What is your evaluation of Sirius CMs financial performance during the 2010-2013 period (as shown in case Exhibit 2)?

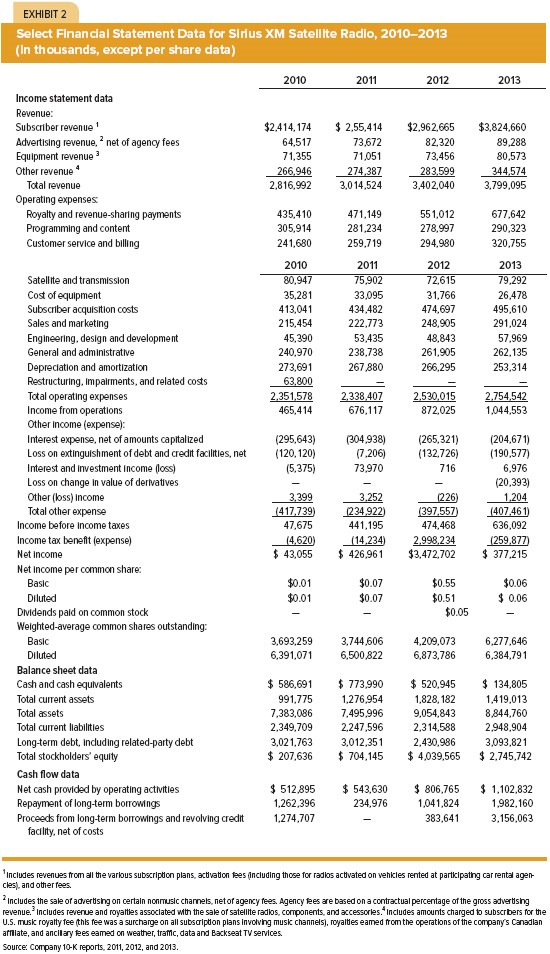

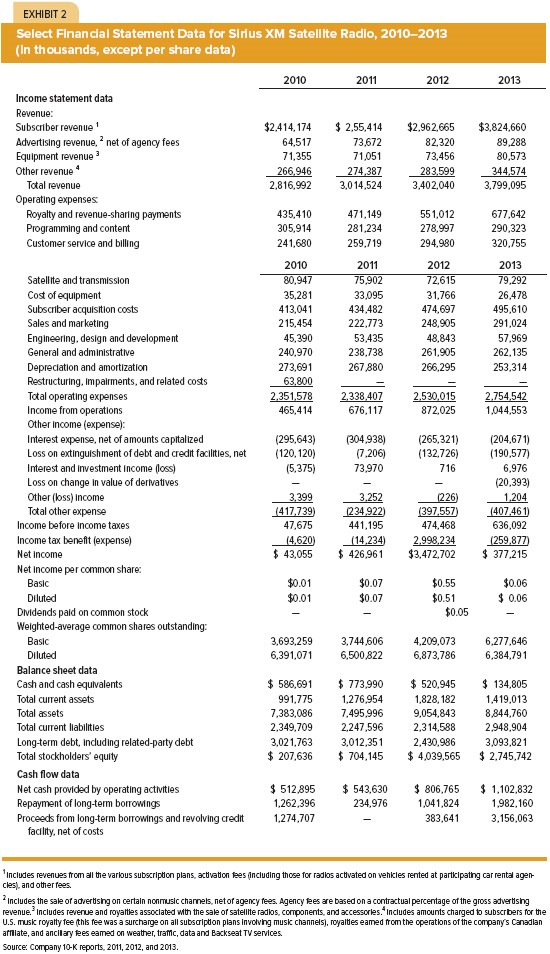

Exhibit 2:

Select Financial Statement Data for Sirlus XM Satellite Radio, 2010-2013 (In thousands, except per share data) 2013 Income statement data $2.4 14,174 64,517 71.355 2.55414 73,672 71051 $2.962665 82,320 $3.824.660 89,288 Advertising revenue, net of agency fees revenue Other revenue4 266946 274 38 283599 344574 3,799,095 Total revenue 2,816,992 3,014.524 3.402040 Operating expenses: Royalty and revenue-sharing payments Programming and content Customer service and billing 435,410 305,914 471.149 281 ,234 551,012 278,997 294,980 677,642 290,323 320,755 241 Satellite and transmission .90 33,095 413,041 215,454 45,390 240,970 273,691 474,697 248,905 48,843 Subscriber acquisition costs Sales and marketing Engineering, design and development General and administrative Depreciation and amortization Restructuring, Impairments, and related costs Total operating expenses Income from operations Other income (expense): Interest expense, net of amounts capitalized Loss on extingulshment of debt and credit facilities, net Interest and Investment Income (loss) Loss on change in value of dertvatives Other (oss) income Total other expense 495,610 291,024 222 773 53.435 262.135 253,314 267 880 2.351578 2338402,530015 2754 542 1,044,553 465.414 676,117 872,025 (265,321 (120.120) (7.206) (132.726) 190,577) 20.393) (417.739) 234 922 397.557 407461 73.970 3399 474.468 Income before income taxes Incometax benefit (expense) Net income Net income per common share: 636,092 (4.620 (14.234) 2.998,234 259.877 $.43,055 $426.961 $3.472.702377,215 Basic Dividends paid on common stock Weighted-average common shares outstanding: 3,693,259 3744606 6,391.071 4.209,073 6,277.646 6,384,791 Basic Diluted Balance sheet data Cash and cash equivalents Total current assets 6,500 822 6,873,786 $586,691 773.990 $520.945134.805 1.419,013 991775 1,276,954 7.383,0867.495.996 2,349.709 3,021,763 $ 207,636 704.145 assets 9,054,843 8 8,844.760 2,314,588 2.430,986 $ 4,039,565 2.948,904 3,093,821 2.745742 Total current liabilities Long-term debt, induding related-party debt Total stockholders equity Cash flow data Net cash provded by operating activities Repayment of long-term borrowings Proceeds from long-term borrowings and revoling credit 1274,707 2.247,596 3,012,351 512.895 1,262,396 $543,630 234,976 806,765 1,041,824 383,641 $1,102,832 1,982,160 3.156,063 fadlity, net of costs Includes revenues trom all the various subscripdon plans, acivation es (ncluding those for radios activated on vehkles rented at partkipating car rental agen cles. and other fees. Includes the Sale or advertisng on certain nonmusic chamels, netor agency fees. Agencyes are based on a contractual percentage of the gross advertisng revenue. Includes revenue and royaltes assoclated wth the sale of satellte rados, componnts,adaccessorles. Includes amounts charged to subscrbers for the U.S. musk royalty Tee (this fee was a surcharge on all subsaripion plans Involving musk channeis), royaldes eamed fromthe operations of the company's Canadiarn arniate, and ancian'es earned on weather, tramc, data and Backseat TV services Source: Company 10-K reports, 2011, 2012, and 2013