Answered step by step

Verified Expert Solution

Question

1 Approved Answer

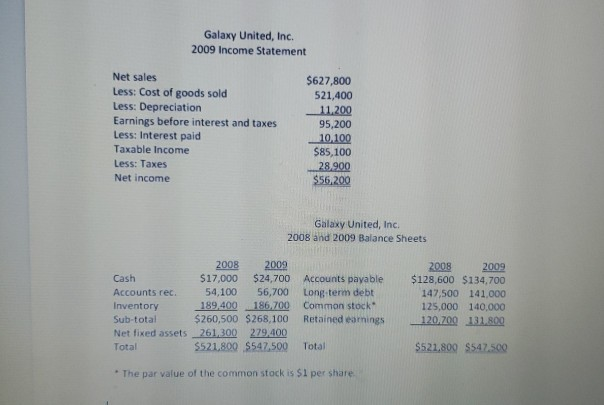

what is the quick ratio for 2009 Galaxy United, Inc. 2009 Income Statement Net sales Less: Cost of goods sold Less: Depreciation Earnings before interest

what is the quick ratio for 2009

Galaxy United, Inc. 2009 Income Statement Net sales Less: Cost of goods sold Less: Depreciation Earnings before interest and taxes Less: Interest paid Taxable income Less: Taxes Net income $627,800 521,400 11.200 95,200 10.100 $85,100 28.900 $56,200 Galaxy United, Inc. 2008 and 2009 Balance Sheets 2008 2009 Cash $17,000 $24,700 Accounts rec. 54,100 56,700 Inventory 189,400 186.700 Sub-total $260,500 $268.100 Net fixed assets 261,300 279,400 Total $521.800 $547,500 Accounts payable Long term debt Common stock Retained earnings 2008 2009 $128,600 $134,700 147,500 141,000 125,000 140,000 120.700 131.800 Total $521,800 $547.500 The par value of the common stock is $1 per shareStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started