Answered step by step

Verified Expert Solution

Question

1 Approved Answer

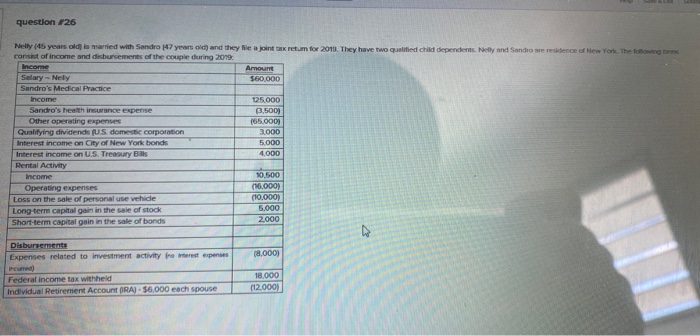

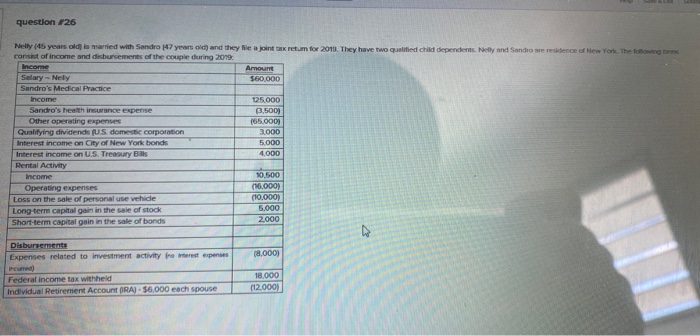

What is the total self-employment tax of the taxpayer? Show computations* 2. What is the Net Investment Income (portfollo income)? 3. What is the Net

What is the total self-employment tax of the taxpayer? Show computations*

2. What is the Net Investment Income (portfollo income)?

question 726 Nel 15 years old is married with Sandro 7 years and they a consist of income and disbursement of the couple during 2009 r e to y have two quid depende n Sandovedence of York The $60000 Salary - Nelly Sandro's Medical Practice income D.000 3.500) 165.000 3000 5000 4,000 Other operating expenses Qualifying dividends US domes corporation Interest income on City of New York bonds Interest income on US Treasury Bills Rental Activity Income Operating expenses Loss on the sale of personal use vehide Long-term capital gain in the sale of stock Short-term capital gain in the sale of bonds 10.500 ( MODOS CO 000 5.000 2000 Disbursements Expenses related to investment activity re p en 8,000) 18.000 112.000) Account IRA) - 56 000 each spouse question 726 Nel 15 years old is married with Sandro 7 years and they a consist of income and disbursement of the couple during 2009 r e to y have two quid depende n Sandovedence of York The $60000 Salary - Nelly Sandro's Medical Practice income D.000 3.500) 165.000 3000 5000 4,000 Other operating expenses Qualifying dividends US domes corporation Interest income on City of New York bonds Interest income on US Treasury Bills Rental Activity Income Operating expenses Loss on the sale of personal use vehide Long-term capital gain in the sale of stock Short-term capital gain in the sale of bonds 10.500 ( MODOS CO 000 5.000 2000 Disbursements Expenses related to investment activity re p en 8,000) 18.000 112.000) Account IRA) - 56 000 each spouse 3. What is the Net income (loss) os Sandro's Medical Practice?

4. Determine: a. The total income subject to preferential tax rates? b. What is the total tax calculated using preferential tax rates? Assume the taxpayer maximum ordinary tax rate for 2019 year is 22%.

5. Calculate the adjusted gross income? Show computations.

6. What is the net income (loss) of rental activity of the couple?

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started