What is the Return on Equity? (Please while you are solving the question, write net income, total operating income, noninterest expense, interest expense e.g.)

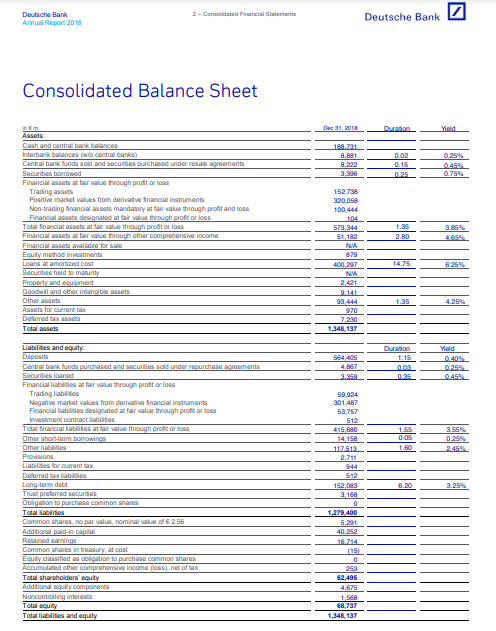

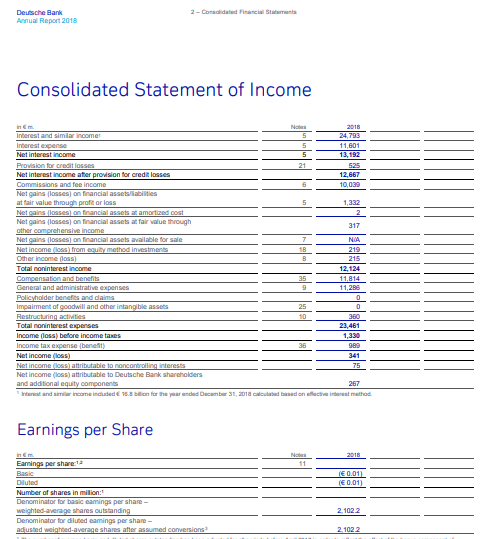

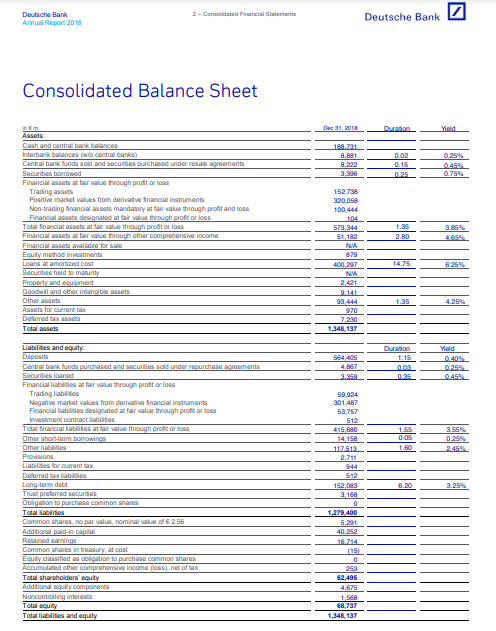

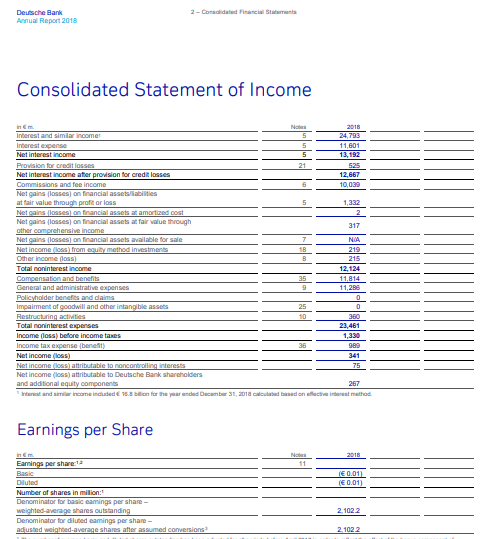

2 - Commaldatud racial Statements Deutsche Bank Annual Report 2018 Deutsche Bank Consolidated Balance Sheet Dec Yield 1981 8,881 0.25% 0.02 0.15 0.25 3,390 04 0.75% Assets: Cash and central bank balances Interbank balances (wio central banks) Central bank funds sold and securits purchased under resale agreements Securities borrowed Financial assets at fair value through profit or loss Trading assets Positive market values from derivative financial instruments Non-trading financial assets mandatory at fair value through profit and loss Financial assets designated at fair value through profit or loss Total financial assets at fair value through profit or loss Financial assets at fair value through other comprehensive income Financial assets available for sale Equity method investments Loans at amortized cost Securities held to maturity Property and equipment Goodwill and other intangible assets Other assets Assets for current tax Deferred tax assets Total assets 3.85% 152.738 320.05 100.444 104 578.344 51.182 NA 879 400 207 NA 1.35 2.80 14.75 6.25% 1.35 4.25% 9.21 99.444 970 7,230 1,348, 137 Duration 1.15 0.03 Yield A4 564,405 99 1.55 0.05 1.80 0.25% 2.455 Liabilities and equity Deposits Central bank funds purchased and securities sold under repurchase agreements Securities loaned Financial liabides at fair value through profit or loss Trading labis Negative market values from derivative financial instruments Financial abilities designated at fair value through profit or loss Investment contractables Total financial abilities at fair value through profit or loss Other short-term borrowings Others Provisions Liabilities for current tax Deemed tax liable Long term debt Trust preferred securities Obligation to purchase common shares Total Fabrics Common shares, no par value, nominal value of 256 Additional pada capital Retained earnings Common shares intrat cost Equity classified as obligation to purchase common shares Accumulated other comprehensive income foss) net of tax Total shareholders' equity Additional equity components Noncontrolling interests Total equity Total liabilities and equity 59 924 301487 53.757 512 415 820 14,158 117518 2.711 944 512 159083 9,160 0 1,279.400 5,201 40252 11. (15 0 6.20 3.25 62.495 4,675 1,56 68,737 1,348, 137 Deutsche Bank Annual Report 2018 2 - Candidated Financial Statements Consolidated Statement of Income inc 2018 Interest and similar income 5 24,793 Interest expense 5 11,601 Net interest income 13,192 Provision for credit losses 21 525 Net interest income after provision for credit losses 12,667 Commissions and fee income 10,039 Net gains (losses on financial stabilities at fair value through profit or loss 1,332 Net gains losses) on financial assets at amortized cost Net gains (losses) on financial assets at fair value through 317 other comprehensive income Net gains (losses) on financial assets available for sale 7 NIA Net income (loss) from equity method investments 18 219 Other income foss) 215 Total noninterest income 12,124 Compensation and benefits 35 11,814 General and administrative expenses 9 11,286 Policyholder benefits and claims 0 Impairment of goodwill and other intangible assets 25 0 Restructuring acties 10 380 Total noninterest expenses 23,461 Income (oss) before income taxes 1,330 Income tax expense benet) 36 989 Net income (los) 341 Net income loss) attributable to rocontrolling interests 75 Net income (los) attributable to Deutsche Bank shareholders and additional equity components 257 and income induded 16.8 billion for the year anded December 31, 2018 con leche rest method Il-KIT11 Earnings per Share 2018 Na 11 IE0.01 (E 0.01) Earnings per share:13 Basic Diluted Number of shares in million: Denominator for basic amings per share- weighted average shares outstanding Denominator for diluted Gamings per share - ad usted weighted average shares after assumed conversions 2.1022 2.1022