Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Samir has a business in the leisure industry. He is purchasing a boat and plans to start luxury river cruises. In his original plan,

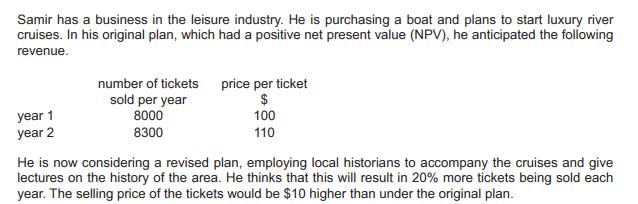

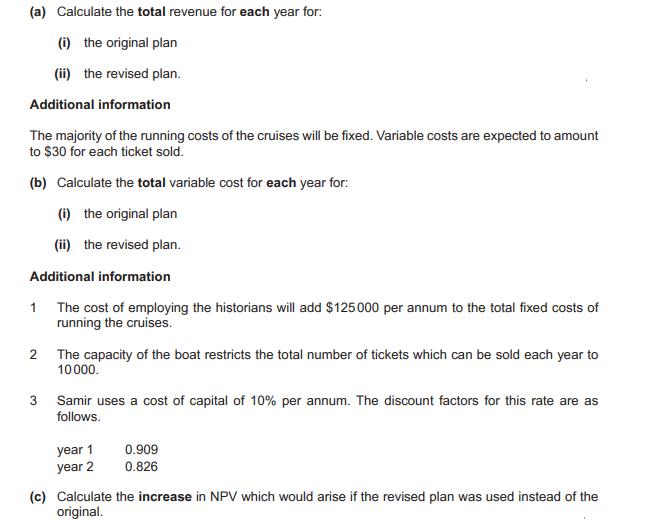

Samir has a business in the leisure industry. He is purchasing a boat and plans to start luxury river cruises. In his original plan, which had a positive net present value (NPV), he anticipated the following revenue. year 1 year 2 number of tickets sold per year 8000 8300 price per ticket $ 100 110 He is now considering a revised plan, employing local historians to accompany the cruises and give lectures on the history of the area. He thinks that this will result in 20% more tickets being sold each year. The selling price of the tickets would be $10 higher than under the original plan. (a) Calculate the total revenue for each year for: (i) the original plan (ii) the revised plan. Additional information The majority of the running costs of the cruises will be fixed. Variable costs are expected to amount to $30 for each ticket sold. (b) Calculate the total variable cost for each year for: (i) the original plan (ii) the revised plan. Additional information 1 The cost of employing the historians will add $125000 per annum to the total fixed costs of running the cruises. 2 The capacity of the boat restricts the total number of tickets which can be sold each year to 10000. 3 Samir uses a cost of capital of 10% per annum. The discount factors for this rate are as follows. year 1 year 2 0.909 0.826 (c) Calculate the increase in NPV which would arise if the revised plan was used instead of the original.

Step by Step Solution

★★★★★

3.43 Rating (159 Votes )

There are 3 Steps involved in it

Step: 1

a i Original plan Year 1 8000 tickets x 100 800000 Year 2 8300 tickets x 110 913000 ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started