What journal entry did CVS make to record Income Tax Expense for the year ended December 31, 2019?

a) Dr. Income Tax Expense$2,366

Cr. Cash$2,366

b)

Dr. Income Tax Expense$2,366

Cr. Current Tax Payable$2,366

c)

Dr. Income Tax Expense$2,366

Dr. Current Tax Payable$4,928

Cr. Deferred Tax Asset/Liability$7,294

d)

Dr. Income Tax Expense$2,366

Dr. Deferred Tax Asset/Liability$649

Cr. Current Tax Payable$3,015

e)

Dr. Income Tax Expense$3,015

Cr. Deferred Tax Asset/Liability$649

Cr. Current Tax Payable$2,366

f)

Dr. Current Tax Payable$2,366

Dr. Deferred Tax Asset/Liability$649

Cr. Income Tax Expense$3,015

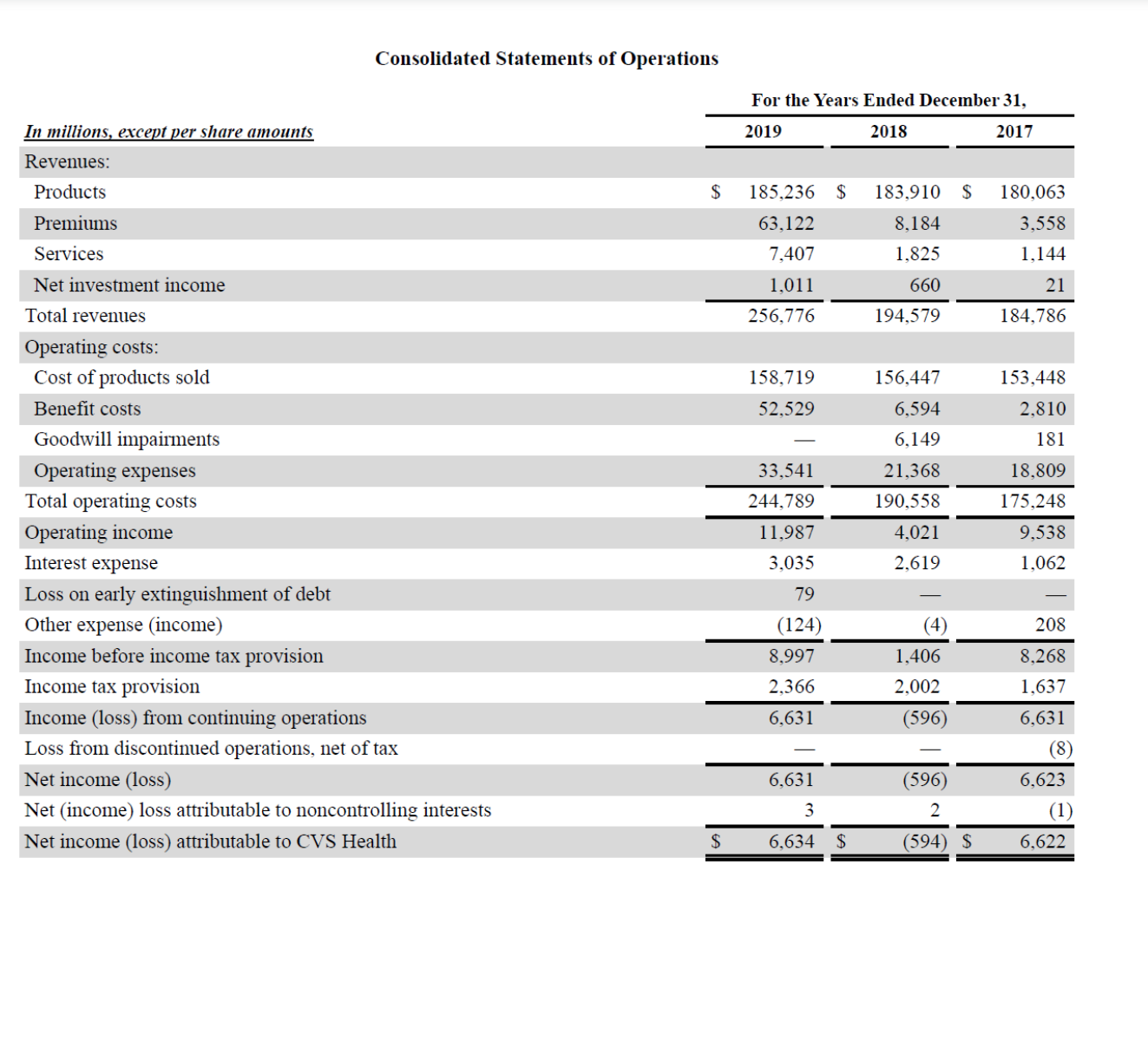

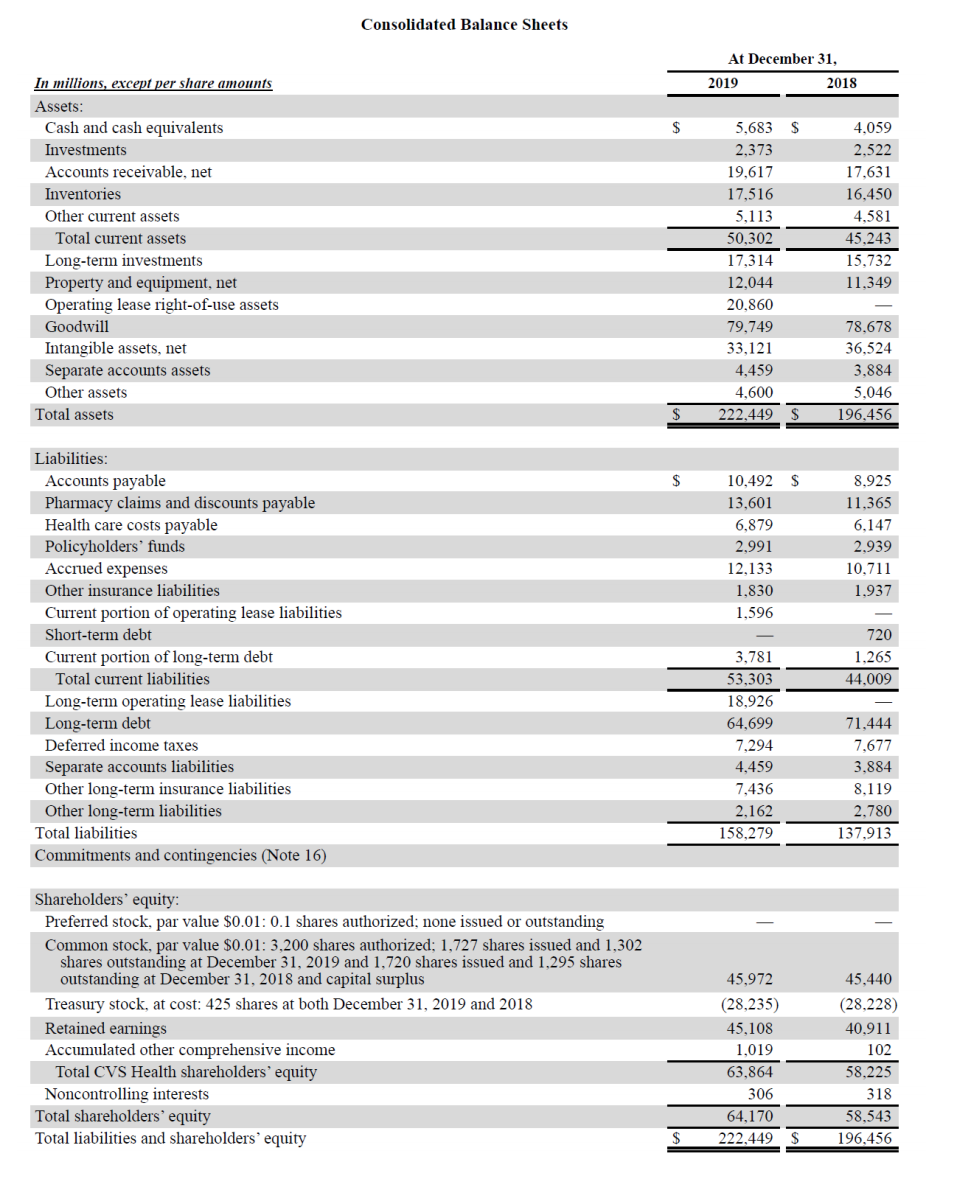

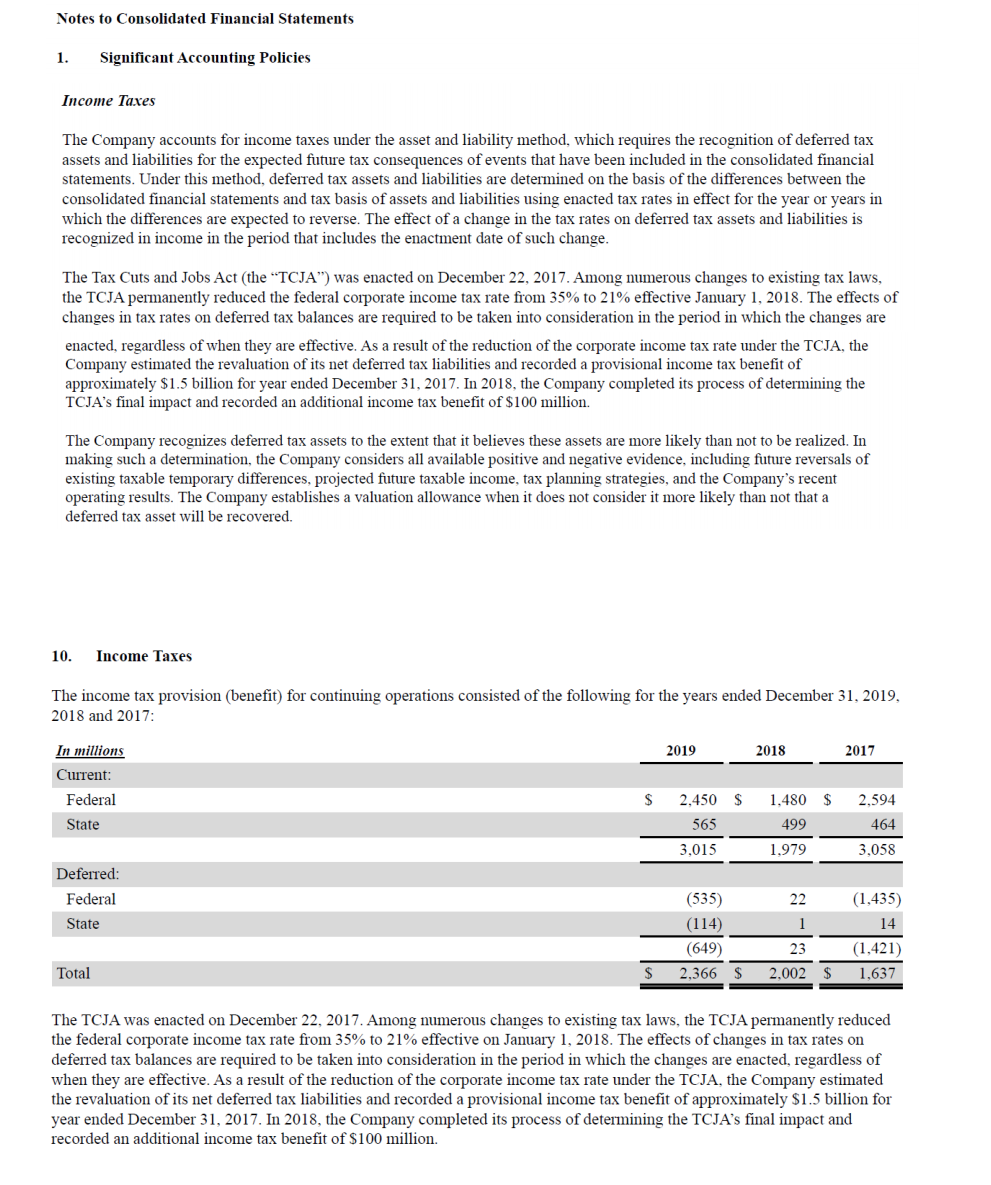

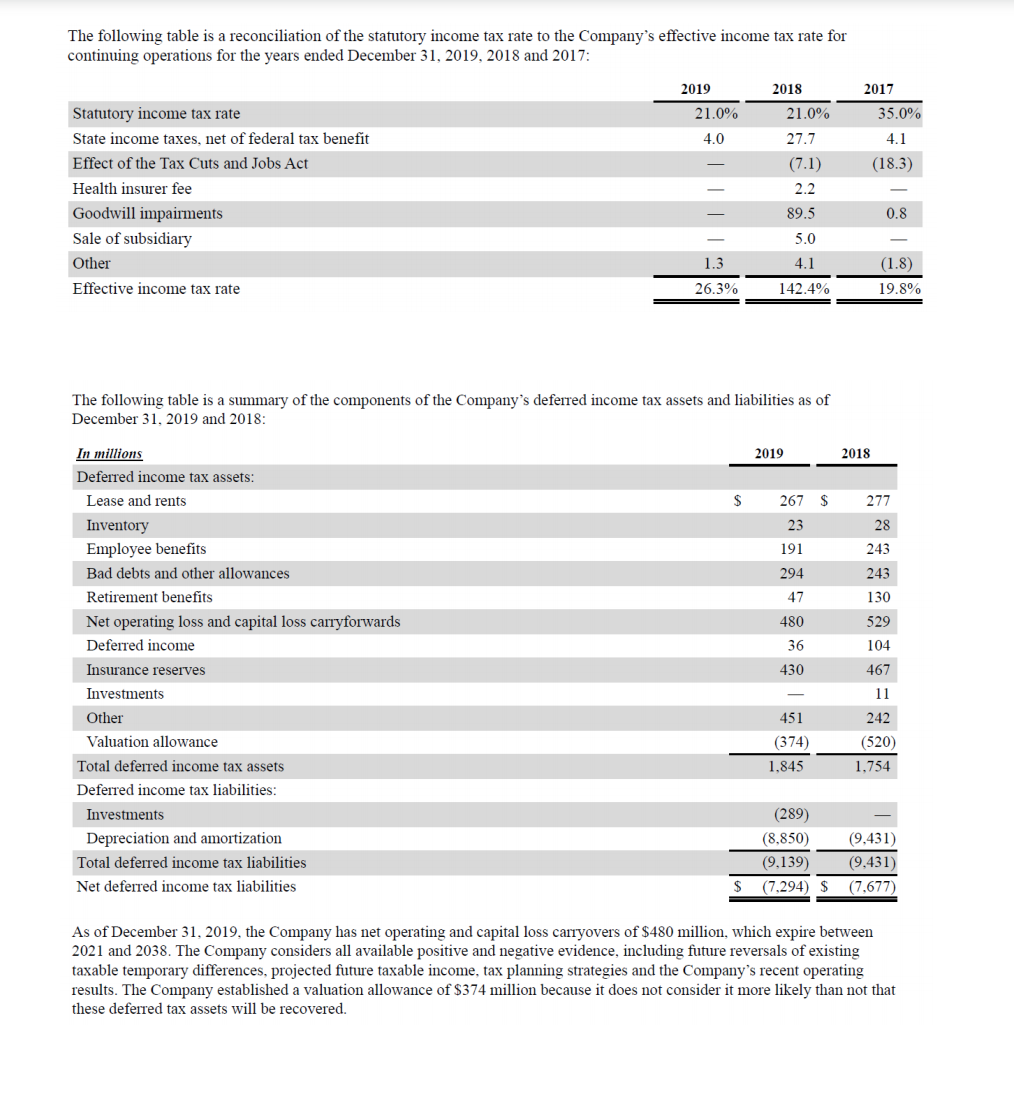

CVSHealth 2019 Annual Report CVS Health Corporation Excerpts from the Annual Report for the Year Ended December 31, 2019Consolidated Statements of Operations For the Years Ended December 31, In millions, except per share amounts 201 TOZ 2017 Revenues: Products $ 185,236 $ 183,910 $ 180,063 Premiums 63,122 8,184 3,558 Services 7,407 1,825 1,144 Net investment income 1,011 660 21 Total revenues 256,776 194,579 184,786 Operating costs: Cost of products sold 158,719 156,447 153,448 Benefit costs 52,529 6,594 2,810 Goodwill impairments 6,149 181 Operating expenses 33,541 21,368 18,809 Total operating costs 244,789 190,558 175,248 Operating income 11,987 4,021 9,538 Interest expense 3.035 2,619 1,062 Loss on