Answered step by step

Verified Expert Solution

Question

1 Approved Answer

What is the strengths and weaknesses of bank Manger? Types of Financial Intermediaries Illustration The following is a balance sheet of one of the Egyptian

What is the strengths and weaknesses of bank Manger?

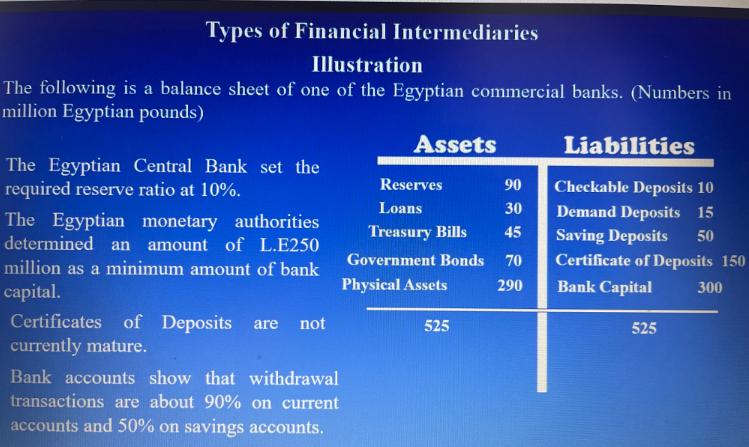

Types of Financial Intermediaries Illustration The following is a balance sheet of one of the Egyptian commercial banks. (Numbers in million Egyptian pounds) The Egyptian Central Bank set the required reserve ratio at 10%. The Egyptian monetary authorities determined an amount of L.E250 million as a minimum amount of bank capital. Certificates of Deposits are not currently mature. Bank accounts show that withdrawal transactions are about 90% on current accounts and 50% on savings accounts. Assets Reserves Loans 30 Treasury Bills 45 Government Bonds 70 Physical Assets 290 525 90 Liabilities Checkable Deposits 10 Demand Deposits 15 Saving Deposits 50 Certificate of Deposits 150 Bank Capital 300 525

Step by Step Solution

★★★★★

3.45 Rating (174 Votes )

There are 3 Steps involved in it

Step: 1

Strengths Relationship building A skilled bank manager excels at building and maintaining relationships with key stakeholders including clients investors regulators and industry professionals Strong r...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started