Answered step by step

Verified Expert Solution

Question

1 Approved Answer

What is your max, min, and average forecast for Denosumab's US revenue in 2015? Explain your assumptions clearly and show the estimates in your spreadsheet.

What is your max, min, and average forecast for Denosumab's US revenue in 2015? Explain your assumptions clearly and show the estimates in your spreadsheet.

2. What are some factors and assumptions that would impact your forecast?

3. What are some other data points you would capture in order to improve the confidence level in your forecast?

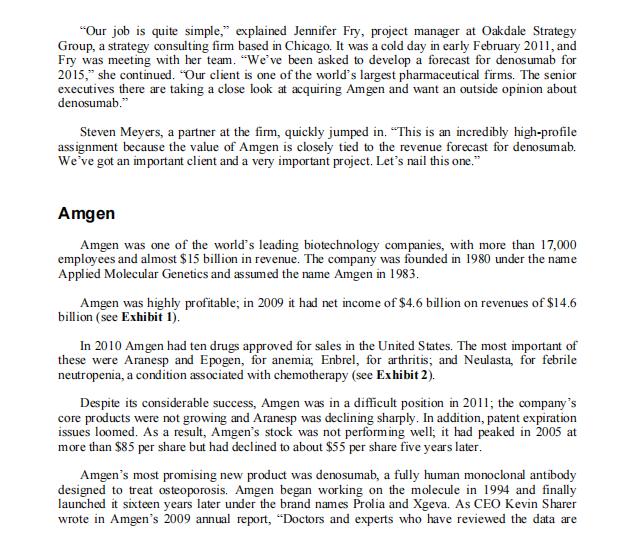

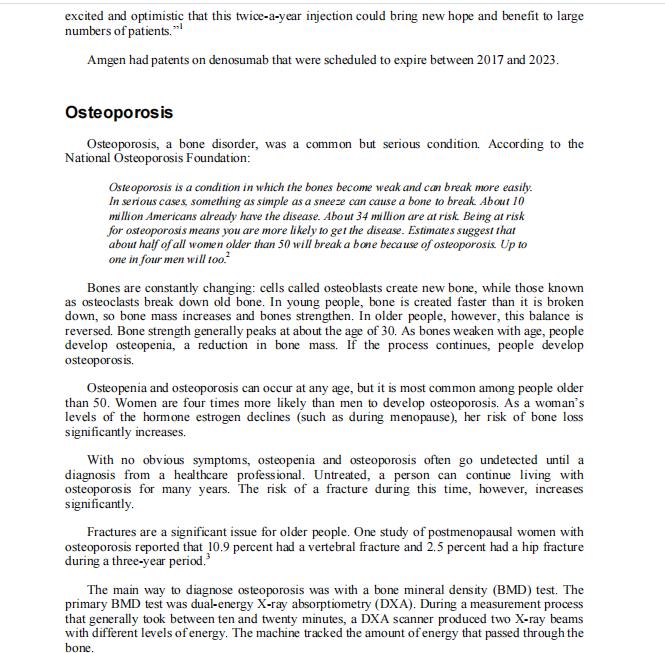

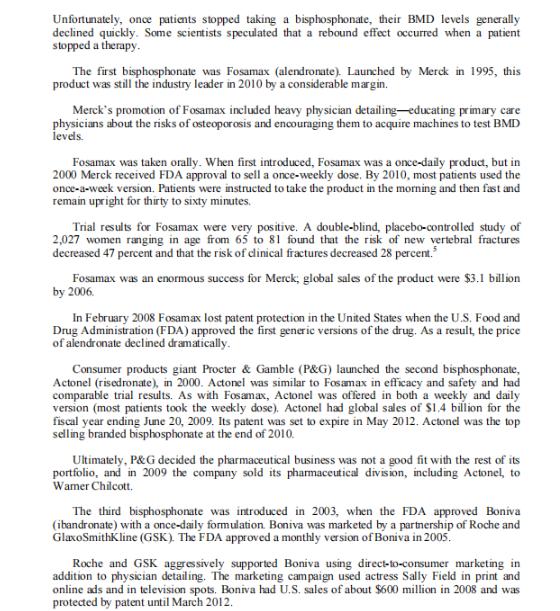

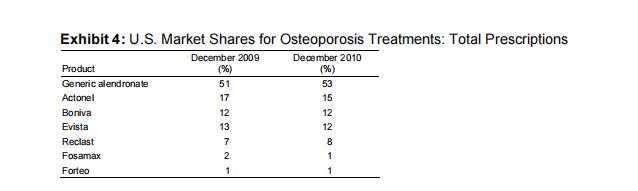

"Our job is quite simple," explained Jennifer Fry, project manager at Oakdale Strategy Group, a strategy consulting firm based in Chicago. It was a cold day in early February 2011, and Fry was meeting with her team. "We've been asked to develop a forecast for denosumab for 2015," she continued. "Our client is one of the world's largest pharmaceutical firms. The senior executives there are taking a close look at acquiring Amgen and want an outside opinion about denosumab." Steven Meyers, a partner at the firm, quickly jumped in. "This is an incredibly high-profile assignment because the value of Amgen is closely tied to the revenue forecast for denosumab. We've got an important client and a very important project. Let's nail this one." Amgen Amgen was one of the world's leading biotechnology companies, with more than 17,000 employees and almost $15 billion in revenue. The company was founded in 1980 under the name Applied Molecular Genetics and assumed the name Amgen in 1983. Amgen was highly profitable; in 2009 it had net income of $4.6 billion on revenues of $14.6 billion (see Exhibit 1). In 2010 Amgen had ten drugs approved for sales in the United States. The most important of these were Aranesp and Epogen, for anemia; Enbrel, for arthritis; and Neulasta, for febrile neutropenia, a condition associated with chemotherapy (see Exhibit 2). Despite its considerable success, Amgen was in a difficult position in 2011; the company's core products were not growing and Aranesp was declining sharply. In addition, patent expiration issues loomed. As a result, Amgen's stock was not performing well; it had peaked in 2005 at more than $85 per share but had declined to about $55 per share five years later. Amgen's most promising new product was denosumab, a fully human monoclonal antibody designed to treat osteoporosis. Amgen began working on the molecule in 1994 and finally launched it sixteen years later under the brand names Prolia and Xgeva. As CEO Kevin Sharer wrote in Amgen's 2009 annual report, "Doctors and experts who have reviewed the data are

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Max Min and Average Forecast for Denosumabs US Revenue in 2015 To estimate Denosumabs US revenue in 2015 you would typically start with available hist...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started