Answered step by step

Verified Expert Solution

Question

1 Approved Answer

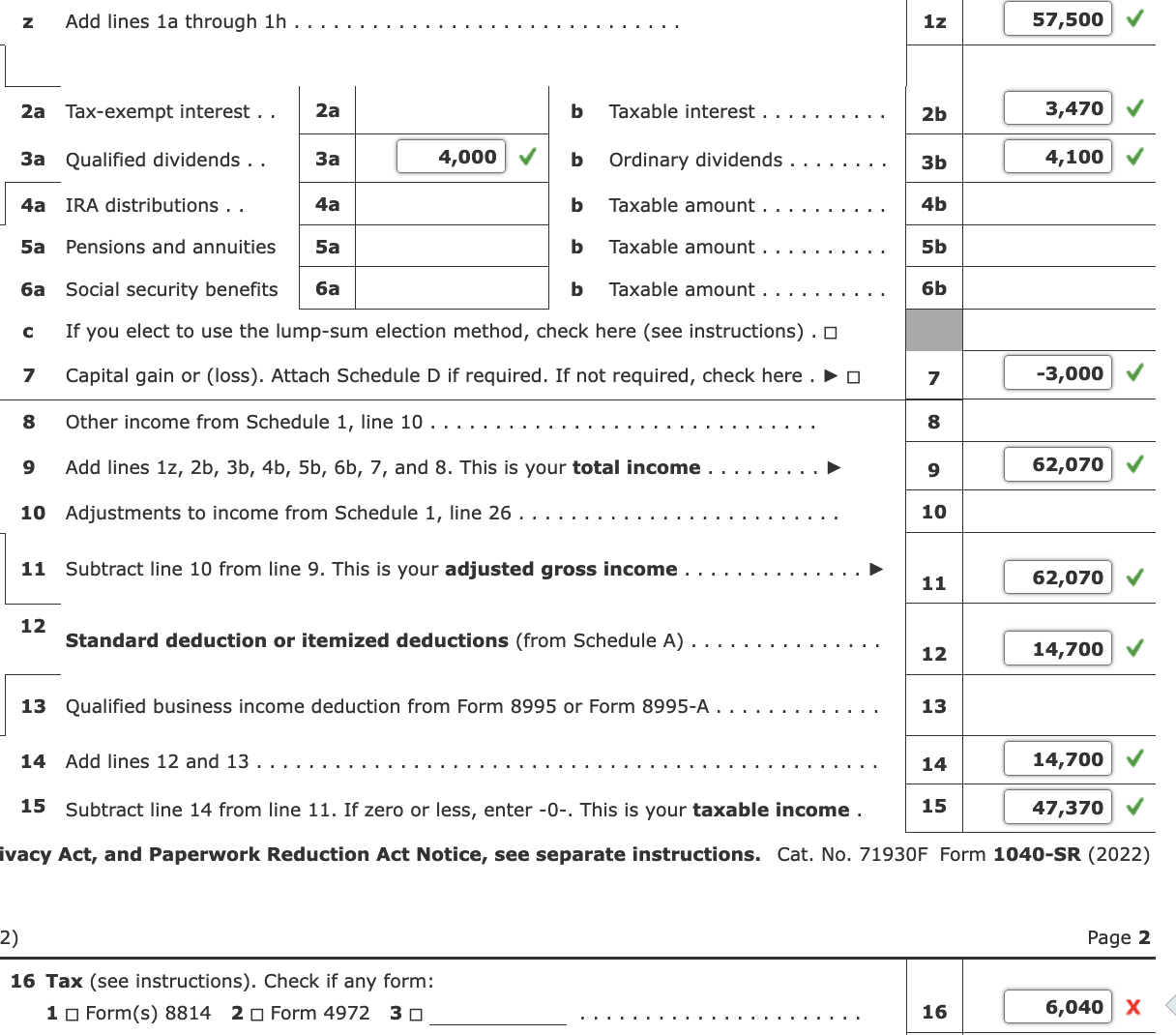

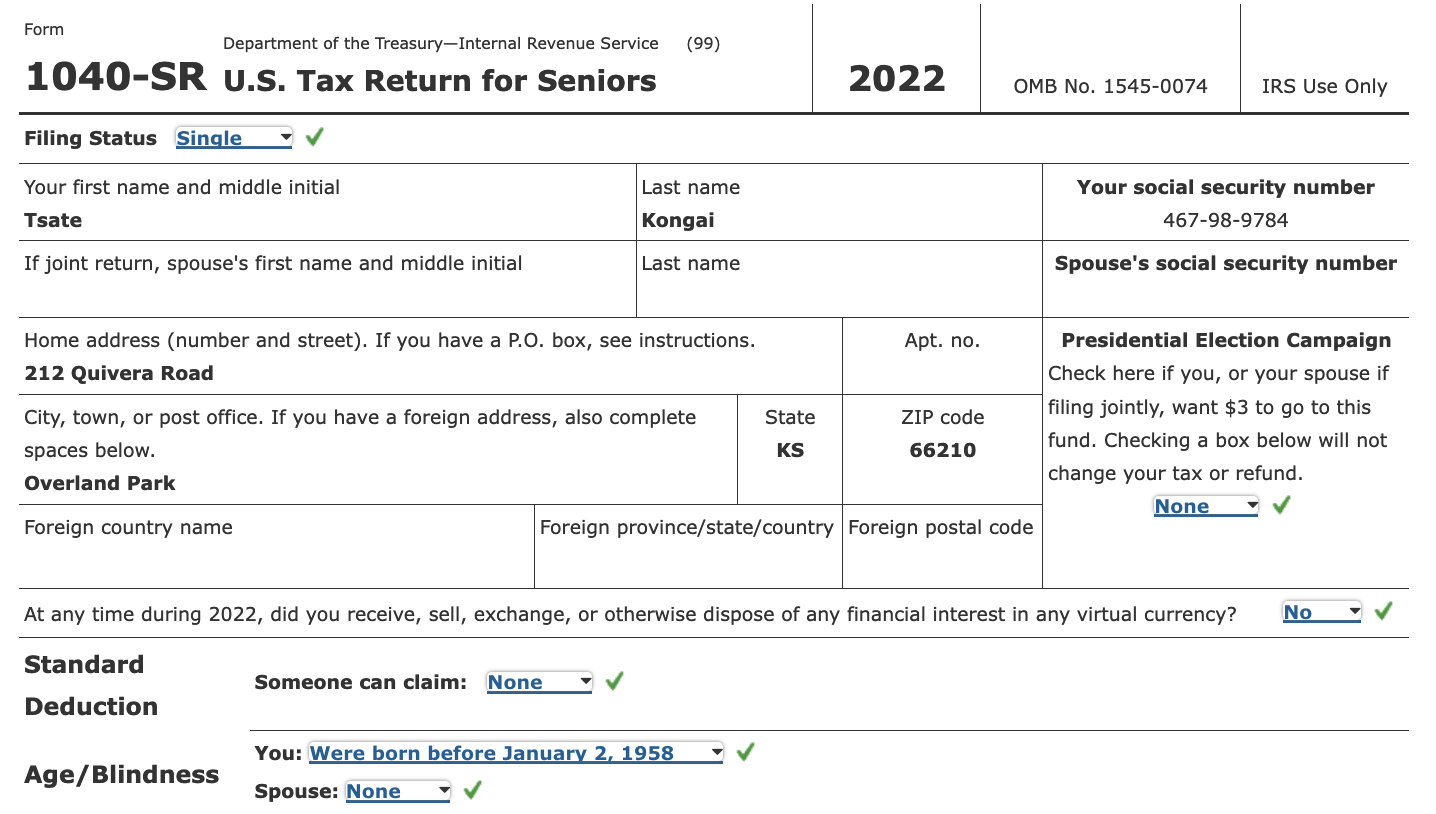

What Is the tax lane 16 for person 65 and older? Z Add lines 1a through 1h 1z 57,500 2a Tax-exempt interest . . 2a

What Is the tax lane 16 for person 65 and older?

Z Add lines 1a through 1h 1z 57,500 2a Tax-exempt interest . . 2a b Taxable interest . . 2b 25 3,470 3a Qualified dividends.. 4,000 4a IRA distributions . . 4a b Ordinary dividends . . . b Taxable amount . . . 3b 4,100 4b 5a Pensions and annuities 5a b Taxable amount . . 5b 6a Social security benefits b Taxable amount . . . 6b C If you elect to use the lump-sum election method, check here (see instructions). 7 Capital gain or (loss). Attach Schedule D if required. If not required, check here. 7 -3,000 8 Other income from Schedule 1, line 10 . . . . 8 9 Add lines 1z, 2b, 3b, 4b, 5b, 6b, 7, and 8. This is your total income 10 Adjustments to income from Schedule 1, line 26 9 62,070 10 11 Subtract line 10 from line 9. This is your adjusted gross income... 11 62,070 12 Standard deduction or itemized deductions (from Schedule A) 12 14,700 13 Qualified business income deduction from Form 8995 or Form 8995-A.. 13 14 Add lines 12 and 13 . . . 14 14,700 15 47,370 15 Subtract line 14 from line 11. If zero or less, enter -0-. This is your taxable income. ivacy Act, and Paperwork Reduction Act Notice, see separate instructions. Cat. No. 71930F Form 1040-SR (2022) 2) 16 Tax (see instructions). Check if any form: 1Form(s) 8814 2 Form 4972 30 Page 2 16 6,040 X Z Add lines 1a through 1h 1z 57,500 2a Tax-exempt interest . . 