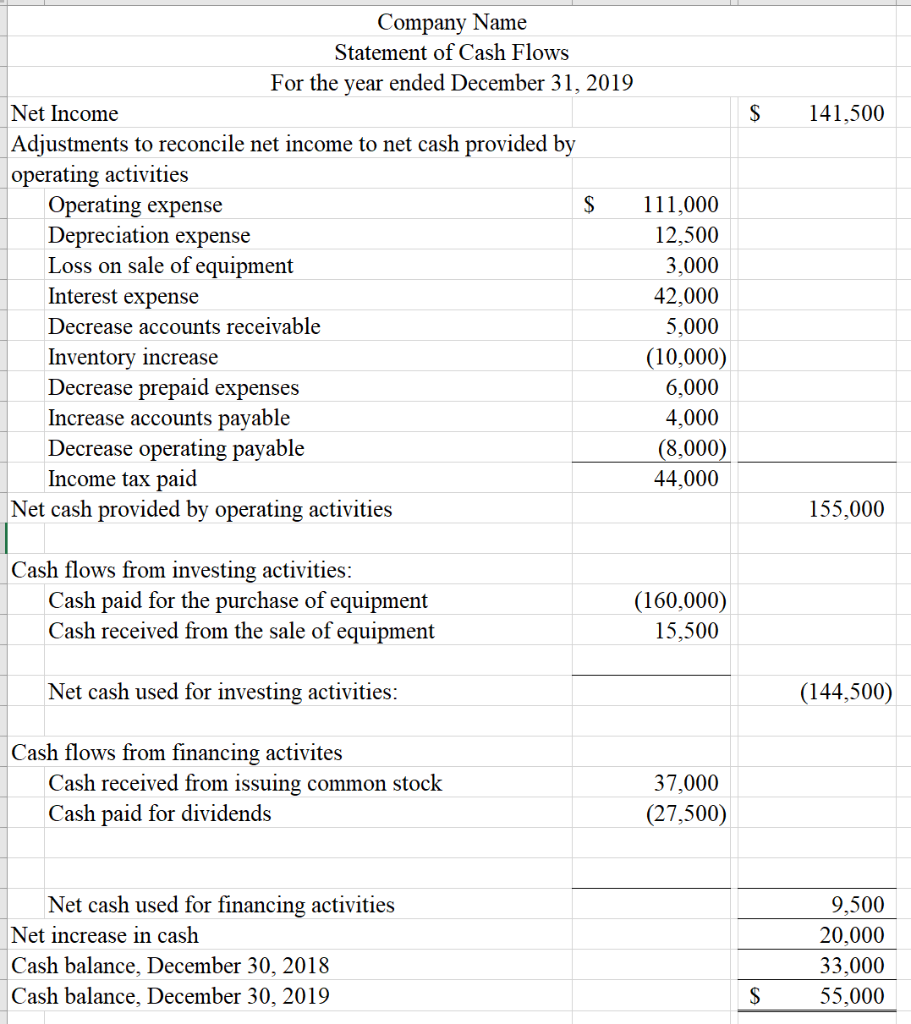

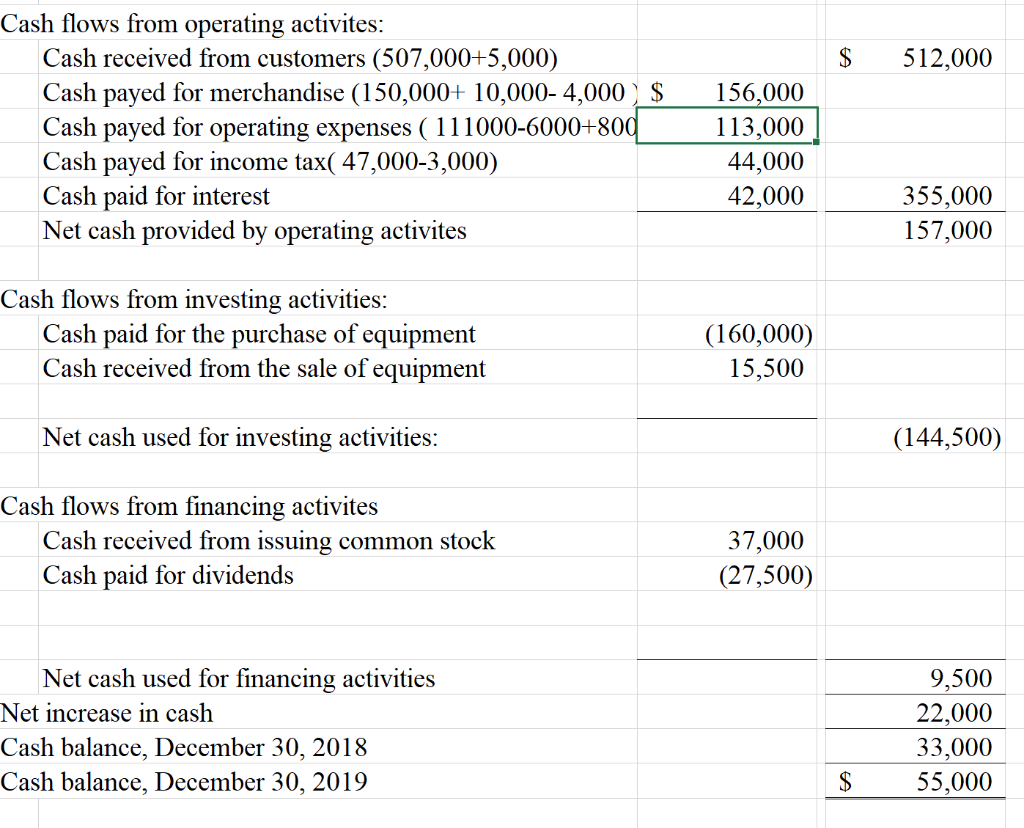

What is wrong with my indirect method

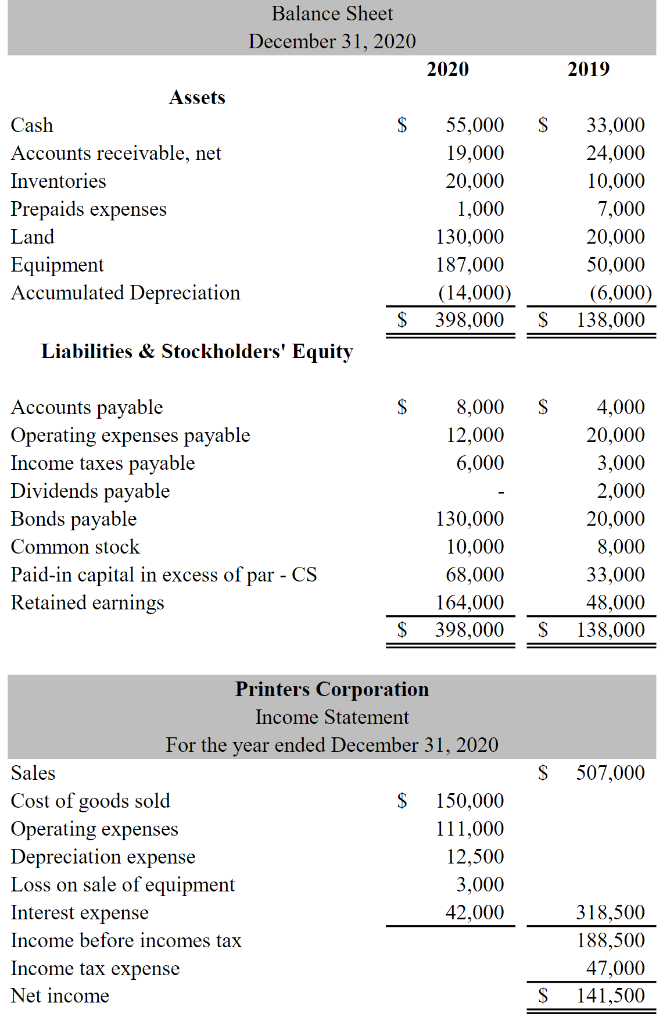

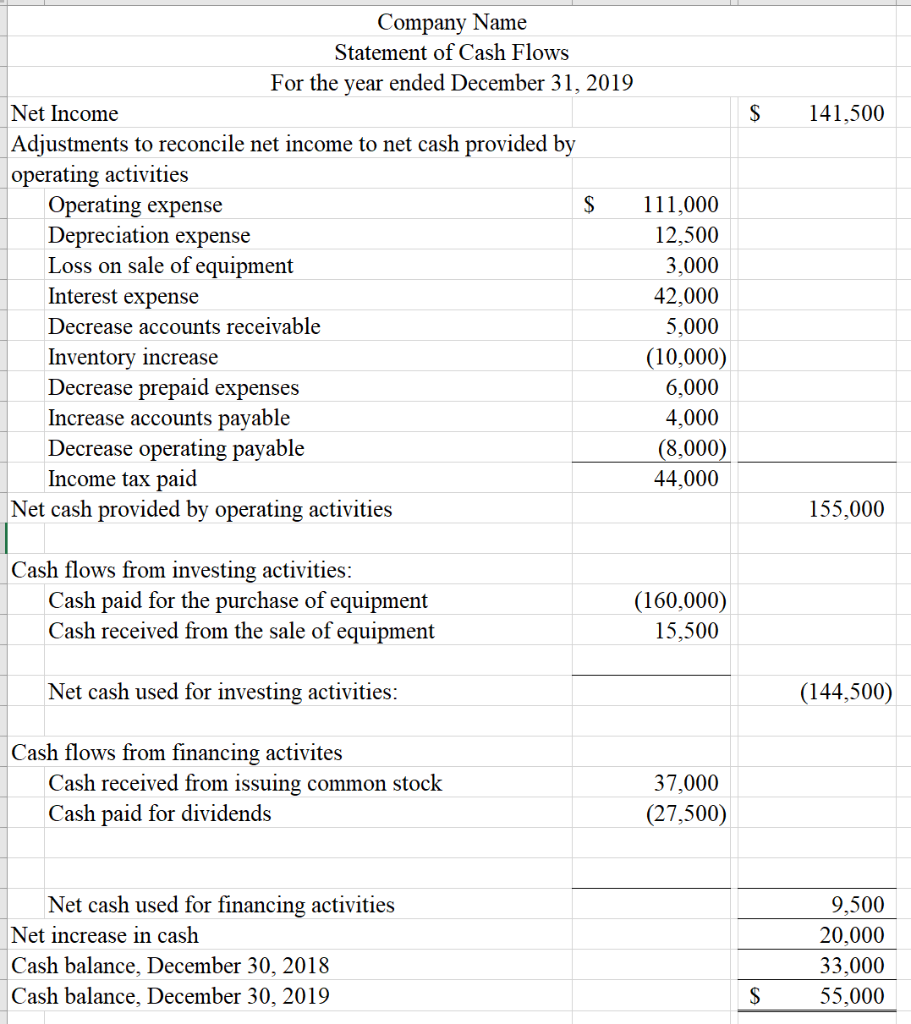

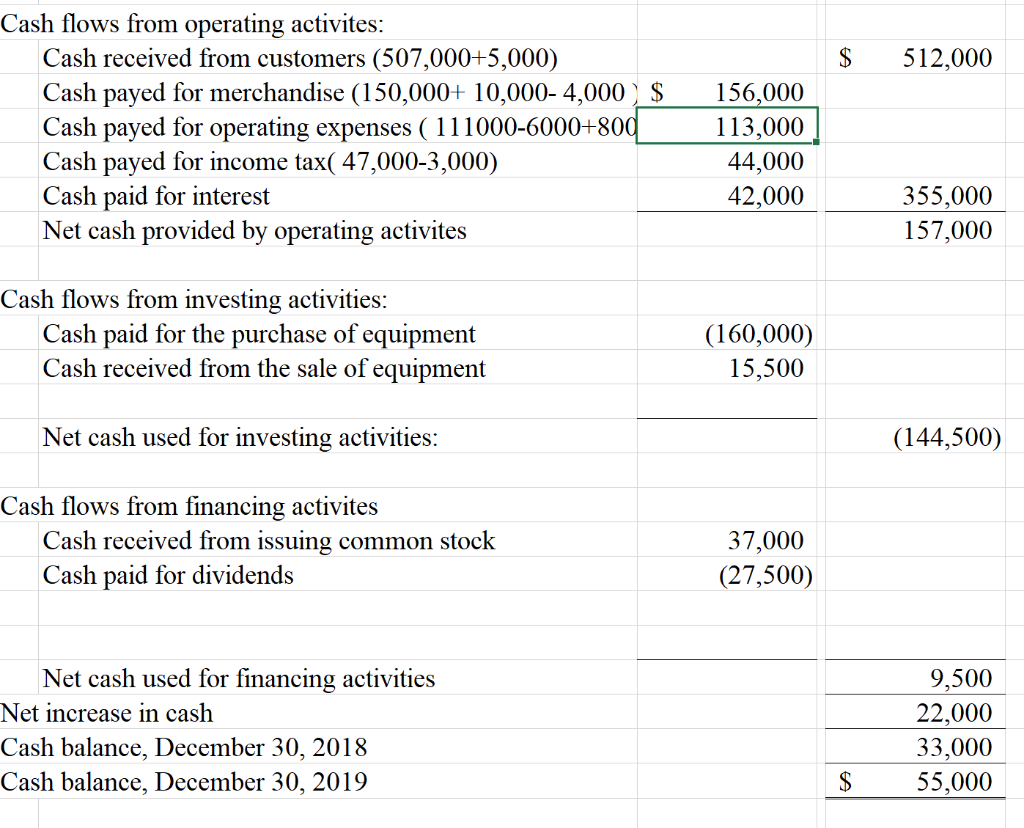

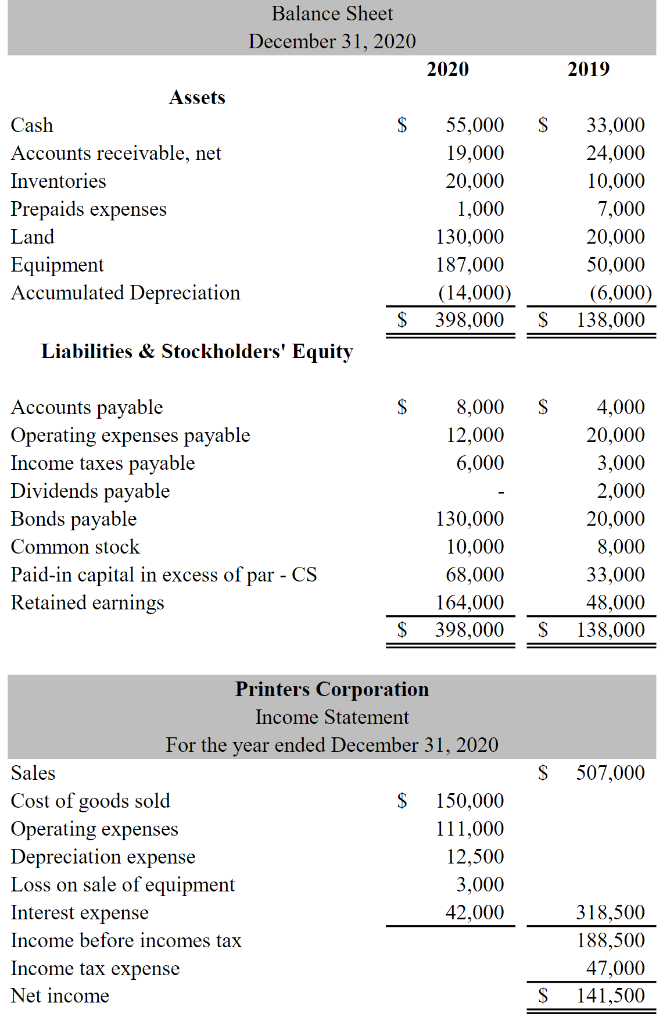

Balance Sheet December 31, 2020 2020 2019 $ $ Assets Cash Accounts receivable, net Inventories Prepaids expenses Land Equipment Accumulated Depreciation 55,000 19,000 20,000 1,000 130,000 187,000 (14,000) 398,000 33,000 24,000 10,000 7,000 20,000 50,000 (6,000) 138,000 $ $ Liabilities & Stockholders' Equity $ 8,000 12,000 6,000 Accounts payable Operating expenses payable Income taxes payable Dividends payable Bonds payable Common stock Paid-in capital in excess of par - CS Retained earnings 130,000 10,000 68,000 164,000 398,000 4,000 20,000 3,000 2,000 20,000 8,000 33,000 48,000 138,000 $ $ S 507,000 Printers Corporation Income Statement For the year ended December 31, 2020 Sales Cost of goods sold $ 150,000 Operating expenses 111,000 Depreciation expense 12,500 Loss on sale of equipment 3,000 Interest expense 