Answered step by step

Verified Expert Solution

Question

1 Approved Answer

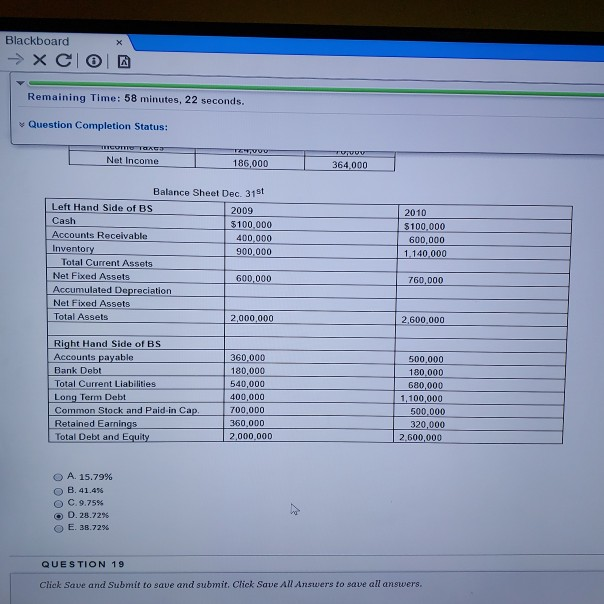

What is the ROE for QAB inc. for the year 2010 X Blackboard XCO Remaining Time: 58 minutes, 22 seconds. Question Completion Status: Net Income

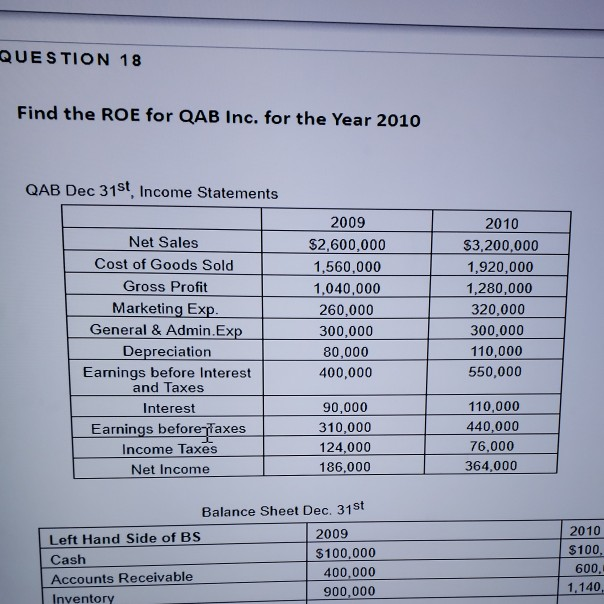

What is the ROE for QAB inc. for the year 2010

X Blackboard XCO Remaining Time: 58 minutes, 22 seconds. Question Completion Status: Net Income TEVU 186,000 364 000 Balance Sheet Dec. 31st Left Hand Side of BS 2009 Cash $100,000 Accounts Receivable 400.000 Inventory Total Current Assets Net Fixed Assets 600,000 Accumulated Depreciation Net Fixed Assets Total Assets 2.000.000 2010 $100.000 600,000 1.140 000 760,000 2.600.000 Right Hand Side of BS Accounts payable Bank Debt Total Current Liabilities Long Term Debt Common Stock and Paid in Cap. Retained Earnings Total Debt and Equity 360,000 180.000 540.000 400,000 700.000 360,000 2 000 000 500.000 180.000 680,000 1,100.000 500.000 320,000 2.600.000 OA. 15.79% B. 41.4% OC. 9.75% 0.26.72% E. 38.72% QUESTION 19 Click Save and submit to save and submit. Click Save All Answers to save all answers. QUESTION 18 Find the ROE for QAB Inc. for the Year 2010 QAB Dec 31st Income Statements Net Sales Cost of Goods Sold Gross Profit Marketing Exp. General & Admin.Exp Depreciation Earnings before Interest and Taxes Interest Earnings before taxes Income Taxes Net Income 2009 $2,600,000 1,560,000 1,040,000 260,000 300,000 80,000 400,000 2010 $3,200,000 1,920,000 1,280,000 320,000 300,000 110,000 550,000 90,000 310,000 124,000 186,000 110,000 440,000 76,000 364,000 Balance Sheet Dec. 31st Left Hand Side of BS 2009 Cash $100,000 Accounts Receivable 400,000 Inventory 900,000 2010 $100, 600. 1,140

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started