early extinguishment of debt 79 Other expense (income) (124) (4) 208 Income before income tax provision 8,997 1,406 8,268 Income tax provision 2,366 2,002 1,637 Income (loss) from continuing operations 6,631 596 6,631 Loss from discontinued operations, net of tax (8) Net income (loss) 6,631 (596) 6,623 Net (income) loss attributable to noncontrolling interests 3 (1) Net income (loss) attributable to CVS Health $ 5,634 $ (594) $ 6,622Consolidated Balance Sheets At December 31, In millions, except per share amounts 2019 018 Assets: Cash and cash equivalents $ 5,683 $ 4.059 Investments 2,373 2.522 Accounts receivable, net 19,617 17,631 Inventories 17,516 16,450 Other current assets 5,113 4,581 Total current assets 50,302 45,243 Long-term investments 17,314 15.732 Property and equipment, net 12,044 11,349 Operating lease right-of-use assets 20,860 Goodwill 79,749 78.678 Intangible assets, net 33,121 36.524 Separate accounts assets 4,459 3,884 Other assets 4,600 5.046 Total assets 222,449 196.456 Liabilities: Accounts payable $ 10,492 $ 8.925 Pharmacy claims and discounts payable 13,601 11,365 Health care costs payable 6,879 6,147 Policyholders' funds 2,991 2,939 Accrued expenses 12,133 10,711 Other insurance liabilities 1,830 1,937 Current portion of operating lease liabilities 1,596 Short-term debt 720 Current portion of long-term debt 3,781 1,265 Total current liabilities 53,303 14.009 Long-term operating lease liabilities 18,926 Long-term debt 64,699 71,444 Deferred income taxes 7.294 