Answered step by step

Verified Expert Solution

Question

1 Approved Answer

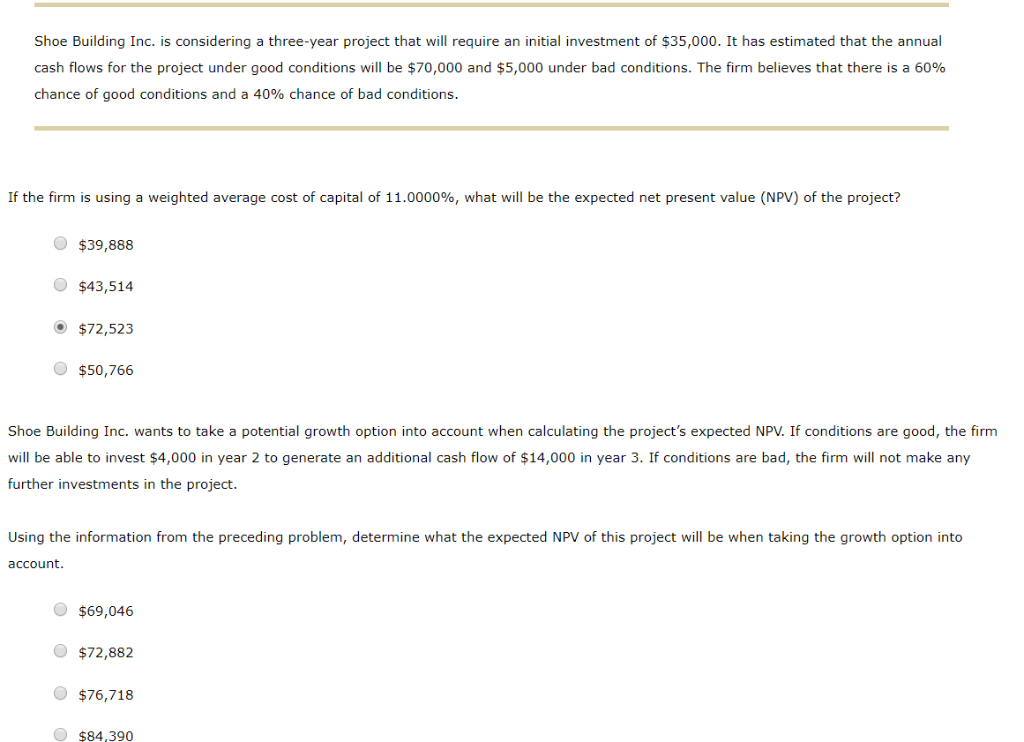

What is the value of Shoe Building Inc.s growth option? A) $3,566 B) 4,195 C) $3,356 D) $3,985 Shoe Building Inc. is considering a three-year

What is the value of Shoe Building Inc.s growth option? A) $3,566 B) 4,195 C) $3,356 D) $3,985

Shoe Building Inc. is considering a three-year project that will require an initial investment of $35,000. It has estimated that the annual cash flows for the project under good conditions will be $70,000 and $5,000 under bad conditions. The firm believes that there is a 60% chance of good conditions and a 40% chance of bad conditions. If the firm is using a weighted average cost of capital of 11.0000%, what will be the expected net present value (NPV) of the project? $39,888 $43,514 $72,523 $50,766 Shoe Building Inc. wants to take a potential growth option into account when calculating the project's expected NPV. If conditions are good, the firm will be able to invest $4,000 in year 2 to generate an additional cash flow of $14,000 in year 3. If conditions are bad, the firm will not make any further investments in the project. Using the information from the preceding problem, determine what the expected NPV of this project will be when taking the growth option into account. O $69,046 $72,882 $76,718 $84,390Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started