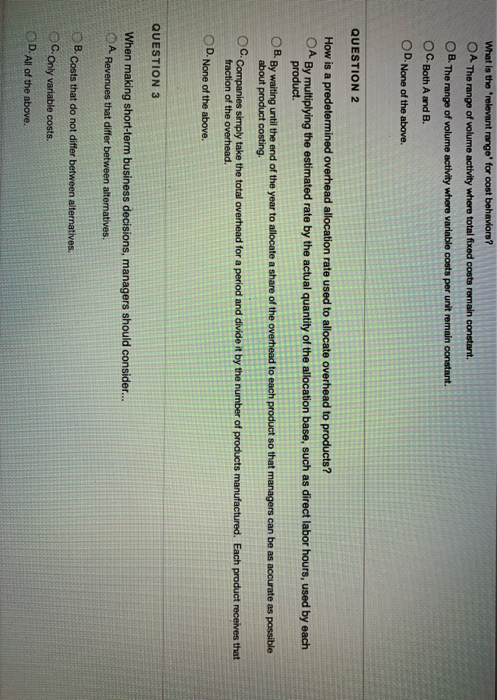

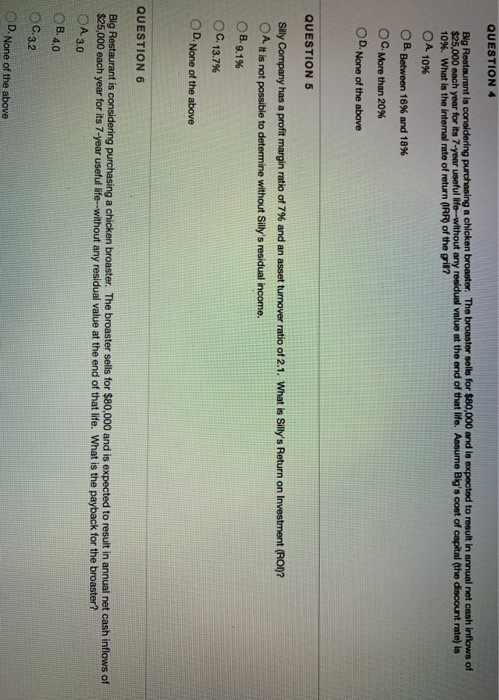

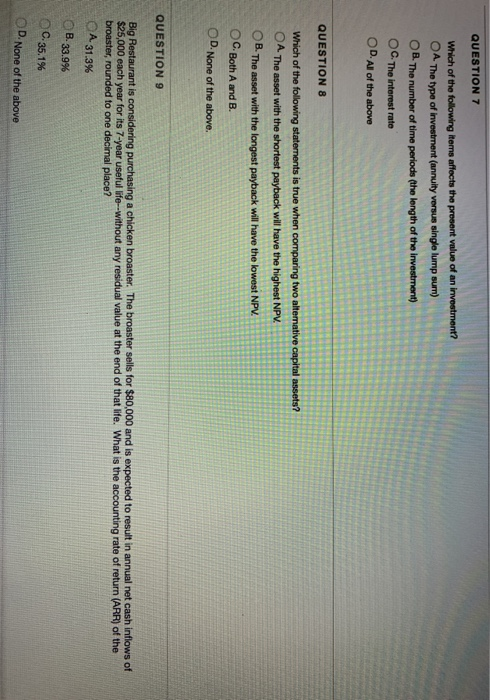

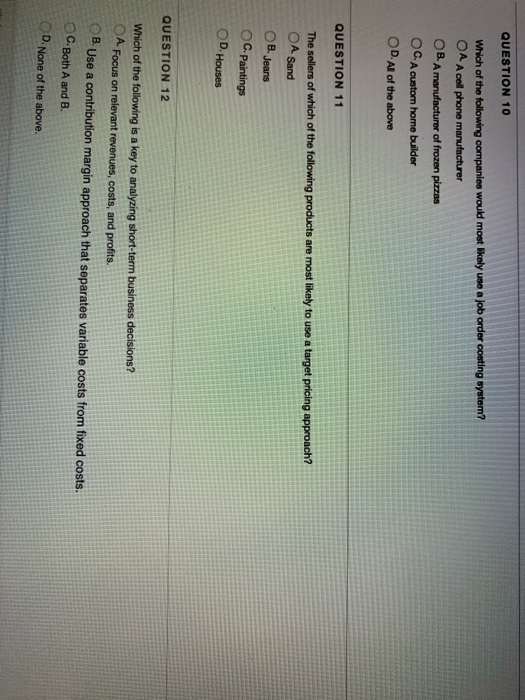

What is the relevant range' for cost behaviors? O A The range of volume activity where total fixed costs remain constant. U . The range of volume activity where variable costs per unit remain constant. OC. Both A and B. OD. None of the above. QUESTION 2 How is a predetermined overhead allocation rate used to allocate overhead to products? OA By multiplying the estimated rate by the actual quantity of the allocation base, such as direct labor hours, used by each product. U . By waiting until the end of the year to allocate a share of the overhead to each product so that managers can be as accurate as possible about product costing. Companies simply take the total overhead for a period and divide it by the number of products manufactured. Each product receives that fraction of the overhead. D.None of the above. QUESTION 3 When making short-term business decisions, managers should consider... A. Revenues that differ between alternatives. OB. Costs that do not differ between alternatives. C. Only variable costs. D. All of the above. QUESTION 4 Big Restaurant is considering purchasing a chicken broaster. The broaster sells for $80,000 and is expected to result in annual net cash inflows of $95.000 each year for its 7-year useful life without any residual value at the end of that life. Assume Bio's cost of capital the incontro 10%. What is the internal rate of return (R) of the grill? OA 10% B. Between 16% and 18% OC. More than 20% OD. None of the above QUESTION 5 Silly Company has a profit margin ratio of 7% and an asset turnover ratio of 2.1. What is Silly's Return on Investment (ROI)? O A It is not possible to determine without Silly's residual income. B.9.1% C. 13.7% D. None of the above QUESTION 6 Big Restaurant is considering purchasing a chicken broaster. The broaster sells for $80,000 and is expected to result in annual net cash inflows of $25,000 each year for its 7-year useful life without any residual value at the end of that life. What is the payback for the broaster O A 3.0 OB. 4.0 C.3.2 D. None of the above QUESTION 7 Which of the following items affects the present value of an investment? OA. The type of investment (annuity versus single lump sum) OB. The number of time periods (the length of the investment) OC. The interest rate OD. All of the above QUESTION 8 Which of the following statements is true when comparing two alternative capital assets? A The asset with the shortest payback will have the highest NPV. OB. The asset with the longest payback will have the lowest NPV. C. Both A and B. D. None of the above. QUESTION 9 Big Restaurant is considering purchasing a chicken broaster. The broaster sells for $80,000 and is expected to result in annual net cash inflows of $25,000 each year for its 7-year useful life without any residual value at the end of that life. What is the accounting rate of return (ARR) of the broaster, rounded to one decimal place? A 31.3% B. 33.9% C.35.1% OD. None of the above QUESTION 10 Which of the following companies would most likely use a job order coating system? OA. A cell phone manufacturer OB. A manufacturer of frozen pizzas OC. A custom home builder OD. All of the above QUESTION 11 The sellers of which of the following products are most likely to use a target pricing approach? O A Sand OB Jeans C. Paintings D. Houses QUESTION 12 Which of the following is a key to analyzing short-term business decisions? A. Focus on relevant revenues, costs, and profits. Use a contribution margin approach that separates variable costs from fixed costs. C. Both A and B. D.None of the above