7.677 Separate accounts liabilities 4.459 3.884 Other long-term insurance liabilities 7,436 8,119 Other long-term liabilities 2,162 2,780 Total liabilities 158,279 137,913 Commitments and contingencies (Note 16) Shareholders' equity: Preferred stock, par value $0.01: 0.1 shares authorized; none issued or outstanding Common stock, par value $0.01: 3,200 shares authorized; 1,727 shares issued and 1,302 shares outstanding at December 31, 2019 and 1, 720 shares issued and 1,295 shares outstanding at December 31, 2018 and capital surplus 45,972 45,440 Treasury stock, at cost: 425 shares at both December 31, 2019 and 2018 (28,235) (28,228) Retained earnings 45,108 40,911 Accumulated other comprehensive income 1,019 102 Total CVS Health shareholders' equity 63,864 58,225 Noncontrolling interests $06 318 Total shareholders' equity 64,170 58,543 Total liabilities and shareholders' equity 222,449 196.456Notes to Consolidated Financial Statements 1. Significant Accounting Policies Income Taxes The Company accounts for income taxes under the asset and liability method, which requires the recognition of deferred tax assets and liabilities for the expected future tax consequences of events that have been included in the consolidated financial statements. Under this method, deferred tax assets and liabilities are determined on the basis of the differences between the consolidated financial statements and tax basis of assets and liabilities using enacted tax rates in effect for the year or years