Answered step by step

Verified Expert Solution

Question

1 Approved Answer

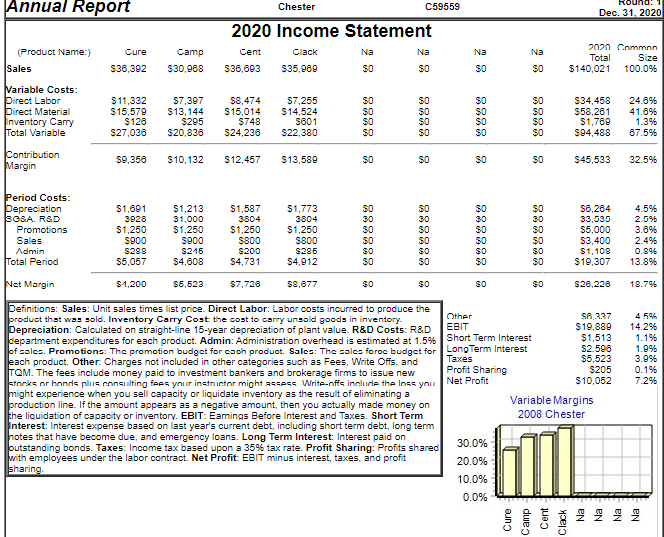

What is the Profit Margin of Chester? Select: 1 .14 13.93 9.04 7.18 Annual Report (Product Name:) Sales Variable Costs: Direct Labor Direct Material Inventory

| What is the Profit Margin of Chester? | ||||||||

| Select: 1 | ||||||||

|

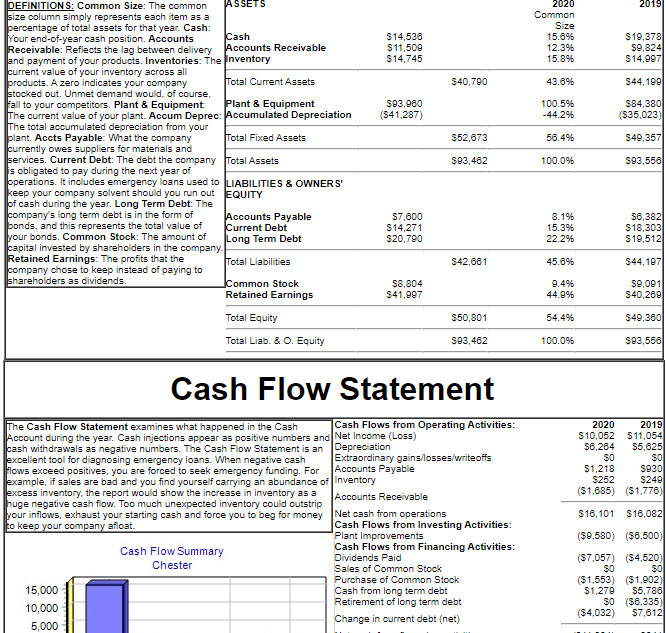

Annual Report (Product Name:) Sales Variable Costs: Direct Labor Direct Material Inventory Carry Total Variable Contribution Margin Period Costs: Depreciation 33&A. R&D Promotions Cure $36,392 $11,332 $15,579 $7,397 $8,474 $13,144 $15,014 $295 $748 $20,836 $24,236 $126 $27,036 $9,356 $10,132 $12,457 $1,601 3928 $1,250 $900 $288 $5,057 $1,200 2020 Income Statement Cent Clack Camp $30,968 $36,693 $35,969 $1,213 31,000 $1,250 $900 $216 $4,608 $1,587 3804 $5,523 $1,250 $800 $200 $4,731 Chester $7,728 $7,255 $14,524 $601 $22,380 $13,589 $1,773 3804 $1,250 $800 $286 $4,912 $2,677 Na $0 $0 $0 $0 $0 $0 8 88888 30 C59559 $0 Sales Admin Total Period Net Margin Definitions: Sales: Unit sales times list price. Direct Labor: Labor costs incurred to produce the product that was sold. Inventory Carry Cost the cost to carry unsold goods in inventory. Depreciation: Calculated on straight-line 15-year depreciation of plant value. R&D Costs: R&D department expenditures for each product. Admin: Administration overhead is estimated at 1.5% of sales. Promotions: The promotion budget for each product. Sales: The sales foroc budget for each product. Other. Charges not included in other categories such as Fees, Write Offs, and TQM. The fees include money paid to investment bankers and brokerage firms to issue new stocks or hands plus consulting fees your instructor might assess Write-offs include the loss you might experience when you sell capacity or liquidate inventory as the result of eliminating a production line. If the amount appears as a negative amount, then you actually made money on the liquidation of capacity or inventory. EBIT: Earnings Before Interest and Taxes. Short Term Interest: Interest expense based on last year's current debt, including short term debt, long term hotes that have become due, an emergency ans. Long Term Interest: Interest paid on outstanding bonds. Taxes: Income tax based upon a 35% tax rate. Profit Sharing: Profits shared with employees under the labor contract. Net Profit: EBIT minus interest, taxes, and profit sharing. $0 Na $0 $0 $0 $0 $0 $0 8 $0 30 $0 $0 $0 $0 $0 Na $0 $0 $0 $0 $0 $0 8 222222 2 30 Other EBIT Short Term Interest Long Term Interest Taxes Profit Sharing Net Profit 30.0% 20.0% 10.0% 0.0% Na 2020 Common Total Size $0 $140,021 100.0% $0 $0 $0 $0 $0 8 $0 30 $0 $0 $0 $0 $0 H Round: 1 Dec. 31, 2020 Cure Camp Cent Clack $34,458 24.6% $58,261 41.6% $1,769 1.3% $94,488 67.5% $45,533 $6,264 33,535 $5,000 $3,400 $1,108 $19,307 $26,226 Variable Margins 2008 Chester $6,337 $19,889 $1,513 $2.596 $5,523 $205 $10,052 32.5% 4.5% 2.5% 3.6% 2.4% 0.8% 13.8% 18.7% 4.5% 14.2% 1.1% 1.9% 3.9% 0.1% 7.2%

Step by Step Solution

★★★★★

3.34 Rating (154 Votes )

There are 3 Steps involved in it

Step: 1

From the cash flow statement given n...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started