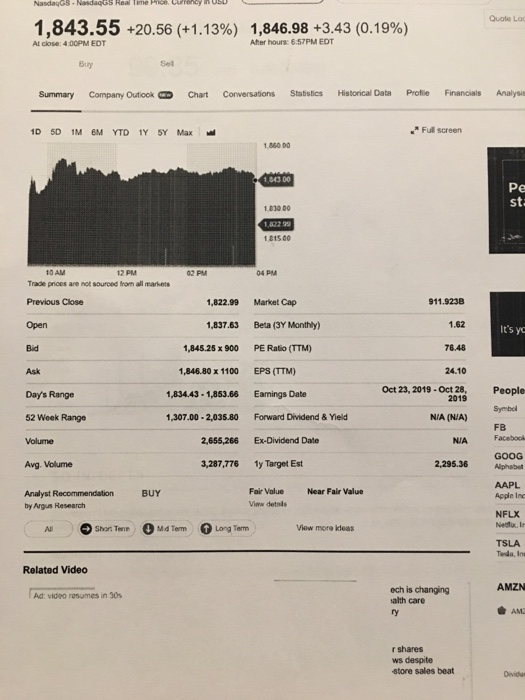

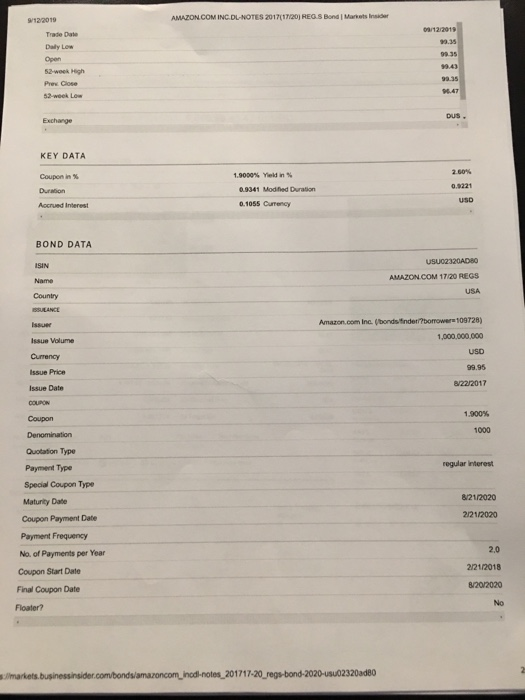

What is the WACC based off of Amazon.com debt or bonds common stock.