in which the differences are expected to reverse. The effect of a change in the tax rates on deferred tax assets and liabilities is recognized in income in the period that includes the enactment date of such change. The Tax Cuts and Jobs Act (the "TCJA") was enacted on December 22, 2017. Among numerous changes to existing tax laws, the TCJA permanently reduced the federal corporate income tax rate from 35% to 21% effective January 1, 2018. The effects of changes in tax rates on deferred tax balances are required to be taken into consideration in the period in which the changes are enacted, regardless of when they are effective. As a result of the reduction of the corporate income tax rate under the TCJA, the Company estimated the revaluation of its net deferred tax liabilities and recorded a provisional income tax benefit of approximately $1.5 billion for year ended December 31, 2017. In 2018, the Company completed its process of determining the TCJA's final impact and recorded an additional income tax benefit of $100 million. The Company recognizes deferred tax assets to the extent that it believes these assets are more likely than not to be realized. In making such a determination, the Company considers all available positive and negative evidence, including future reversals of existing taxable temporary differences, projected future taxable income, tax planning strategies, and the Company's recent operating results. The Company establishes a valuation allowance when it does not consider it more likely than not that a deferred tax asset will be recovered. 10. Income Taxes The income tax provision (benefit) for continuing operations consisted of the following for the years ended December 31, 2019, 2018 and 2017: In millions 2019 2018 2017 Current: Federal $ 2,450 $ 1,480 $ 2,594 State 565 499 464 3,015 1.979 5,058 Deferred: Federal (535) 22 (1,435) State (114) 14 649 23 1,421) Total 2,366 2,002 1,637 The TCJA was enacted on December 22, 2017. Among numerous changes to existing tax laws, the TCJA permanently reduced the federal corporate income tax rate from 35% to 21% effective on January 1, 2018. The effects of changes in tax rates on deferred tax balances are required to be taken into consideration in the period in which the changes are enacted, regardless of when they are effective. As a result of the reduction of the corporate income tax rate under the TCJA. the Company estimated the revaluation of its net deferred tax liabilities and recorded a provisional income tax benefit of approximately $1.5 billion for year ended December 31, 2017. In 2018, the Company completed its process of determining the TCJA's final impact and recorded an additional income tax benefit of $100 million.The following table is a reconciliation of the statutory income tax rate to the Company's effective income tax rate for continuing operations for the years ended December 31, 2019, 2018 and 2017: 2019 2018 2017 Statutory income tax rate 21.0% 21.0% 35.0% State income taxes, net of