Answered step by step

Verified Expert Solution

Question

1 Approved Answer

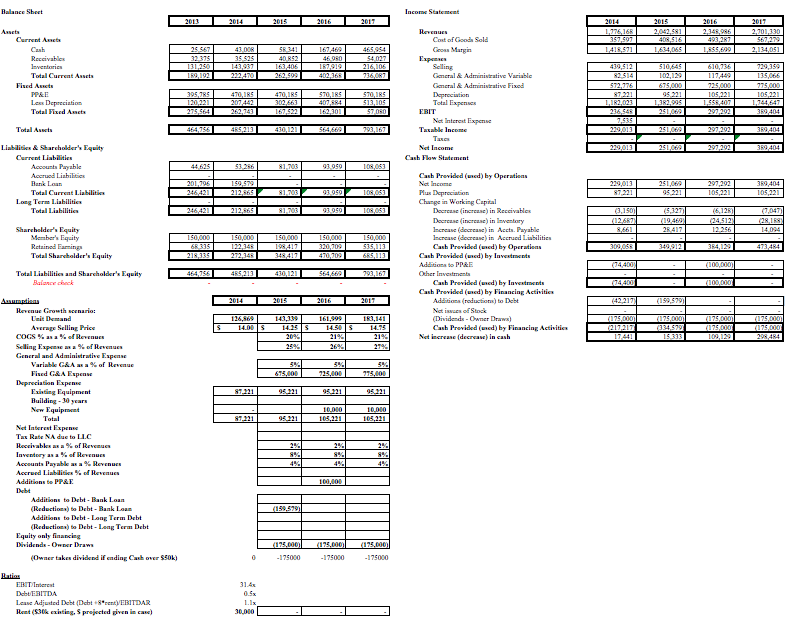

What is true about financial performance from 2014 to 2017? a. EBIT/Interest is improving b. Operating profit margin is improving c. Lease Adjusted Debt /

What is true about financial performance from 2014 to 2017?

a. EBIT/Interest is improving

b. Operating profit margin is improving

c. Lease Adjusted Debt / EBITDAR is increasing

d. None of these

Balance Sheet Income Statement 201 201 2013 2014 2015 2016 2014 2015 2016 2.348,986 401.287 Assets Revenues 1776168 357,597 L418,57 2042,581 408,516 2,701,330 567.279 Carrent Acts Cost of Goods Sold 5R34 2,134,05 Cash 25,567 43.008 16746 465,954 Geoas Margin Expenses Selling Gncral& Administrative Variable 1634,065 L855.699 Reccivable 32375 131.250 189,192 35.525 40 852 46.950 54.027 216,106 736,087 510,645 102,19 729,359 187919 402,368 610,36 117449 ventarics 143,937 222470 163.406 439,512 82514 Total Current Assets 262,599 135,066 675,000 Fised Aets Gneral& Adminisirative Fixed Deprecistion Total Expenses 572.776 725,000 775,000 105.221 1,144,647 3R9404 570,1RS 40A84 162.301 87,22 1,IR.023 236.548 7,535 229013 PP& Less Depreciation 470,R 20442 262,143 570.185 513,105 ST.050 395.785 470,1RS 30263 167,522 95.221 105.221 120,221 275.564 1,558,407 297,292 138 251,069 Total Fixed Acts EBIT Net Interest Expense 430,121 564.669 793.167 251,69 464,56 4R3313 389404 Total Assets Taxable Income 297,292 Taxcs 229,013 297,292 3 404 Liabilities& Sharholder's Equity 251,0 Net Income Carrent Liabilities Cash Flaw Statement 91040 108,053 Accounts Payshle 44.625 53.286 81,703 Cash Previded (ed) by Operatiens Net Income Plus Depreciation Change in Warking Capial Docrease(increaac) in Reccivables Docrease (inerense) in Inventory ncrease (decrease) in Accts. Payable ncrease (docrease) in Accrued Linbilities Cash Previded (ued) by Operatioas Cash Previded (ed) by Investents Accrued Lishilities 201,796 229,013 87,221 Bank Laan 159,579 212.865 251,0 95 297,292 105,22 3R9404 105,221 81,703 93.959 Total Current Liabilities 246421 108,083 Long Term Lisbilitics 81,303 6.327 246421 (6,128 (7047 (28,188) Total Liabilitics 212,865 93,959 (3,1507 (12,687) 8,66 (19,469 (24,512) 12256 Sharehelder's Equity Membar's Equity Retained Eamings Total Shareholder's Equity 28417 14.094 150,000 68315 218.335 150,000 150,000 150,000 150,000 198417 348417 535,113 473A84 122,348 272,348 320.709 309,058 349,912 384,129 470,709 6R5,113 (74,400 Additiona to PPAE (100,000 485.213 430,121 564,669 Total Liahilitie and Shareholder's Equity 44,756 793,6 Oher Investments (100.0001 (74400 Balance chack Cash Previded (ued) by Investments Cash Previded (uned) by Financing Activitics Additiona (roductiona) to Del (42217) (159,579) Assumtiaas 2014 2015 2016 2017 Revenue Grouth scenario: Net isas of Stock (175,000) (175.000 2484 143,13 1425 S 83,14 Unit Demand 126.869 161,99 14.50 S (Dividends-Owner Drawa) Cash Previded (ued) by Financing Activities Net increase (decrease) in cash (175,000) (217.217 1744 (175,000 (334,579) 15,333 (175,000) (175,000 109.129 Average Selling Price COGS% % of Revenues Seling Expaae a% of Revenues General and Administrative Espease 14.00 S 14.75 20% 21% 21% 26% 27% 25% 5% Variab G&A ax a % of Revenue 5% 5% Fised G&A Espense Depreciason Expeme Exiting Equipment Building-30 years New Equipment 15,000 725,000 715,000 8T221 95221 95221 95.221 10,000 105,221 10.000 105,221 Total 87221 95221 Net Interest Expens Tax Rate NA due to LLC 2% 8% 4% Receivabks a a % of Reveucs 2% 2% Inventory as a % of Revenues 8% 8% Acceunts Payabk asa% Revenues 4% 4% Accrued Liablities % of Revenues Additions te PPAE 100,000 Deb Additions to Debt- Bank Loa (Reductiona) to Deht-Baak Loa Additions to Dcbt- Long Term Debt (Reductions) o Debt-Leag Term Debt Equity only fiaancing (159,579) (175.000) (175,000) (175,000) ividends-Owner Draws (Owner takes dividend if ending Cash over $50k) 0 -175000 -175000 -175000 Batias EBT Inerest 31.4 DebtEITDA 0.5x Lease Adjusted Debt (Debt +8rentEBITDAR Rent (S30k exiting, S prejected gven in ca) 3Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started