Answered step by step

Verified Expert Solution

Question

1 Approved Answer

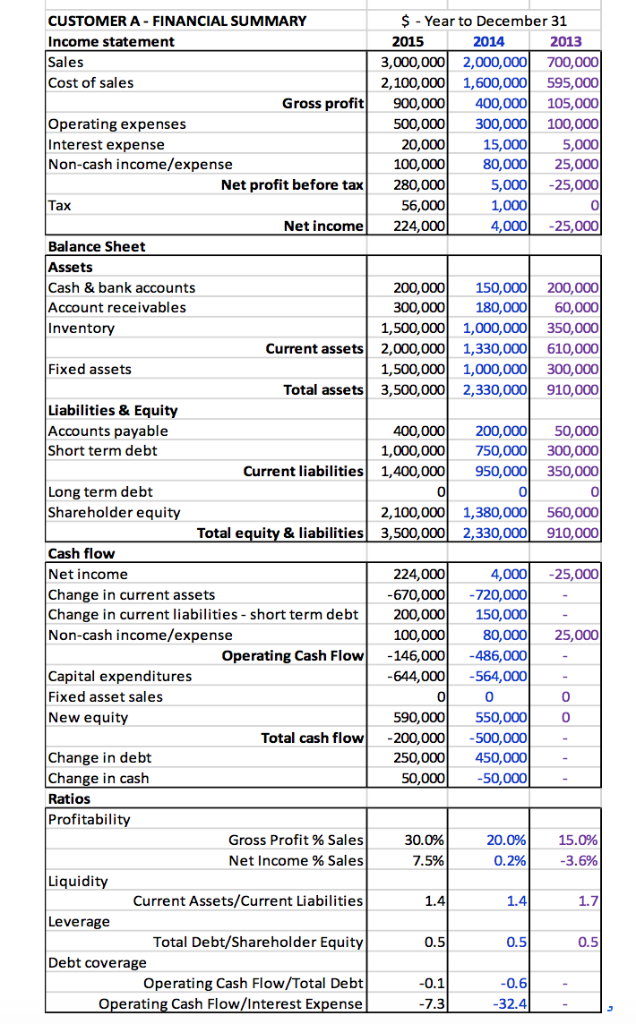

What is the primary source of repayment of the proposed working capital finance? s - Year to December 31 2014 CUSTOMER A-FINANCIAL SUMMARY Income statement

What is the primary source of repayment of the proposed working capital finance?

s - Year to December 31 2014 CUSTOMER A-FINANCIAL SUMMARY Income statement Sales Cost of sales 2015 2013 ,000,000 2,000,000 700,000 2,100,0001,600,00 595,000 Gross profit 900,000 400,000 105,000 0,000 300,000 100,000 5,000 0000080,000 25,000 5,000-25,000 0 4,00025,000 Operating expenses nterest expense Non-cash income/expense 20,000 15,000 Net profit before tax 280,000 56,000 Net income 224,000 Tax 1,000 Balance Sheet Assets Cash & bank accounts Account receivables Inventory 00,000 150,000 200,000 00,000180,000 60,000 1,500,000 1,000,000 350,000 Current assets 2,000,0001,330,000 610,000 1,500,000 1,000,000 300,000 Total assets 3,500,000 2,330,000 910,000 Fixed assets Liabilities& Equity Accounts payable Short term debt 00,000200,000 50,000 1,000,000750,000 300,000 Current liabilities 1,400,000 950,000 350,000 0 2,100,000 1,380,000 560,000 Total eguity & liabilities 3,500,000 2,330,000 910,000 Long term debt Shareholder equity 0 0 Cash flow Net income Change in current assets Change in current liabilities-short term debt 200,000150,000 Non-cash income/expense 224,000 ,000-25,000 670,000720,000 100,000 80,000 25,000 644,000-564,000 90,000550,0000 250,000450,000 Operating Cash Flow-146,000-486,000 Capital expenditures Fixed asset sales New equity 0 0 0 Total cash flow-200,000500,000 Change in debt Change in cash Ratios Profitability 50,000 50,000 Gross Profit % Sales Net Income % Sales 30.0% 20.0% 0.2% 15.0% 3.6% Liquidity Current Assets/Current Liabilities Total Debt/Shareholder Equity Operating Cash Flow/Total Debt 1.4 1.4 1.7 Leverage 0.5 0.5 0.5 Debt coverage -0.1 7.3 Operating Cash Flow/Interest Expense 32.4

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started