Answered step by step

Verified Expert Solution

Question

1 Approved Answer

What method of depreciation does Target use for GAAP financial reports? What method do they use for income tax purposes? (Hint: Use Footnotes beginning

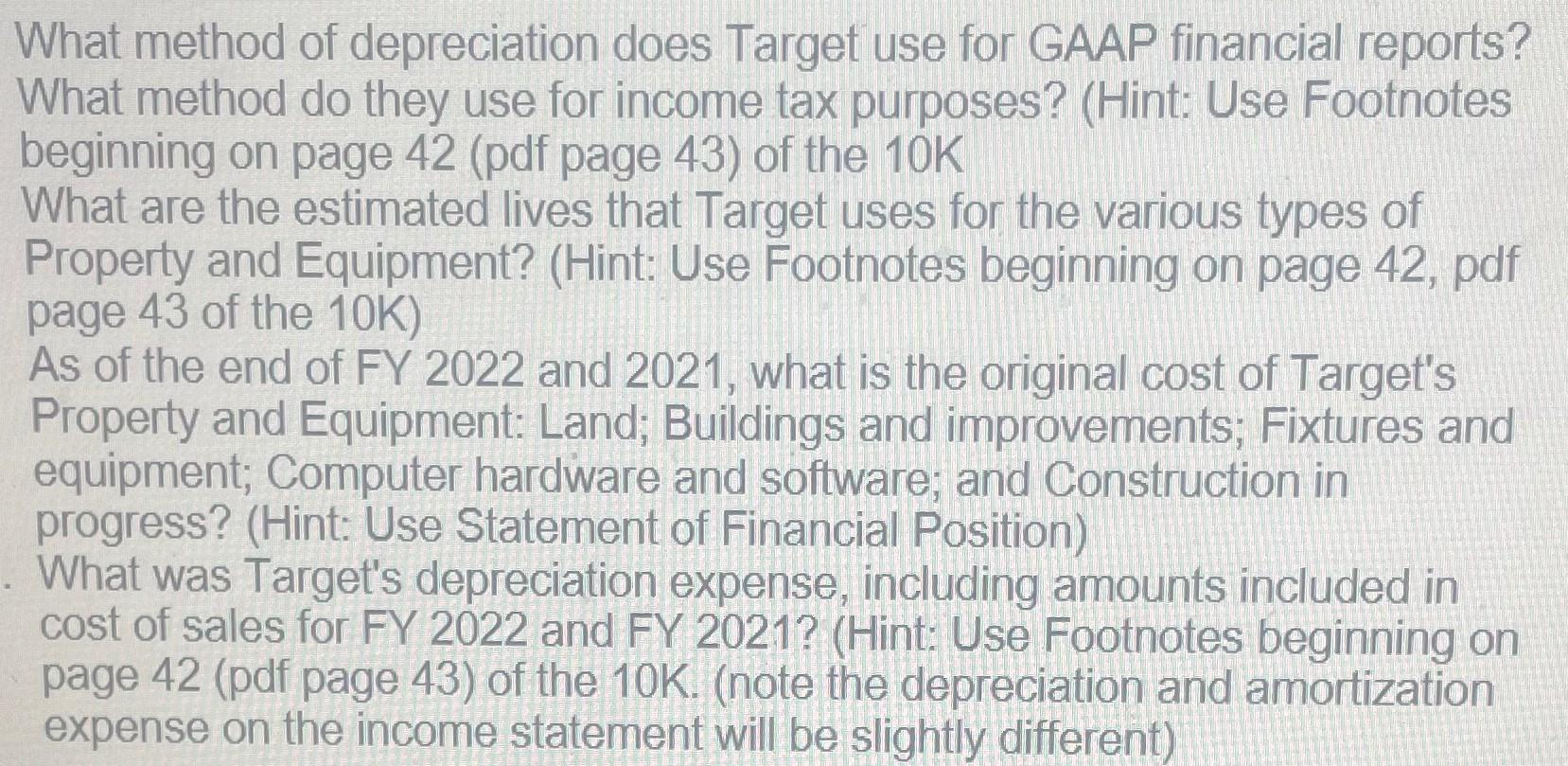

What method of depreciation does Target use for GAAP financial reports? What method do they use for income tax purposes? (Hint: Use Footnotes beginning on page 42 (pdf page 43) of the 10K What are the estimated lives that Target uses for the various types of Property and Equipment? (Hint: Use Footnotes beginning on page 42, pdf page 43 of the 10K) As of the end of FY 2022 and 2021, what is the original cost of Target's Property and Equipment: Land; Buildings and improvements; Fixtures and equipment; Computer hardware and software; and Construction in progress? (Hint: Use Statement of Financial Position) What was Target's depreciation expense, including amounts included in cost of sales for FY 2022 and FY 2021? (Hint: Use Footnotes beginning on page 42 (pdf page 43) of the 10K. (note the depreciation and amortization expense on the income statement will be slightly different)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started