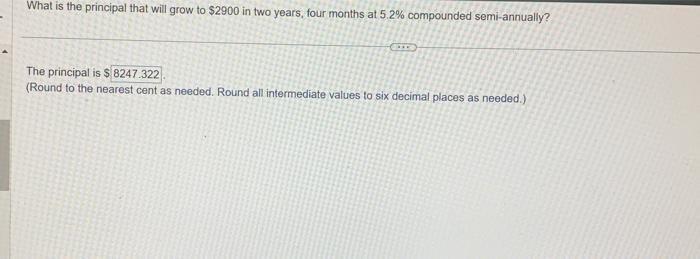

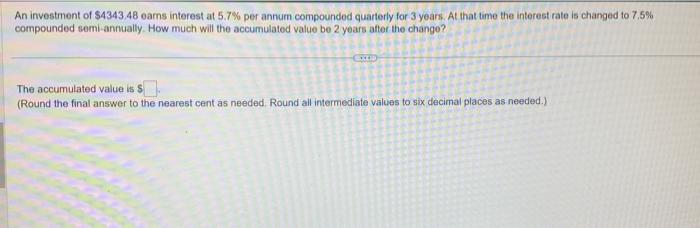

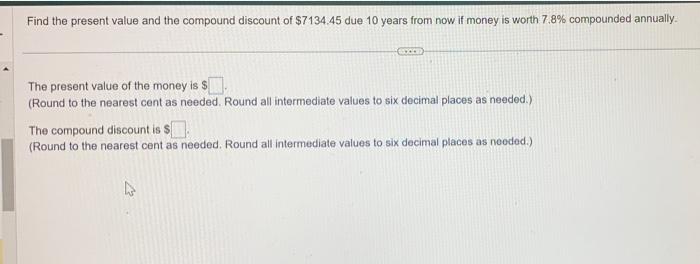

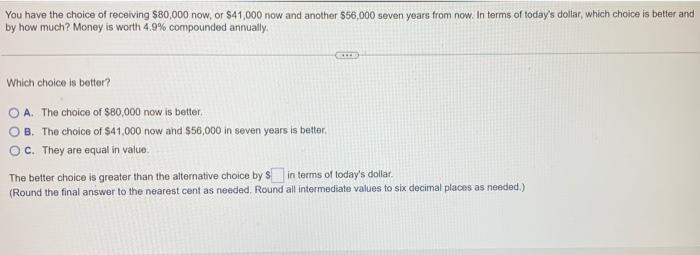

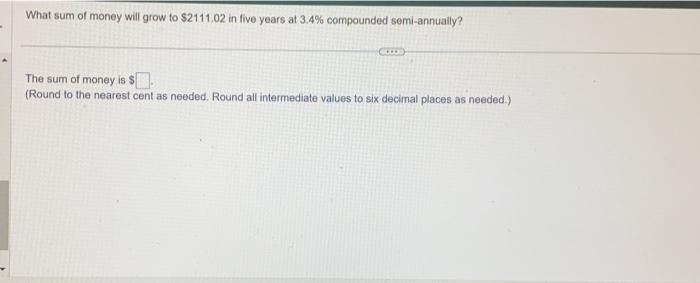

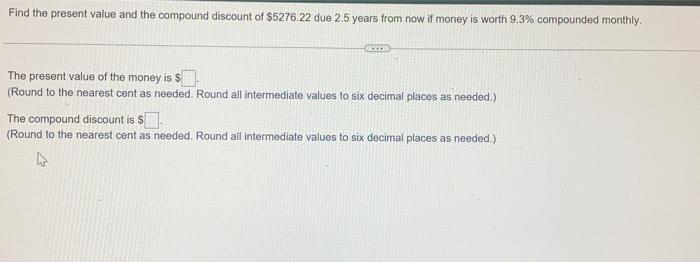

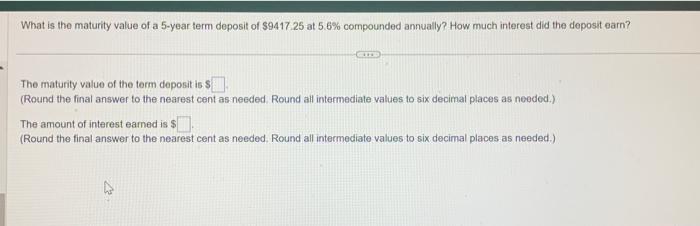

What is the principal that will grow to $2900 in two years, four months at 5.2% compounded semi-annually? The principal is $ (Round to the nearest cent as needed. Round all intermediate values to six decimal places as needed.) An investment of $4343.48 eams interest at 5.7% per annum compounded quarterly for 3 years. At that time the interest rate is changed to 7.5% compounded semi-annually. How much will the accumulated value be 2 years after the chango? The accumulated value is S (Round the final answer to the nearest cent as needed. Round all intermediate values to six decimal places as needed.) Find the present value and the compound discount of $7134.45 due 10 years from now if money is worth 7.8% compounded annually. The present value of the money is S (Round to the nearest cent as needed. Round all intermediate values to six decimal places as needed.) The compound discount is S (Round to the nearest cent as needed. Round all intermediate values to six decimal places as nooded.) You have the choice of receiving $80,000 now, or $41,000 now and another $56,000 seven years from now. In terms of today's doilar, which choice is better and by how much? Money is worth 4.9% compounded annually. Which choice is better? A. The choice of $80,000 now is better. B. The choice of $41,000 now and $56,000 in seven years is befter, C. They are equal in value. The better choice is greater than the alternative choice by s in terms of today's dollar. (Round the final answer to the nearest cent as needed. Round all intermediate values to six decimal places as needed.) What sum of money will grow to $2111.02 in five years at 3.4% compounded semi-annually? The sum of money is $ (Round to the nearest cent as needed. Round all intermediate values to six decimal places as needed.) The present value of the money is $ (Round to the nearest cent as needed. Round all intermediate values to six decimal places as needed.) The compound discount is $ (Round to the nearest cent as needed. Round all intermediate values to six decimal places as needed.) The maturity value of the term deposit is $ (Round the final answer to the nearest cent as needed. Round all intermediale values to six decimal places as needod.) The amount of interest eamed is \$ (Round the final answer to the nearest cent as needed. Round all intermediate values to six decimal places as needed.)