Question

Delco Accents is looking at a project that will require $140,000 in fixed assets and an initial investment in net working capital of $19,000.

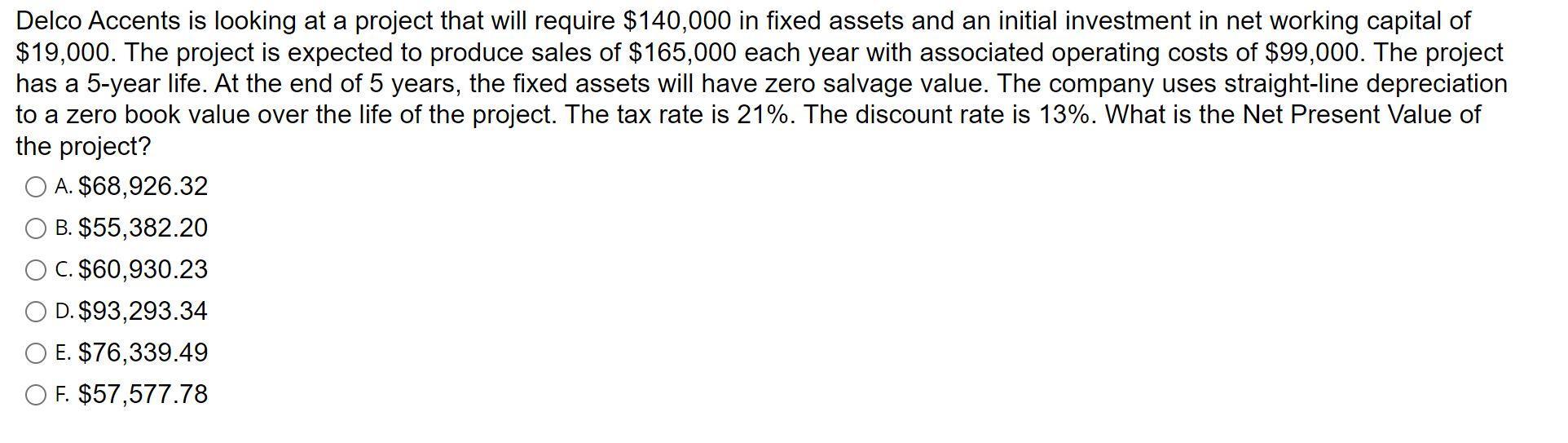

Delco Accents is looking at a project that will require $140,000 in fixed assets and an initial investment in net working capital of $19,000. The project is expected to produce sales of $165,000 each year with associated operating costs of $99,000. The project has a 5-year life. At the end of 5 years, the fixed assets will have zero salvage value. The company uses straight-line depreciation to a zero book value over the life of the project. The tax rate is 21%. The discount rate is 13%. What is the Net Present Value of the project? O A. $68,926.32 B. $55,382.20 C. $60,930.23 D. $93,293.34 E. $76,339.49 O F. $57,577.78

Step by Step Solution

3.45 Rating (145 Votes )

There are 3 Steps involved in it

Step: 1

Correct Option is 5538220 Initial Investment 140000 Useful ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get StartedRecommended Textbook for

Linear Algebra A Modern Introduction

Authors: David Poole

4th edition

1285463242, 978-1285982830, 1285982835, 978-1285463247

Students also viewed these Accounting questions

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

View Answer in SolutionInn App