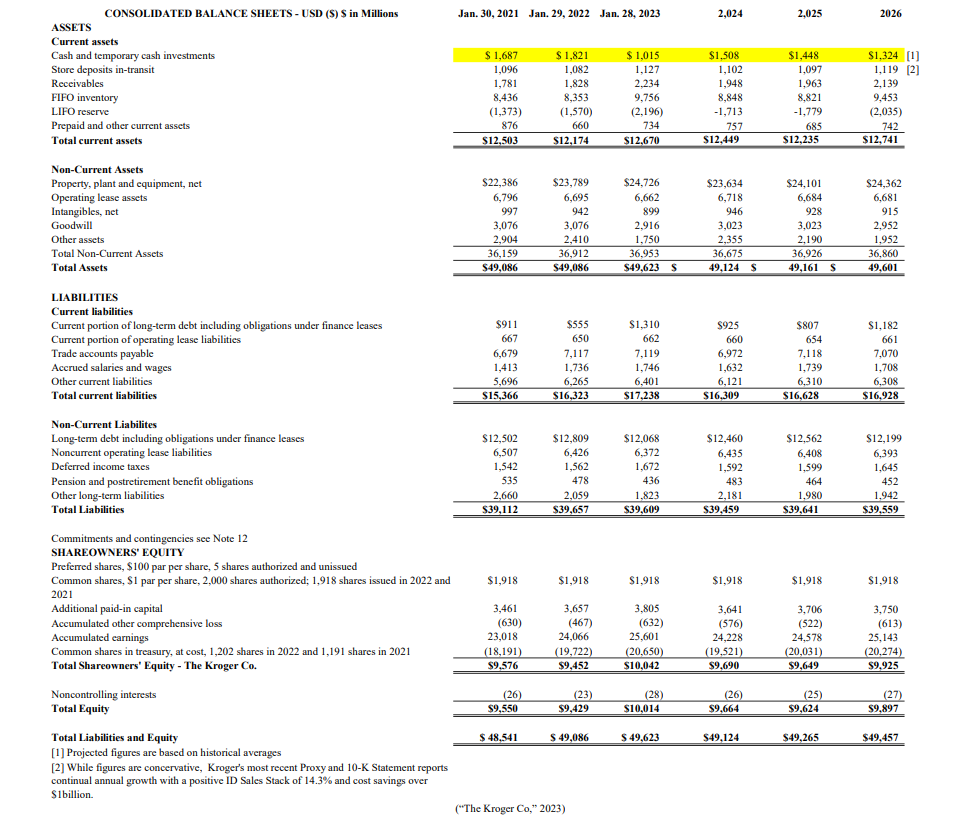

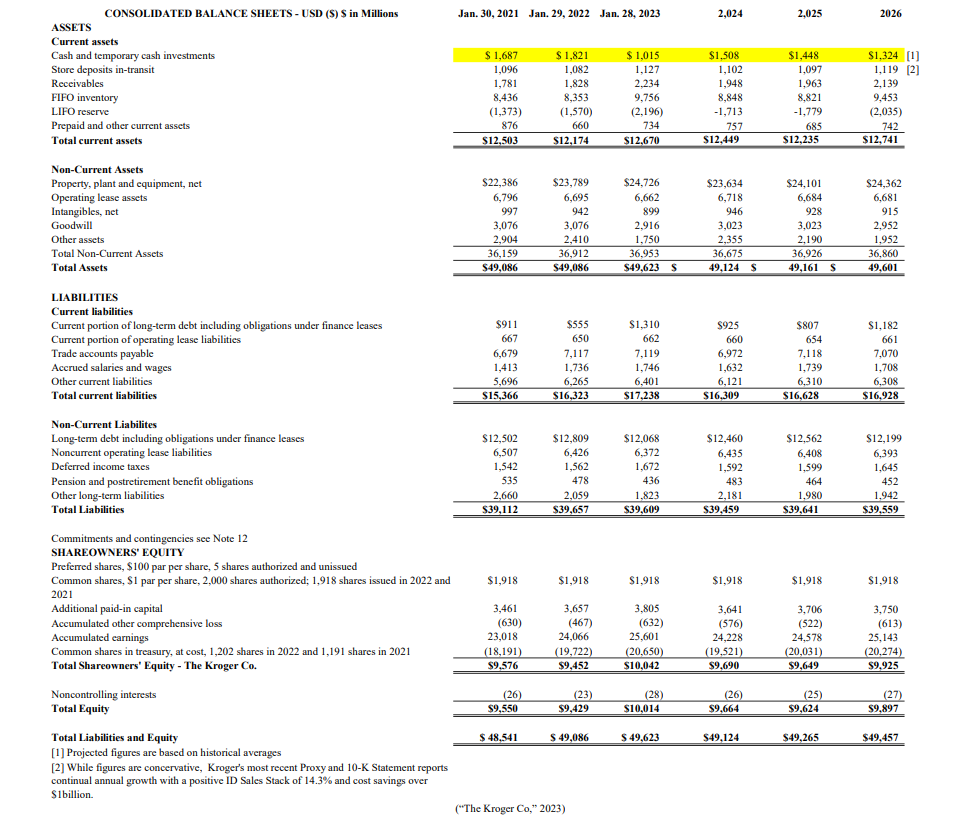

What line on this balance sheet shows retained earnings? And what lines should be used to calculate it?