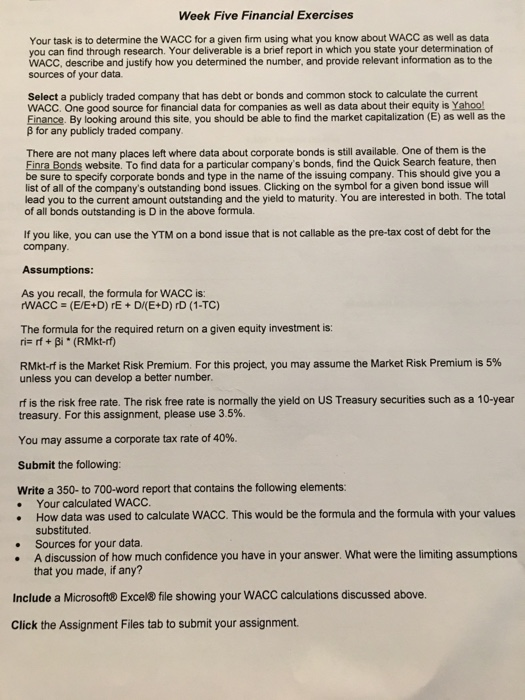

Week Five Financial Exercises Your task is to determine the WACC for a given firm using what you know about WACC as well as data you can find through research. Your deliverable is a brief report in which you state your determination of WACC, describe and justify how you determined the number, and provide relevant information as to the sources of your data Select a publicly traded company that has debt or bonds and common stock to calculate the current WACC One good source for financial data for companies as well as data about their equity is Yahoo! Finance By looking around this site, you should be able to find the market capitalization (E) as well as the B for any publicly traded company There are not many places left where data about corporate bonds is still available. One of them is the Finra Bonds website. To find data for a particular company's bonds, find the Quick Search feature, then be sure to specify corporate bonds and type in the name of the issuing company. This should give you a list of all of the company's outstanding bond issues. Clicking on the symbol for a given bond issue will lead you to the current amount outstanding and the yield to maturity. You are interested in both. The total of all bonds outstanding is D in the above formula. If you like, you can use the YTM on a bond issue that is not callable as the pre-tax cost of debt for the company Assumptions: As you recall, the formula for WACC is: WACC - (E/E+D) rE+DE+D) D (1-TC) The formula for the required return on a given equity investment is ri= rf + Bi * (RMkt-rf) RMkt-rf is the Market Risk Premium. For this project, you may assume the Market Risk Premium is 5% unless you can develop a better number rfis the risk free rate. The risk free rate is normally the yield on US Treasury securities such as a 10-year treasury. For this assignment, please use 3.5%. You may assume a corporate tax rate of 40%. Submit the following: Write a 350-to 700-word report that contains the following elements: Your calculated WACC. How data was used to calculate WACC. This would be the formula and the formula with your values substituted. Sources for your data. A discussion of how much confidence you have in your answer. What were the limiting assumptions that you made, if any? Include a Microsoft Excel file showing your WACC calculations discussed above. Click the Assignment Files tab to submit your assignment. NAGSUSU 1,843.55 +20.56 (+1.13%) 1,846.98 +3.43 (0.19%) Al cos 4:00PM EDT Ater hours 6:57PM EDT Conversations Statistics Historical Data Protte Financial Analys Summary Company Outlook Chart - 1050 IM BM YTD 1Y SY Max Full screen 1 MODO 10000 10300 10229 1815.00 04 PM 12 PM Trade prices are not sourced from all markets Previous Close 1,822.99 Market Cap 911.9238 Open 1,837.63 Beta (3Y Monthly) 1.62 Bid 1,845.25 x 900 PE Ratio (TTM) 76.48 Ask 1,846.80 x 1100 EPS (TTM) 24.10 Oct 23, 2019 - Oct 28 Day's Range 1,834.43 - 1,853.66 Earnings Date People 52 Week Range 1,307.00 -2,035.80 Forward Dividend & Yield N/A (NA) FB Volume 2,655,266 Ex-Dividend Date NIA Facebook Avg. Volume 3,287,776 1y Target Est 2,295.36 GOOG Alphabu BUY Near Fair Value Fair Value View details AAPL Apple and Analyst Recommendation by Hesearch Short Term NFLX Md Tom Long Term View more ideas TSLA Related Video AMZN Ad Video resumes in 5 ech is changing alth care AM r shares ws despite store sales beat 9/12/2019 AMAZON.COM INC. DL-NOTES 2017(17120) REG. Bond Marketinde Tradie Date Daily Low 52-week High Prex Close Exchange KEY DATA Coupon in % 1.9000% Yield in Duwon 9341 Modified Duration Accrued Interest 0.1055 Currency BOND DATA USU02320ADBO AMAZON.COM 17/20 REGS Name USA Country Issue Volume Amazon.com Inc. bondsfinder/borrower 109728) 1,000,000,000 USD Currency 99.95 Issue Price 8/22/2017 Issue Date COUPON 1.900% Coupon 1000 Denomination Quotation Type Payment Type Special Coupon Type regular interest Maturity Date 8/21/2020 2/21/2020 Coupon Payment Date Payment Frequency No. of Payments per Year Coupon Start Date Final Coupon Date Floater? 2.0 2121/2018 8/20/2020 markets, businessinsider.com/bonds/amazoncom_inodl-notes 201717-20regs bond 2020-802320ad80