42,000 Income before incomes tax Income tax expense Net income 318,500 188,500 47.000 141,500 S $ 141,500 Company Name Statement of Cash Flows For the year ended December 31, 2019 Net Income Adjustments to reconcile net income to net cash provided by operating activities Operating expense $ 111,000 Depreciation expense 12,500 Loss on sale of equipment 3,000 Interest expense 42,000 Decrease accounts receivable 5,000 Inventory increase (10,000) Decrease prepaid expenses 6,000 Increase accounts payable 4,000 Decrease operating payable (8,000) Income tax paid 44,000 Net cash provided by operating activities 155,000 Cash flows from investing activities: Cash paid for the purchase of equipment Cash received from the sale of equipment (160,000) 15,500 Net cash used for investing activities: (144,500) Cash flows from financing activites Cash received from issuing common stock Cash paid for dividends 37,000 (27,500) Net cash used for financing activities Net increase in cash Cash balance, December 30, 2018 Cash balance, December 30, 2019 9,500 20,000 33,000 Cash flows from operating activites: $ 512,000 Cash payed for merchandise (150,000+ 10,000-4,000) $ Cash payed for operating expenses ( 111000-6000+800 Cash payed for income tax( 47,000-3,000) Cash paid for interest Net cash provided by operating activites 156,000 113,000 44,000 42,000 355,000 157,000 Cash flows from investing activities: Cash paid for the purchase of equipment Cash received from the sale of equipment (160,000) 15,500 Net cash used for investing activities: (144,500) Cash flows from financing activites Cash received from issuing common stock Cash paid for dividends 37,000 (27,500) Net cash used for financing activities Net increase in cash Cash balance, December 30, 2018 Cash balance, December 30, 2019 9,500 22,000 33,000 55,000 $ Balance Sheet December 31, 2020 2020 2019 $ $ Assets Cash Accounts receivable, net Inventories Prepaids expenses Land Equipment Accumulated Depreciation 55,000 19,000 20,000 1,000 130,000 187,000 (14,000) 398,000 33,000 24,000 10,000 7,000 20,000 50,000 (6,000) 138,000 $ $ Liabilities & Stockholders' Equity $ 8,000 12,000 6,000 Accounts payable Operating expenses payable Income taxes payable Dividends payable