CONSOLIDATED BALANCE SHEETS - USD (\$) $ in Millions Jan. 30, 2021 Jan. 29, 2022 Jan. 28, 2023 2026 ASSETS Current assets Cash and temporary cash investments Store deposits in-transit Receivables FIFO inventory LIFO reserve Prepaid and other current assets Total current assets \begin{tabular}{rrrrrr} $1,687 & $1,821 & $1,015 & $1,508 & $1,448 & $1,324[1] \\ 1,096 & 1,082 & 1,127 & 1,102 & 1,097 & 1,119 \\ 1,781 & 1,828 & 2,234 & 1,948 & 1,963 & 2,139 \\ 8,436 & 8,353 & 9,756 & 8,848 & $,821 & 9,453 \\ (1,373) & (1,570) & (2,196) & 1,713 & 1,779 & (2,035) \\ 876 & 660 & 734 & 757 & 685 & 742 \\ \hline $12,503 & $12,174 & $12,670 & $12,449 & $12,235 & $12,741 \\ \hline \end{tabular} Non-Current Assets Property, plant and equipment, net Operating lease assets Intangibles, net Goodwill Other assets Total Non-Current Assets Total Assets LIABILITIES Current liabilities Current portion of long-term debt including obligations under finance leases Current portion of operating lease liabilities Trade accounts payable Accrued salaries and wages Other current liabilities Total current liabilities \begin{tabular}{rrrrrr} $911 & $555 & $1,310 & $925 & $807 & $1,182 \\ 667 & 650 & 662 & 660 & 654 & 661 \\ 6,679 & 7,117 & 7,119 & 6,972 & 7,118 & 7,070 \\ 1,413 & 1,736 & 1,746 & 1,632 & 1,739 & 1,708 \\ 5,696 & 6,265 & 6,401 & 6,121 & 6,310 & 6,308 \\ \hline $15,366 & $16,323 & $17,238 & $16,309 & $16,628 & $16,928 \\ \hline \hline \end{tabular} Non-Current Liabilites Long-term debt including obligations under finance leases Noncurrent operating lease liabilities Deferred income taxes Pension and postretirement benefit obligations Other long-term liabilities Total Liabilities \begin{tabular}{rrrrrr} $12,502 & $12,809 & $12,068 & $12,460 & $12,562 & $12,199 \\ 6,507 & 6,426 & 6,372 & 6,435 & 6,408 & 6,393 \\ 1,542 & 1,562 & 1,672 & 1,592 & 1,599 & 1,645 \\ 535 & 478 & 436 & 483 & 464 & 452 \\ 2,660 & 2,059 & 1,823 & 2,181 & 1,980 & 1,942 \\ \hline $39,112 & $39,657 & $39,609 & $39,459 & $39,641 & $39,559 \\ \hline \hline \end{tabular} Commitments and contingencies see Note 12 SHAREOWNERS' EQUITY Preferred shares, $100 par per share, 5 shares authorized and unissued Common shares, \$1 par per share, 2,000 shares authorized; 1,918 shares issued in 2022 and $1,918$1,918$1,918$1,918$18 2021 Additional paid-in capital Accumulated other comprehensive loss Accumulated earnings Common shares in treasury, at cost, 1,202 shares in 2022 and 1,191 shares in 2021 Total Shareowners' Equity - The Kroger Co. Noncontrolling interests Total Equity Total Liabilities and Equity [1] Projected figures are based on historical averages [2] While figures are concervative, Kroger's most recent Proxy and 10-K Statement reports continual annual growth with a positive ID Sales Stack of 14.3% and cost savings over \$1billion. ("The Kroger Co," 