federal tax benefit 4.0 27.7 4.1 Effect of the Tax Cuts and Jobs Act (7.1) (18.3) Health insurer fee 2.2 Goodwill impairments 89.5 0.8 Sale of subsidiary 5.0 Other 1.3 4.1 (1.8) Effective income tax rate 26.3% 142.4% 19.8% The following table is a summary of the components of the Company's deferred income tax assets and liabilities as of December 31, 2019 and 2018: In millions 2019 2018 Deferred income tax assets: Lease and rents $ 267 $ 277 Inventory 23 28 Employee benefits 191 243 Bad debts and other allowances 294 243 Retirement benefits 47 130 Net operating loss and capital loss carryforwards 480 529 Deferred income 36 104 Insurance reserves 430 467 Investments 11 Other 451 242 Valuation allowance (374) (520) Total deferred income tax assets 1,845 1,754 Deferred income tax liabilities: Investments 289) Depreciation and amortization (8,850) (9,431) Total deferred income tax liabilities (9,139) (9,431) Net deferred income tax liabilities 7,294) (7.677) As of December 31, 2019, the Company has net operating and capital loss carryovers of $480 million, which expire between 2021 and 2038. The Company considers all available positive and negative evidence, including future reversals of existing taxable temporary differences, projected future taxable income, tax planning strategies and the Company's recent operating results. The Company established a valuation allowance of $374 million because it does not consider it more likely than not that these deferred tax assets will be recovered