2a b Taxable interest . . 2b 25 3,470 3a Qualified dividends.. 4,000 4a IRA distributions . . 4a b Ordinary dividends . . . b Taxable amount . . . 3b 4,100 4b 5a Pensions and annuities 5a b Taxable amount . . 5b 6a Social security benefits b Taxable amount . . . 6b C If you elect to use the lump-sum election method, check here (see instructions). 7 Capital gain or (loss). Attach Schedule D if required. If not required, check here. 7 -3,000 8 Other income from Schedule 1, line 10 . . . . 8 9 Add lines 1z, 2b, 3b, 4b, 5b, 6b, 7, and 8. This is your total income 10 Adjustments to income from Schedule 1, line 26 9 62,070 10 11 Subtract line 10 from line 9. This is your adjusted gross income... 11 62,070 12 Standard deduction or itemized deductions (from Schedule A) 12 14,700 13 Qualified business income deduction from Form 8995 or Form 8995-A.. 13 14 Add lines 12 and 13 . . . 14 14,700 15 47,370 15 Subtract line 14 from line 11. If zero or less, enter -0-. This is your taxable income. ivacy Act, and Paperwork Reduction Act Notice, see separate instructions. Cat. No. 71930F Form 1040-SR (2022) 2) 16 Tax (see instructions). Check if any form: 1Form(s) 8814 2 Form 4972 30 Page 2 16 6,040 X

Step by Step Solution

★★★★★

3.36 Rating (152 Votes )

There are 3 Steps involved in it

Step: 1

Workings to calculate the tax for a single filer who is 65 or older in 2022 1 Taxable income from l...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started