Bonds payable Common stock Paid-in capital in excess of par - CS Retained earnings 130,000 10,000 68,000 164,000 398,000 4,000 20,000 3,000 2,000 20,000 8,000 33,000 48,000 138,000 $ $ S 507,000 Printers Corporation Income Statement For the year ended December 31, 2020 Sales Cost of goods sold $ 150,000 Operating expenses 111,000 Depreciation expense 12,500 Loss on sale of equipment 3,000 Interest expense 42,000 Income before incomes tax Income tax expense Net income 318,500 188,500 47.000 141,500 S $ 141,500 Company Name Statement of Cash Flows For the year ended December 31, 2019 Net Income Adjustments to reconcile net income to net cash provided by operating activities Operating expense $ 111,000 Depreciation expense 12,500 Loss on sale of equipment 3,000 Interest expense 42,000 Decrease accounts receivable 5,000 Inventory increase (10,000) Decrease prepaid expenses 6,000 Increase accounts payable 4,000 Decrease operating payable (8,000) Income tax paid 44,000 Net cash provided by operating activities 155,000 Cash flows from investing activities: Cash paid for the purchase of equipment Cash received from the sale of equipment (160,000) 15,500 Net cash used for investing activities: (144,500) Cash flows from financing activites Cash received from issuing common stock Cash paid for dividends 37,000 (27,500) Net cash used for financing activities Net increase in cash Cash balance, December 30, 2018 Cash balance, December 30, 2019 9,500 20,000 33,000 Cash flows from operating activites: $ 512,000 Cash payed for merchandise (150,000+ 10,000-4,000) $ Cash payed for operating expenses ( 111000-6000+800 Cash payed for income tax( 47,000-3,000) Cash paid for interest Net cash provided by operating activites 156,000 113,000 44,000 42,000 355,000 157,000 Cash flows from investing activities: Cash paid for the purchase of equipment Cash received from the sale of equipment (160,000) 15,500 Net cash used for investing activities: (144,500) Cash flows from financing activites Cash received from issuing common stock Cash paid for dividends 37,000 (27,500) Net cash used for financing activities Net increase in cash Cash balance, December 30, 2018 Cash balance, December 30, 2019 9,500 22,000 33,000 55,000 $