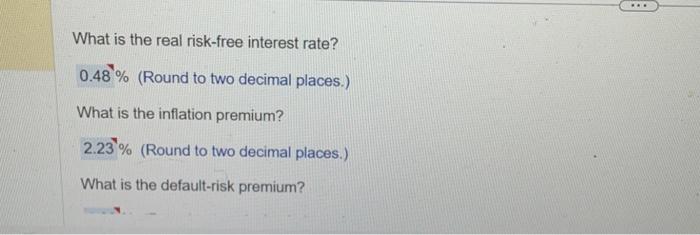

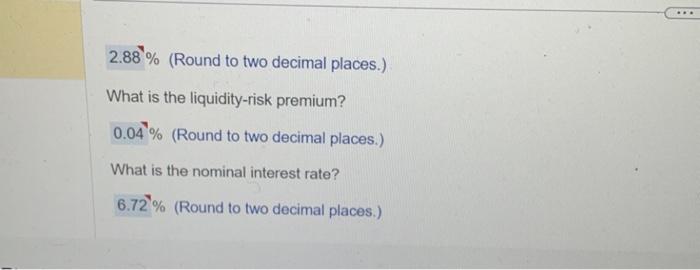

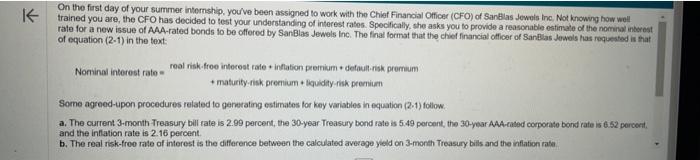

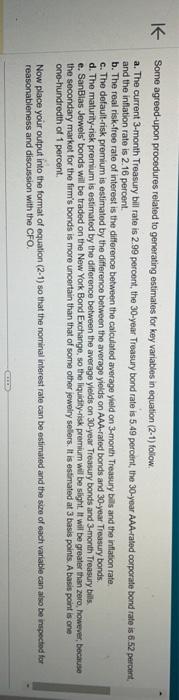

What is the real risk-free interest rate? (Round to two decimal places.) What is the inflation premium? (Round to two decimal places.) What is the default-risk premium? 2.88% (Round to two decimal places.) What is the liquidity-risk premium? 0.04% (Round to two decimal places.) What is the nominal interest rate? (Round to two decimal places.) On the first day of your summer intemship, you've been assigned to work with the Chief Finanoial Officer (CFO) of SanBlas Jewnis ine, Not knowng how well trained you are, the CFO has decided to test your understanding of interest ratos. Specifically, she asks you to provide a reasonable estinate of the nominal interest rate for a new issue of AAA-rated bonds to be offered by SanBlas Jewels inc. The final format that the cheef financial oflicer of SanPlas Jewels has requested is that of equation (21) in the text: Nominalinterestrate=realriskffroeintecestrale+inflationpretrium+defauiliriskpremium+maturity-fiskpremium+liquidity-riskpremiurn Some agreed-upon procedures related to generating estimates for key variables in equation (2.1) follow. a. The current 3-month Treasury bill rate is 2.99 percent, the 30-year Treasury bond rate is 5.49 porcent, the 30-year AAA-raded comporate bond rate is 6.52 percenit, and the inflation rate is 2.16 percent. b. The real risk-free rate of interest is the difference behween the calculated average yeld on 3-month Treasury bills and the inflation rate Some agreed-upon procedures related to generating estimates for key variables in equation (2-1) foliow. a. The current 3-month Treasury bill rate is 2.99 percont, the 30 -yeat Treasury bond rate is 5.49 percent, the 30-year AAA-rated coiporate bond rate is 6.52 percent and the inflation rate is 2.16 percent. b. The real risk-free rate of interest is the difference betwsen the calculated average yield on 3-month Treasury bils and the inflation rate c. The defaultrisk premium is estimatod by the difference between the average yields on AAA-rated bonds and 30 -year Treasury bonds. d. The maturity-risk premium is estimated by the difference between the average yleids on 30 -year Treasury bonds and 3-month Treasury bills. e. SanBlas Jewels' bonds will be traded on the New York. Bond Exchange, so the liquidity-risk premium will be slight. It will be greater than zero, however, because the secondary market for the fimis bonds is more uncertain than that of some other joweiry selers. It is estimated at 3 basis points. A basis point is one ono-hundrodth of 1 percent. Now place your output into the format of equation (2-1) so that the norrinal interest rate can be estimated and the size of each variable can also be inepected tar reasonableness and discussion with the CFO. What is the real risk-free interest rate? (Round to two decimal places.) What is the inflation premium? (Round to two decimal places.) What is the default-risk premium? 2.88% (Round to two decimal places.) What is the liquidity-risk premium? 0.04% (Round to two decimal places.) What is the nominal interest rate? (Round to two decimal places.) On the first day of your summer intemship, you've been assigned to work with the Chief Finanoial Officer (CFO) of SanBlas Jewnis ine, Not knowng how well trained you are, the CFO has decided to test your understanding of interest ratos. Specifically, she asks you to provide a reasonable estinate of the nominal interest rate for a new issue of AAA-rated bonds to be offered by SanBlas Jewels inc. The final format that the cheef financial oflicer of SanPlas Jewels has requested is that of equation (21) in the text: Nominalinterestrate=realriskffroeintecestrale+inflationpretrium+defauiliriskpremium+maturity-fiskpremium+liquidity-riskpremiurn Some agreed-upon procedures related to generating estimates for key variables in equation (2.1) follow. a. The current 3-month Treasury bill rate is 2.99 percent, the 30-year Treasury bond rate is 5.49 porcent, the 30-year AAA-raded comporate bond rate is 6.52 percenit, and the inflation rate is 2.16 percent. b. The real risk-free rate of interest is the difference behween the calculated average yeld on 3-month Treasury bills and the inflation rate Some agreed-upon procedures related to generating estimates for key variables in equation (2-1) foliow. a. The current 3-month Treasury bill rate is 2.99 percont, the 30 -yeat Treasury bond rate is 5.49 percent, the 30-year AAA-rated coiporate bond rate is 6.52 percent and the inflation rate is 2.16 percent. b. The real risk-free rate of interest is the difference betwsen the calculated average yield on 3-month Treasury bils and the inflation rate c. The defaultrisk premium is estimatod by the difference between the average yields on AAA-rated bonds and 30 -year Treasury bonds. d. The maturity-risk premium is estimated by the difference between the average yleids on 30 -year Treasury bonds and 3-month Treasury bills. e. SanBlas Jewels' bonds will be traded on the New York. Bond Exchange, so the liquidity-risk premium will be slight. It will be greater than zero, however, because the secondary market for the fimis bonds is more uncertain than that of some other joweiry selers. It is estimated at 3 basis points. A basis point is one ono-hundrodth of 1 percent. Now place your output into the format of equation (2-1) so that the norrinal interest rate can be estimated and the size of each variable can also be inepected tar reasonableness and discussion with the CFO