Answered step by step

Verified Expert Solution

Question

1 Approved Answer

What is the revenue recognized from gift cards during fiscal year 2020 if Best Buy collected $50 (millions) in fiscal year 2020 from new gift

What is the revenue recognized from gift cards during fiscal year 2020 if Best Buy collected $50 (millions) in fiscal year 2020 from new gift card sales?

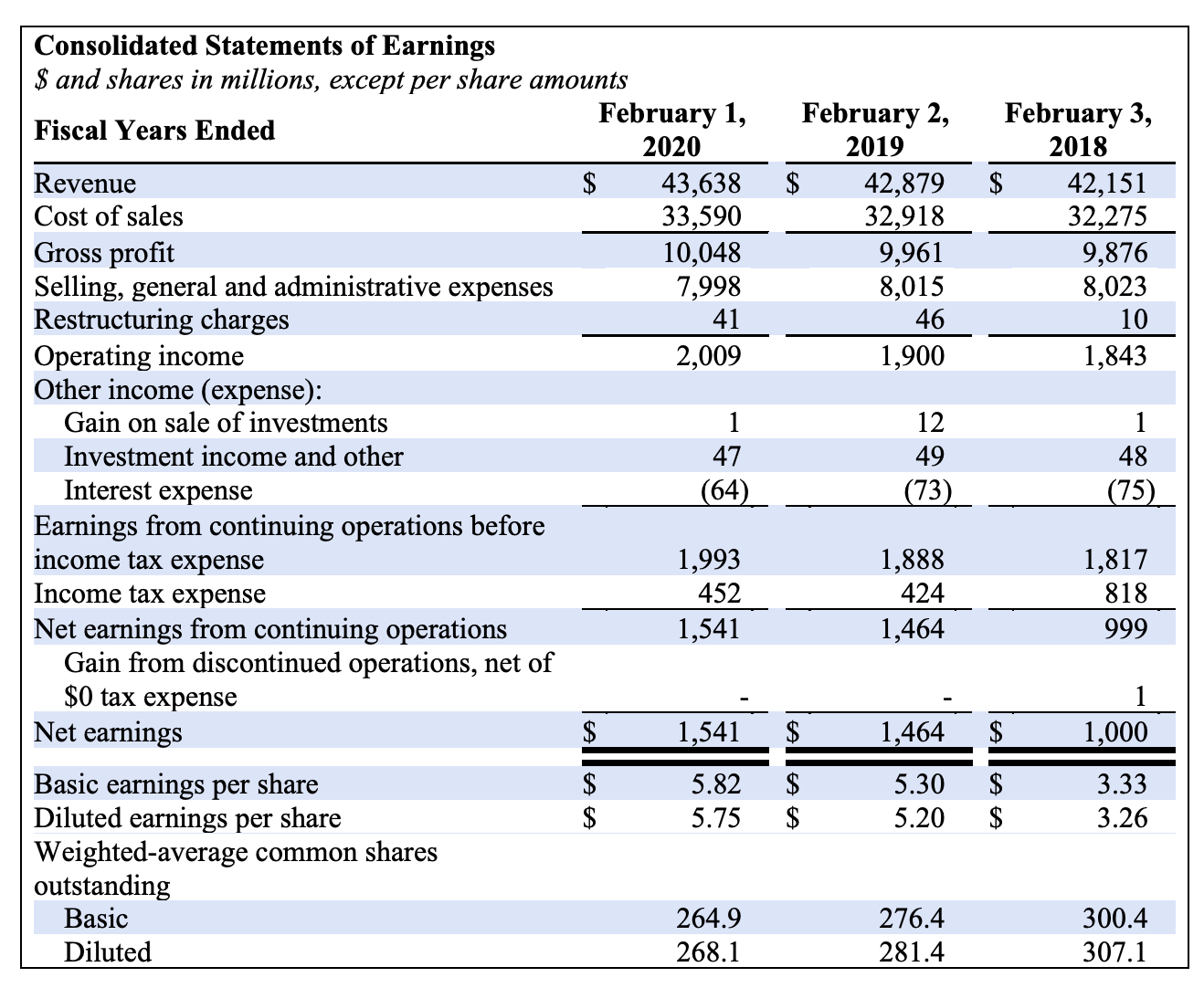

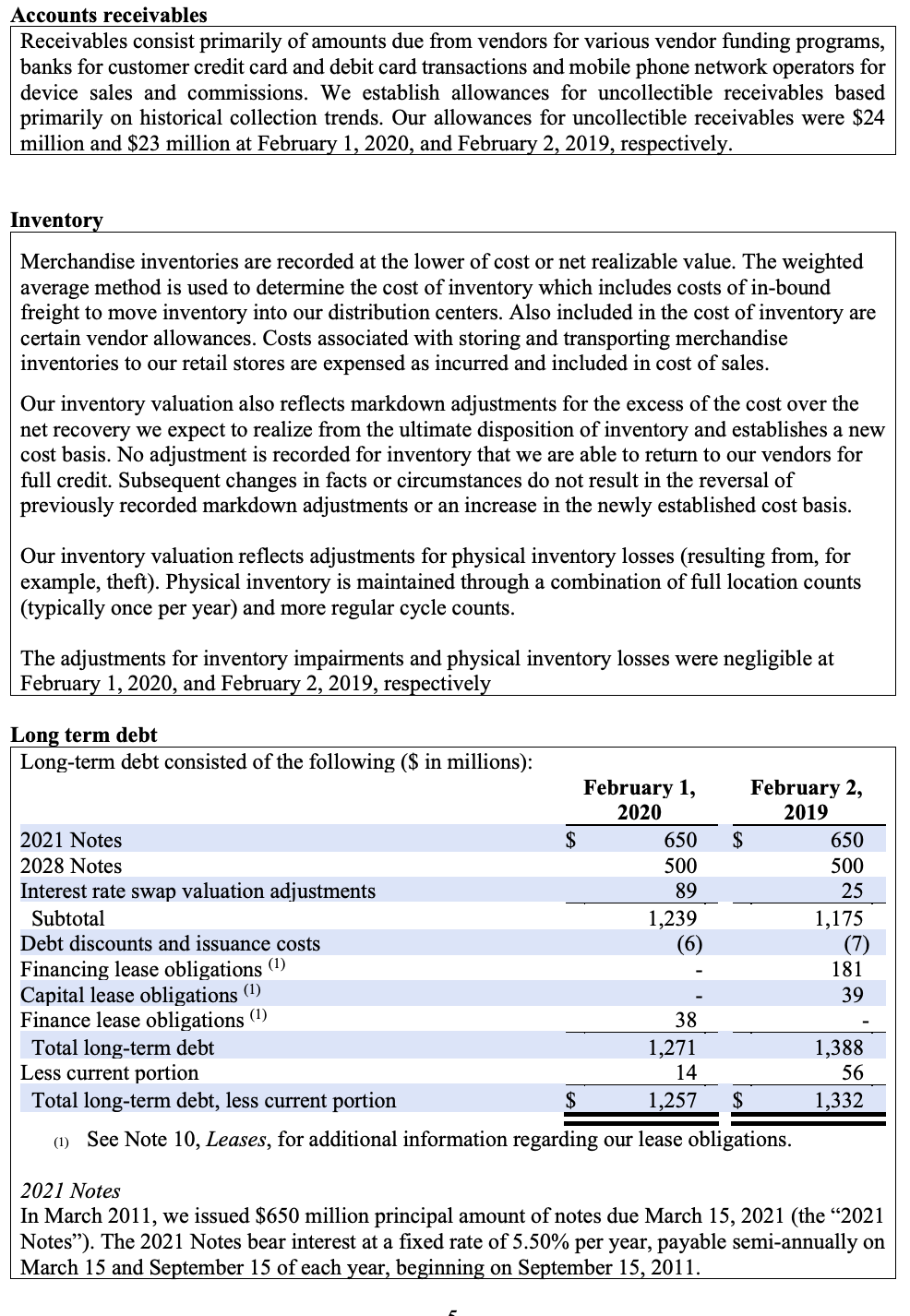

Consolidated Statements of Earnings $ and shares in millions, except per share amounts February 1, February 2, February 3, Fiscal Years Ended 2020 2019 2018 Revenue $ 43,638 $ 42,879 $ 42,151 Cost of sales 33,590 32,918 32,275 Gross profit 10,048 9,961 9,876 Selling, general and administrative expenses 7,998 8,015 8,023 Restructuring charges 41 46 10 Operating income 2,009 1,900 1,843 Other income (expense): Gain on sale of investments 1 12 1 Investment income and other 47 49 48 Interest expense (64) (73) (75) Earnings from continuing operations before income tax expense 1,993 1,888 1,817 Income tax expense 452 424 818 Net earnings from continuing operations 1,541 1,464 999 Gain from discontinued operations, net of $0 tax expense Net earnings $ 1,541 $ 1,464 $ 1,000 Basic earnings per share 5.82 Diluted earnings per share $ 5.75 EA SA $ 5.30 $ 3.33 $ 5.20 $ 3.26 Weighted-average common shares outstanding Basic Diluted 264.9 276.4 300.4 268.1 281.4 307.1

Step by Step Solution

★★★★★

3.25 Rating (146 Votes )

There are 3 Steps involved in it

Step: 1

To determine the revenue recognized from gift cards during fiscal year 2020 for Best Buy we need to look at the information provided Unfortunately the specific revenue recognized from gift cards is no...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started