2023) CONSOLIDATED BALANCE SHEETS - USD (\$) $ in Millions Jan. 30, 2021 Jan. 29, 2022 Jan. 28, 2023 2026 ASSETS Current assets Cash and temporary cash investments Store deposits in-transit Receivables FIFO inventory LIFO reserve Prepaid and other current assets Total current assets \begin{tabular}{rrrrrr} $1,687 & $1,821 & $1,015 & $1,508 & $1,448 & $1,324[1] \\ 1,096 & 1,082 & 1,127 & 1,102 & 1,097 & 1,119 \\ 1,781 & 1,828 & 2,234 & 1,948 & 1,963 & 2,139 \\ 8,436 & 8,353 & 9,756 & 8,848 & $,821 & 9,453 \\ (1,373) & (1,570) & (2,196) & 1,713 & 1,779 & (2,035) \\ 876 & 660 & 734 & 757 & 685 & 742 \\ \hline $12,503 & $12,174 & $12,670 & $12,449 & $12,235 & $12,741 \\ \hline \end{tabular} Non-Current Assets Property, plant and equipment, net Operating lease assets Intangibles, net Goodwill Other assets Total Non-Current Assets Total Assets LIABILITIES Current liabilities Current portion of long-term debt including obligations under finance leases Current portion of operating lease liabilities Trade accounts payable Accrued salaries and wages Other current liabilities Total current liabilities \begin{tabular}{rrrrrr} $911 & $555 & $1,310 & $925 & $807 & $1,182 \\ 667 & 650 & 662 & 660 & 654 & 661 \\ 6,679 & 7,117 & 7,119 & 6,972 & 7,118 & 7,070 \\ 1,413 & 1,736 & 1,746 & 1,632 & 1,739 & 1,708 \\ 5,696 & 6,265 & 6,401 & 6,121 & 6,310 & 6,308 \\ \hline $15,366 & $16,323 & $17,238 & $16,309 & $16,628 & $16,928 \\ \hline \hline \end{tabular} Non-Current Liabilites Long-term debt including obligations under finance leases Noncurrent operating lease liabilities Deferred income taxes Pension and postretirement benefit obligations Other long-term liabilities Total Liabilities \begin{tabular}{rrrrrr} $12,502 & $12,809 & $12,068 & $12,460 & $12,562 & $12,199 \\ 6,507 & 6,426 & 6,372 & 6,435 & 6,408 & 6,393 \\ 1,542 & 1,562 & 1,672 & 1,592 & 1,599 & 1,645 \\ 535 & 478 & 436 & 483 & 464 & 452 \\ 2,660 & 2,059 & 1,823 & 2,181 & 1,980 & 1,942 \\ \hline $39,112 & $39,657 & $39,609 & $39,459 & $39,641 & $39,559 \\ \hline \hline \end{tabular} Commitments and contingencies see Note 12 SHAREOWNERS' EQUITY Preferred shares, $100 par per share, 5 shares authorized and unissued Common shares, \$1 par per share, 2,000 shares authorized; 1,918 shares issued in 2022 and $1,918$1,918$1,918$1,918$18 2021 Additional paid-in capital Accumulated other comprehensive loss Accumulated earnings Common shares in treasury, at cost, 1,202 shares in 2022 and 1,191 shares in 2021 Total Shareowners' Equity - The Kroger Co. Noncontrolling interests Total Equity Total Liabilities and Equity [1] Projected figures are based on historical averages [2] While figures are concervative, Kroger's most recent Proxy and 10-K Statement reports continual annual growth with a positive ID Sales Stack of 14.3% and cost savings over \$1billion. ("The Kroger Co," 2023)