What is the Profit Attributable to Equity Holders of Parent/ Controlling Interest (Parents Interests) in Consolidated Net income for 2014?

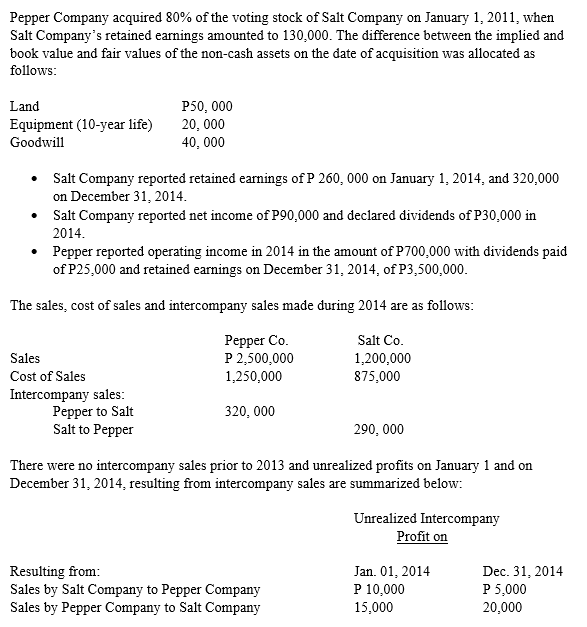

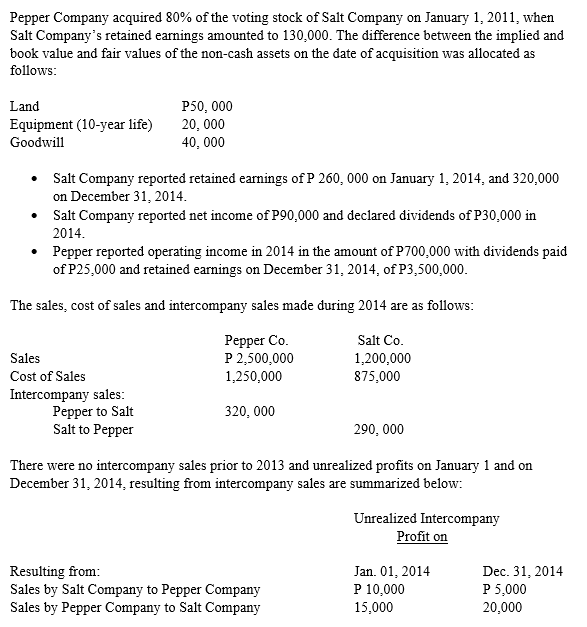

Pepper Company acquired 80% of the voting stock of Salt Company on January 1, 2011, when Salt Company's retained earnings amounted to 130,000. The difference between the implied and book value and fair values of the non-cash assets on the date of acquisition was allocated as follows: Land Equipment (10-year life) Goodwill P50,000 20,000 40,000 Salt Company reported retained earnings of P 260,000 on January 1, 2014, and 320,000 on December 31, 2014. Salt Company reported net income of P90,000 and declared dividends of P30,000 in 2014. Pepper reported operating income in 2014 in the amount of P700,000 with dividends paid of P25,000 and retained earnings on December 31, 2014, of P3,500,000. The sales, cost of sales and intercompany sales made during 2014 are as follows: Pepper Co. P 2,500,000 1,250,000 Salt Co. 1,200,000 875,000 Sales Cost of Sales Intercompany sales: Pepper to Salt Salt to Pepper 320,000 290,000 There were no intercompany sales prior to 2013 and unrealized profits on January 1 and on December 31, 2014, resulting from intercompany sales are summarized below: Unrealized Intercompany Profit on Resulting from: Sales by Salt Company to Pepper Company Sales by Pepper Company to Salt Company Jan. 01, 2014 P 10,000 15,000 Dec 31, 2014 P 5,000 20,000 Pepper Company acquired 80% of the voting stock of Salt Company on January 1, 2011, when Salt Company's retained earnings amounted to 130,000. The difference between the implied and book value and fair values of the non-cash assets on the date of acquisition was allocated as follows: Land Equipment (10-year life) Goodwill P50,000 20,000 40,000 Salt Company reported retained earnings of P 260,000 on January 1, 2014, and 320,000 on December 31, 2014. Salt Company reported net income of P90,000 and declared dividends of P30,000 in 2014. Pepper reported operating income in 2014 in the amount of P700,000 with dividends paid of P25,000 and retained earnings on December 31, 2014, of P3,500,000. The sales, cost of sales and intercompany sales made during 2014 are as follows: Pepper Co. P 2,500,000 1,250,000 Salt Co. 1,200,000 875,000 Sales Cost of Sales Intercompany sales: Pepper to Salt Salt to Pepper 320,000 290,000 There were no intercompany sales prior to 2013 and unrealized profits on January 1 and on December 31, 2014, resulting from intercompany sales are summarized below: Unrealized Intercompany Profit on Resulting from: Sales by Salt Company to Pepper Company Sales by Pepper Company to Salt Company Jan. 01, 2014 P 10,000 15,000 Dec 31, 2014 P 5,000 20,000