Question

What is the Schedule A deduction for taxes? Tax Year 2022 2. Paul is employed as a nuclear engineer with Atom Systems Consultants, Inc. (ASCI).

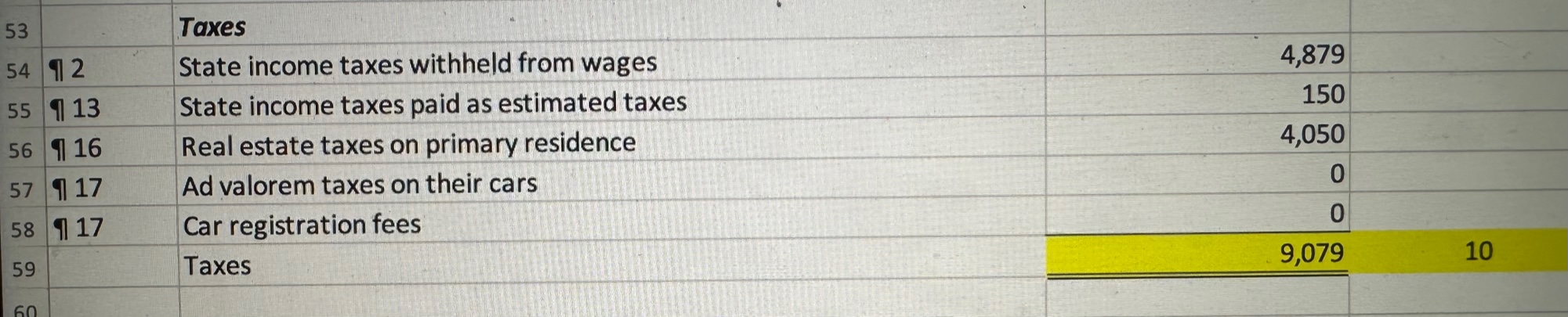

What is the Schedule A deduction for taxes? Tax Year 2022

2. Paul is employed as a nuclear engineer with Atom Systems Consultants, Inc. (ASCI). Paul's pay stubs indicate that he had $7,320 withheld in federal taxes, $4,879 in state taxes. He earned $90,000 of wages subject to employee Social Security taxes and Medicare taxes. ASCI has an extensive fringe benefits program for its employees.

13. In addition to the taxes withheld from his salary, he also made timely estimated federal tax payments of $175 per quarter and timely estimated state income tax payments of $150 for the first three quarters. The $150 fourth-quarter state payment was made on December 28 of the current year. Paul would like to receive a refund for any overpayment.

16. Paul paid $4,050 in real estate taxes on his principal residence. The real estate tax is used to pay for town schools and other municipal services.

17. Paul drives a 2019 Acura TL. His car registration fee (based on the car year) is $50 and covers the period 1/1/22 through 12/31/22. In addition, he paid $280 in property tax to the state based on the book value of the car.

Taxes State income taxes withheld from wages State income taxes paid as estimated taxes Real estate taxes on primary residence Ad valorem taxes on their cars Car registration fees Taxes 4,8791504,050009,079

Taxes State income taxes withheld from wages State income taxes paid as estimated taxes Real estate taxes on primary residence Ad valorem taxes on their cars Car registration fees Taxes 4,8791504,050009,079 Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started