Question

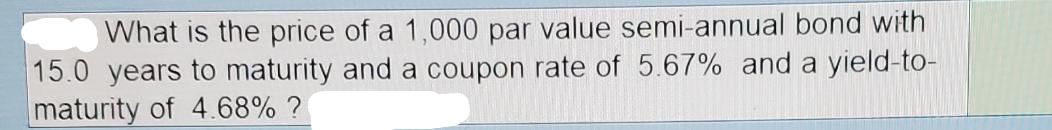

What is the price of a 1,000 par value semi-annual bond with 15.0 years to maturity and a coupon rate of 5.67% and a

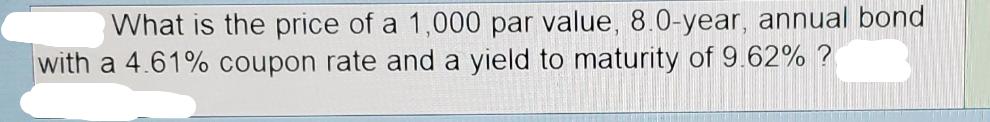

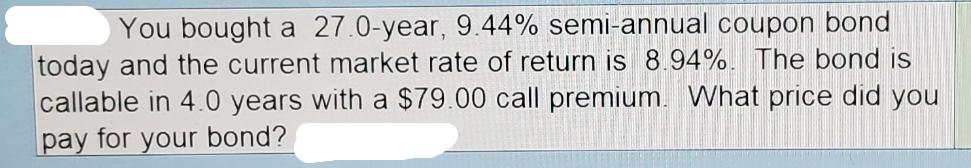

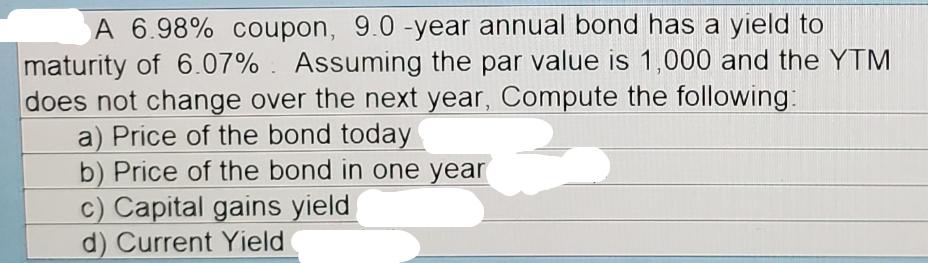

What is the price of a 1,000 par value semi-annual bond with 15.0 years to maturity and a coupon rate of 5.67% and a yield-to- maturity of 4.68% ? What is the price of a 1,000 par value, 8.0-year, annual bond with a 4.61% coupon rate and a yield to maturity of 9.62% ? You bought a 27.0-year, 9.44% semi-annual coupon bond today and the current market rate of return is 8.94%. The bond is callable in 4.0 years with a $79.00 call premium. What price did you pay for your bond? A 6.98% coupon, 9.0 -year annual bond has a yield to maturity of 6.07% Assuming the par value is 1,000 and the YTM does not change over the next year, Compute the following: a) Price of the bond today b) Price of the bond in one year c) Capital gains yield d) Current Yield

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get StartedRecommended Textbook for

Derivatives Markets

Authors: Robert McDonald

3rd Edition

978-9332536746, 9789332536746

Students also viewed these Finance questions

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

View Answer in SolutionInn App