annually. a) Russ receives $3,000 in once a year interest income payments from a trust fund set up by his deceased father's estate. The amount will never change until it runs out in 20 years. What will be the buying power of $3,000 in ten years if inflation rises at 3 percent a year? Type your answer here b) Russ and Cindy have discussed starting a family but decided to wait for perhaps five more years in order to get their careers moving along as well and getting their personal finances solidly on the road to success. They also know that having kids is expensive. Estimates show that an extra expense of a child would be about $16,000 a year through high school graduation. How much money will they likely cumulatively spend on a child over 18 years assuming 3 percent inflation? Type your answer here Round to the nearest cent, DO NOT INCLUDE COMMAS ORS Fullscreen